Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On September 18, 2020, Luffy Co. acquired all ofDoflamingolnc.'s P4,300,000 identifiable assets and P1,060,000 liabilities. Book values of Doflamingo'sassets and liabilities equal to their fair

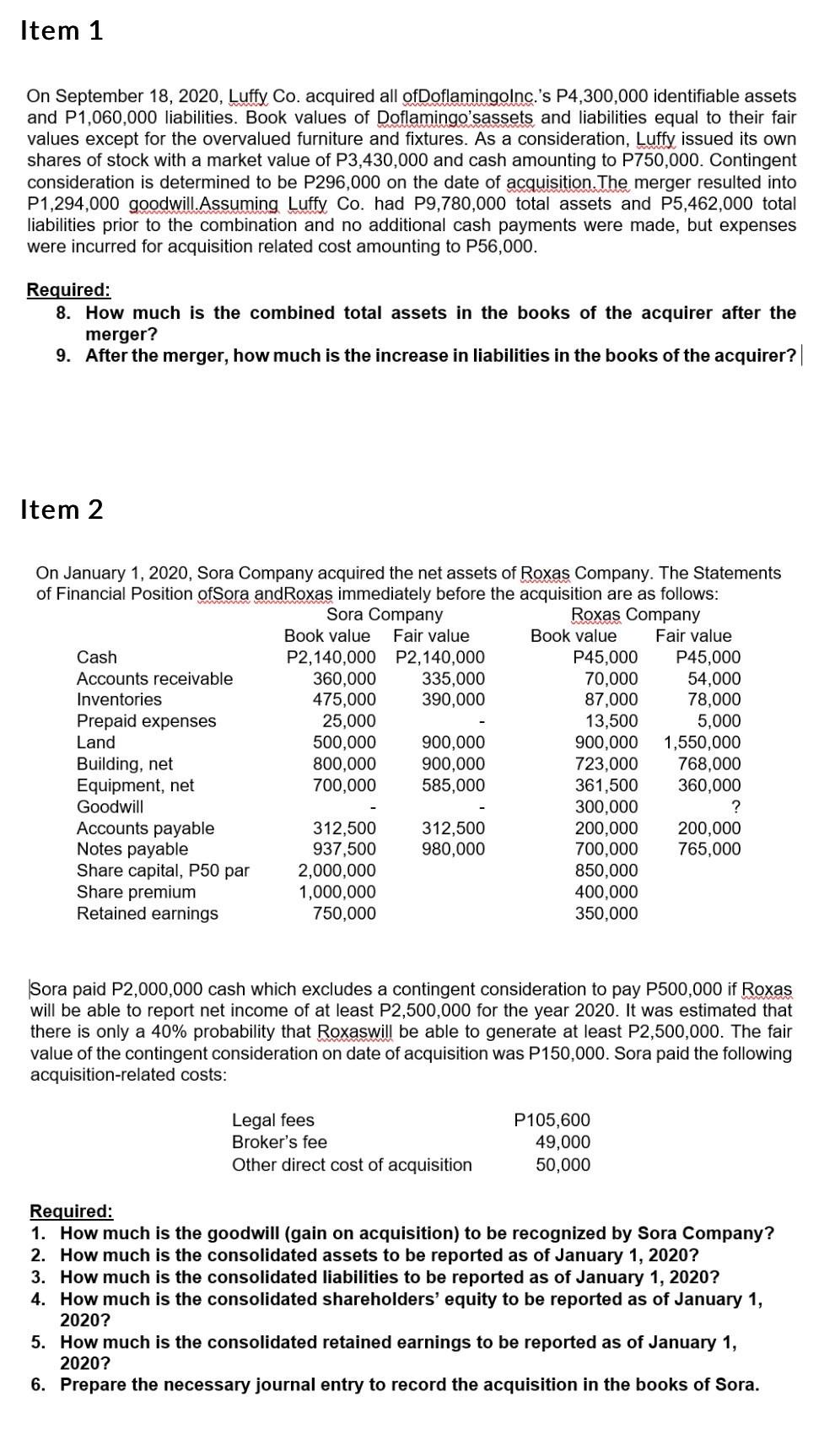

On September 18, 2020, Luffy Co. acquired all ofDoflamingolnc.'s P4,300,000 identifiable assets and P1,060,000 liabilities. Book values of Doflamingo'sassets and liabilities equal to their fair values except for the overvalued furniture and fixtures. As a consideration, Luffy issued its own shares of stock with a market value of P3,430,000 and cash amounting to P750,000. Contingent consideration is determined to be P296,000 on the date of acquisition. The merger resulted into P1,294,000 goodwill.Assuming Luffy Co. had P9,780,000 total assets and P5,462,000 total liabilities prior to the combination and no additional cash payments were made, but expenses were incurred for acquisition related cost amounting to P56,000. Required: 8. How much is the combined total assets in the books of the acquirer after the merger? 9. After the merger, how much is the increase in liabilities in the books of the acquirer? | Item 2 On January 1, 2020, Sora Company acquired the net assets of Roxas Company. The Statements of Financial Position ofSora andRoxas immediately before the acquisition are as follows: Sora paid P2,000,000 cash which excludes a contingent consideration to pay P500,000 if Roxas will be able to report net income of at least P2,500,000 for the year 2020 . It was estimated that there is only a 40% probability that Roxaswill be able to generate at least P2,500,000. The fair value of the contingent consideration on date of acquisition was P150,000. Sora paid the following acquisition-related costs: Required: 1. How much is the goodwill (gain on acquisition) to be recognized by Sora Company? 2. How much is the consolidated assets to be reported as of January 1, 2020? 3. How much is the consolidated liabilities to be reported as of January 1,2020 ? 4. How much is the consolidated shareholders' equity to be reported as of January 1 , 2020 ? 5. How much is the consolidated retained earnings to be reported as of January 1 , 2020? 6. Prepare the necessary journal entry to record the acquisition in the books of Sora

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started