Question

On September 30, 2012, Blossom Company issued 11% bonds with a par value of $560,000 due in 20 years. They were issued at 98 and

On September 30, 2012, Blossom Company issued 11% bonds with a par value of $560,000 due in 20 years. They were issued at 98 and were callable at 105 at any date after September 30, 2017. Because Blossom Company was able to obtain financing at lower rates, it decided to call the entire issue on September 30, 2018, and to issue new bonds. New 9% bonds were sold in the amount of $850,000 at 102; they mature in 20 years. Blossom Company uses straight-line amortization. Interest payment dates are March 31 and September 30.

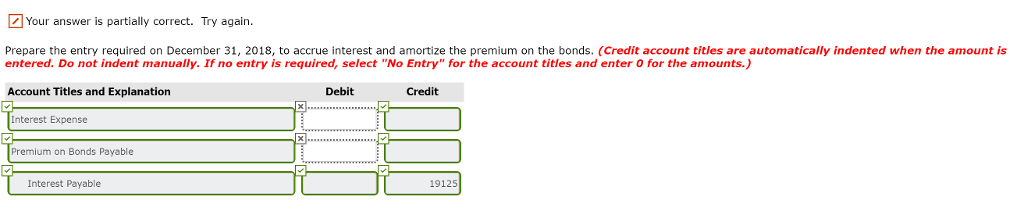

I got the first part correctly, pls help me with the bottom empty parts! The green boxes are correct!

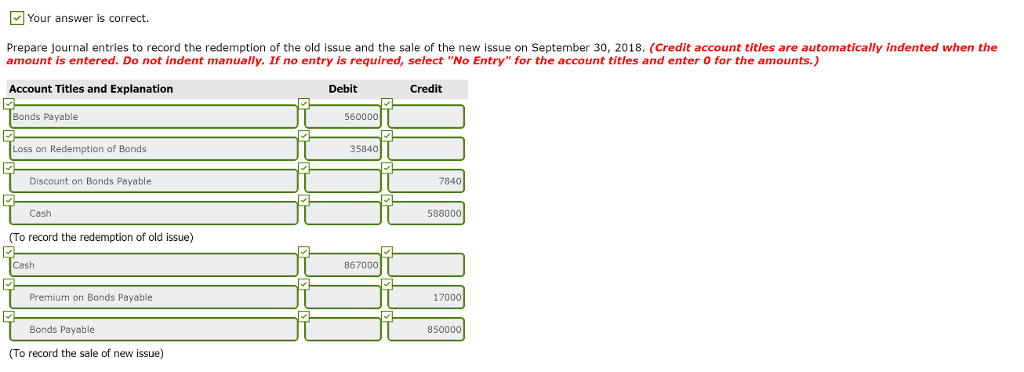

Your answer is correct. Prepare journal entries to record the redemption of the old issue and the sale of the new issue on September 30, 2018. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Bonds Payable Debit Credit 560000 Loss on Redemption of Bonds 35840 Discount on Bonds Payable 7840 Cash 583000 To record the redemption of old issue) Cash 867000 Premium on Bonds Payable 17000 Bonds Payable 850000 (To record the sale of new issue)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started