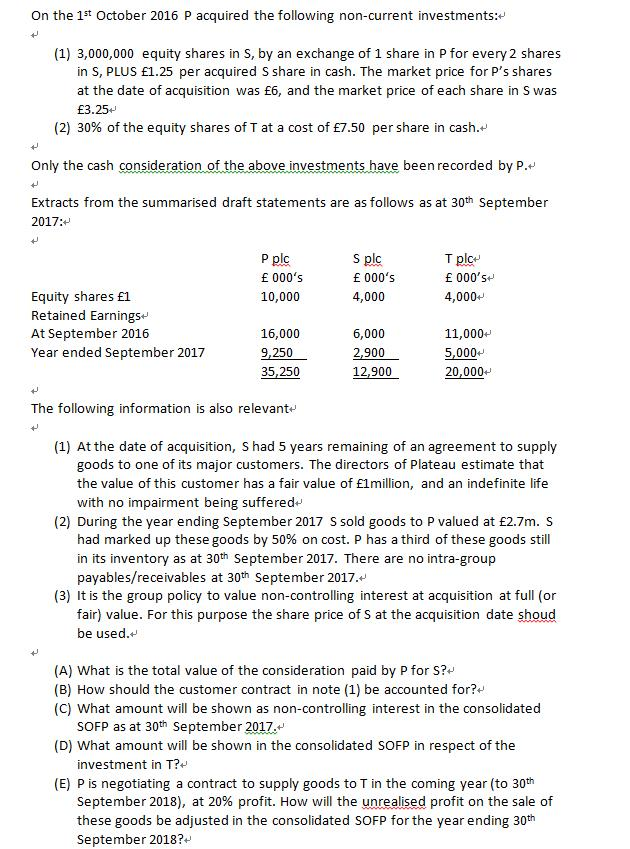

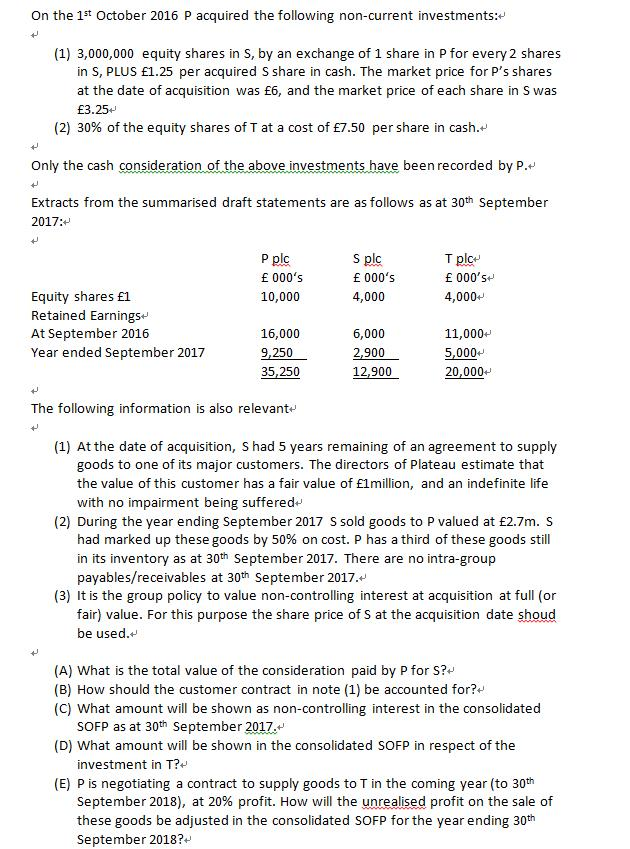

On the 1st October 2016 P acquired the following non-current investments:+ (1) 3,000,000 equity shares in S, by an exchange of 1 share in P for every 2 shares in S, PLUS 1.25 per acquired S share in cash. The market price for P's shares at the date of acquisition was E6, and the market price of each share in S was 3.25 (2) 30% of the equity shares of T at a cost of 7.50 per share in cash Only the cash consideration of the above investments have been recorded by P.+ Extracts from the summarised draft statements are as follows as at 30th September 2017: S plc E 000's 4,000 4 E 000's 4,000 E 000's Equity shares 1 Retained Earningst At September 2016 Year ended September 2017 10,000 16,000 9,250 35,250 6,000 2,900 12.900 11,000+ 5,000 20,000 The following information is also relevant+ (1) At the date of acquisition, s had 5 years remaining of an agreement to supply goods to one of its major customers. The directors of Plateau estimate that the value of this customer has a fair value of E1million, and an indefinite life with no impairment being suffered- (2) During the year ending September 2017 S sold goods to P valued at 2.7m. S had marked up these goods by 50% on cost. P has a third of these goods still in its inventory as at 30th September 2017. There are no intra-group payables/receivables at 30th September 2017. (3) It is the group policy to value non-controlling interest at acquisition at full (or fair) value. For this purpose the share price of S at the acquisition date shoud used. 41 (A) What is the total value of the consideration paid by P for S? (B) How should the customer contract in note (1) be accounted for? (C) What amount will be shown as non-controlling interest in the consolidated SOFP as at 30th September 2017. (D) What amount will be shown in the consolidated SOFP in respect of the investment in T? (E) P is negotiating a contract to supply goods to T in the coming year (to 30th September 2018), at 20% profit. How will the unrealised profit on the sale of these goods be adjusted in the consolidated SOFP for the year ending 30th September 2018? On the 1st October 2016 P acquired the following non-current investments:+ (1) 3,000,000 equity shares in S, by an exchange of 1 share in P for every 2 shares in S, PLUS 1.25 per acquired S share in cash. The market price for P's shares at the date of acquisition was E6, and the market price of each share in S was 3.25 (2) 30% of the equity shares of T at a cost of 7.50 per share in cash Only the cash consideration of the above investments have been recorded by P.+ Extracts from the summarised draft statements are as follows as at 30th September 2017: S plc E 000's 4,000 4 E 000's 4,000 E 000's Equity shares 1 Retained Earningst At September 2016 Year ended September 2017 10,000 16,000 9,250 35,250 6,000 2,900 12.900 11,000+ 5,000 20,000 The following information is also relevant+ (1) At the date of acquisition, s had 5 years remaining of an agreement to supply goods to one of its major customers. The directors of Plateau estimate that the value of this customer has a fair value of E1million, and an indefinite life with no impairment being suffered- (2) During the year ending September 2017 S sold goods to P valued at 2.7m. S had marked up these goods by 50% on cost. P has a third of these goods still in its inventory as at 30th September 2017. There are no intra-group payables/receivables at 30th September 2017. (3) It is the group policy to value non-controlling interest at acquisition at full (or fair) value. For this purpose the share price of S at the acquisition date shoud used. 41 (A) What is the total value of the consideration paid by P for S? (B) How should the customer contract in note (1) be accounted for? (C) What amount will be shown as non-controlling interest in the consolidated SOFP as at 30th September 2017. (D) What amount will be shown in the consolidated SOFP in respect of the investment in T? (E) P is negotiating a contract to supply goods to T in the coming year (to 30th September 2018), at 20% profit. How will the unrealised profit on the sale of these goods be adjusted in the consolidated SOFP for the year ending 30th September 2018