Answered step by step

Verified Expert Solution

Question

1 Approved Answer

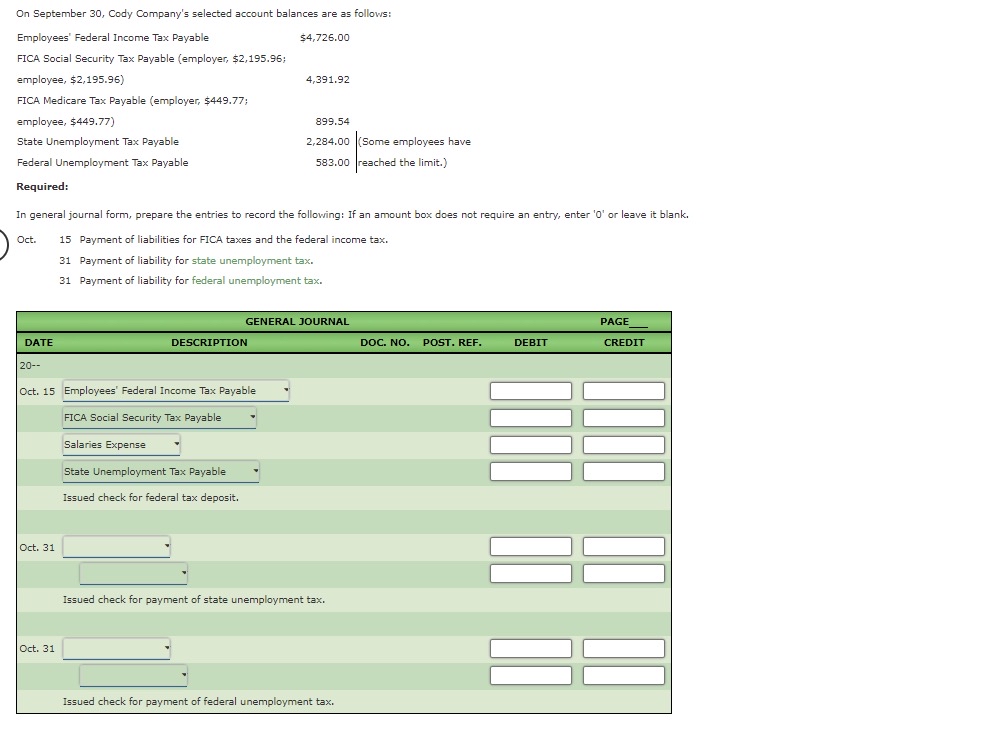

On September 30, Cody Company's selected account balances are as follows: Employees' Federal Income Tax Payable $4,726.00 FICA Social Security Tax Payable (employer, $2,195.96;

On September 30, Cody Company's selected account balances are as follows: Employees' Federal Income Tax Payable $4,726.00 FICA Social Security Tax Payable (employer, $2,195.96; employee, $2,195.96) 4,391.92 FICA Medicare Tax Payable (employer, $449.77; employee, $449.77) State Unemployment Tax Payable Federal Unemployment Tax Payable Required: 899.54 2,284.00 (Some employees have 583.00 reached the limit.) In general journal form, prepare the entries to record the following: If an amount box does not require an entry, enter '0' or leave it blank. Oct. 15 Payment of liabilities for FICA taxes and the federal income tax. 31 Payment of liability for state unemployment tax. 31 Payment of liability for federal unemployment tax. DATE 20-- GENERAL JOURNAL PAGE DESCRIPTION DOC. NO. POST. REF. DEBIT CREDIT Oct. 15 Employees' Federal Income Tax Payable FICA Social Security Tax Payable Salaries Expense State Unemployment Tax Payable Issued check for federal tax deposit. Oct. 31 Oct. 31 Issued check for payment of state unemployment tax. Issued check for payment of federal unemployment tax.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DATE GENERAL JOURNAL 2023 DOC NO POST REF DEBIT PAGE CREDIT Oct 15 Employees Federal Income Tax Paya...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started