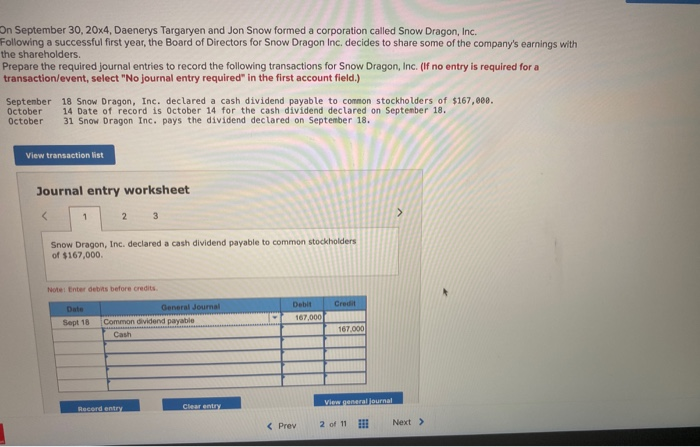

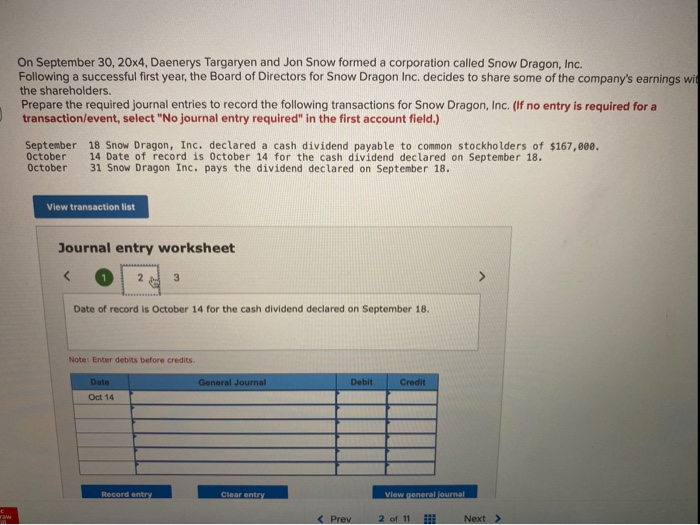

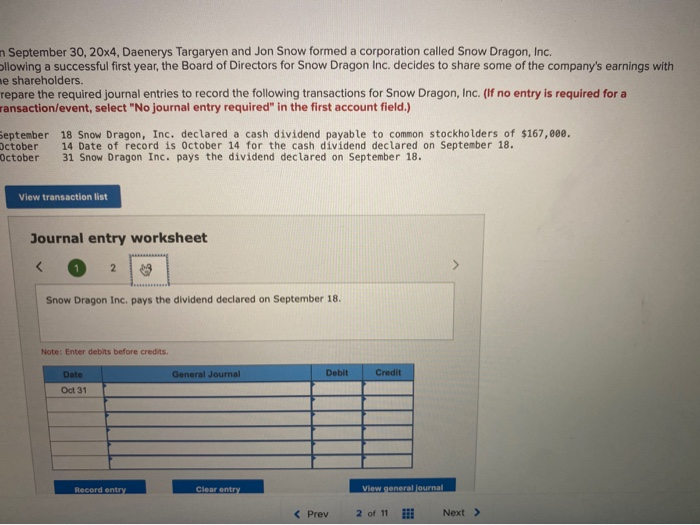

On September 30, 20x4, Daenerys Targaryen and Jon Snow formed a corporation called Snow Dragon, Inc. Following a successful first year, the Board of Directors for Snow Dragon Inc. decides to share some of the company's earnings with the shareholders. Prepare the required journal entries to record the following transactions for Snow Dragon, Inc. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) September 18 Snow Dragon, Inc. declared a cash dividend payable to common stockholders of $167,000. October 14 Date of record is October 14 for the cash dividend declared on September 18. October 31 Snow Dragon Inc. pays the dividend declared on September 18. View transaction list Journal entry worksheet 3 Snow Dragon, Inc. declared a cash dividend payable to common stockholders of $167,000 Note Enter debits before credits Credit General Journal Common dividend payable Cash Debit 167.000 Sept 18 167.000 Clear entry Record entry View general Journal On September 30, 20x4, Daenerys Targaryen and Jon Snow formed a corporation called Snow Dragon, Inc. Following a successful first year, the Board of Directors for Snow Dragon Inc. decides to share some of the company's earnings will the shareholders. Prepare the required journal entries to record the following transactions for Snow Dragon, Inc. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) September 18 Snow Dragon, Inc. declared a cash dividend payable to common stockholders of $167,000. October 14 Date of record is October 14 for the cash dividend declared on September 18. October 31 Snow Dragon Inc. pays the dividend declared on September 18. View transaction list Journal entry worksheet 2 3 > Date of record is October 14 for the cash dividend declared on September 18. Note: Enter debits before credits Date General Journal Debit Credit Oct 14 Record entry Clear entry View general Journal Taw September 30, 20x4, Daenerys Targaryen and Jon Snow formed a corporation called Snow Dragon, Inc. ollowing a successful first year, the Board of Directors for Snow Dragon Inc. decides to share some of the company's earnings with me shareholders. repare the required journal entries to record the following transactions for Snow Dragon, Inc. (If no entry is required for a ransaction/event, select "No journal entry required" in the first account field.) September 18 Snow Dragon, Inc. declared a cash dividend payable to common stockholders of $167,000. October 14 Date of record is October 14 for the cash dividend declared on September 18. 31 Snow Dragon Inc. pays the dividend declared on September 18. October View transaction list Journal entry worksheet