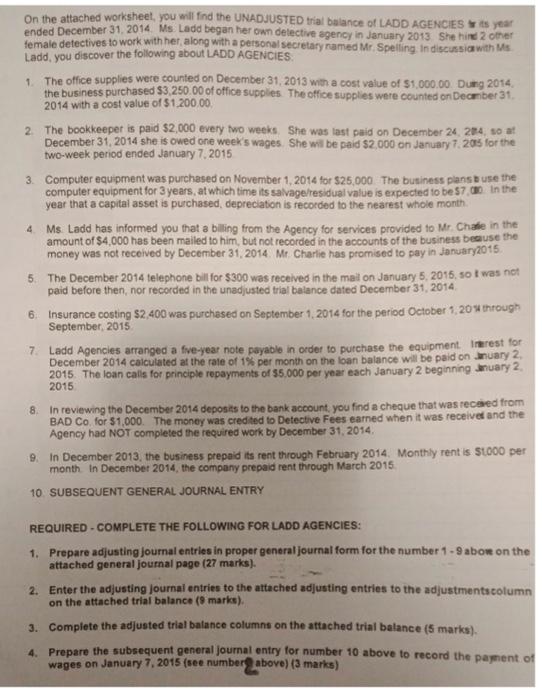

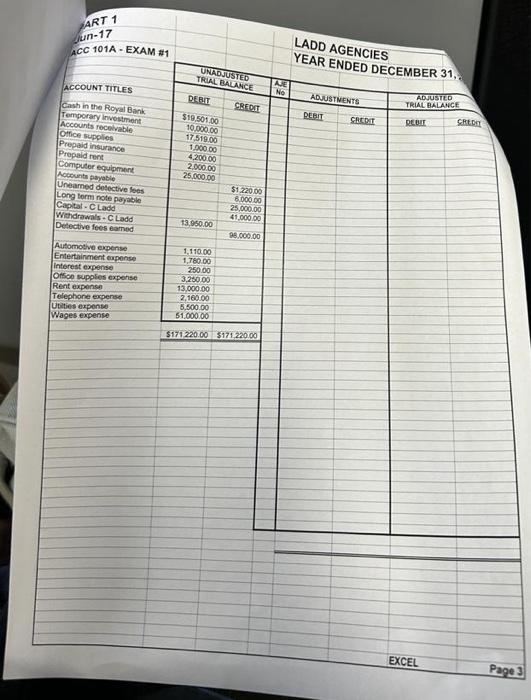

On the attached worksheet, you will find the UNADJUSTED trial balance of LADD AGENCIES ir is year ended December 31, 2014. Ms: Ladd began her own delective agency in January 2013 She hive 2 other female detectives to work with her, along with a personal secretary named Mr. Spelling in discussiawith Ms. Ladd, you discover the following about LADD AGENCIES. 1. The office supplies were counted on December 31, 2013 with a cost value of $1,000.00. Dung 2014. the business purchased $3,250.00 of office supples. The office supples were counted on Decmber 31 . 2014 with a cost value of $1,200,00. 2. The bookkeeper is paid $2,000 every two weeks. She was last paid on December 24, 224, s0 at December 31,2014 she is owed one week's wages. She wil be paid $2,000 on January 7.205 for the two-week period ended January 7,2015 3. Computer equipment was purchased on November 1,2014 for $25,000. The business plans b use the computer equipment for 3 years, at which time its saivagelresidual value is expected to be 57 , at in the year that a capital asset is purchased, depreciation is recorded to the nearest whole month. 4. Ms. Ladd has informed you that a billing from the Agency for services provided to Mr. Chate in the amount of $4,000 has been mailed to him, but not recorded in the accounts of the business beause the money was not received by December 31, 2014. Mr. Charlie has promised to pay in january2015. 5. The December 2014 telephone bill for $300 was received in the mal on January 5,2016 , so t was not paid before then, nor recorded in the unadjusted trial balance dated December 31,2014 . 6. Insurance costing $2,400 was purchesed on September 1,2014 for the period October 1,20 w through September, 2015 7. Ladd Agencies arranged a fve-year note payable in order to purchase the equipment. Intest for December 2014 calculated at the rale of 1% per month on the loan balance will be paid on Inuary 2. 2015 . The loan calls for principle repayments of 55.000 per year each January 2 beginning anuary 2. 2015 8. In reviewing the December 2014 deposis to the bank account you find a cheque that was recaied from BAD Co, for $1,000. The money was credted to Detective Fees eamed when it was recelved and the Agency had NOT completed the required work by December 31, 2014. 9. In December 2013, the business prepaid its rent through February 2014. Monthly rent is 51000 per month in December 2014, the company prepaid rent through March 2015. 10. SUBSEQUENT GENERAL JOURNAL ENTRY REQUIRED - COMPLETE THE FOLLOWING FOR LADD AGENCIES: 1. Prepare adjusting journal entries in proper general journal form for the number 1 - 9 abov on the attached general journal page (27 marks). 2. Enter the adjusting journal entries to the attached adjusting entries to the adjustmentscolumn on the attached trial balance ( marks). 3. Complete the adjusted trial balance columns on the attached trial balance ( 5 marks). 4. Prepare the subsequent general journal entry for number 10 above to record the paynent of wages on January 7,2015 (see number? above)