Question

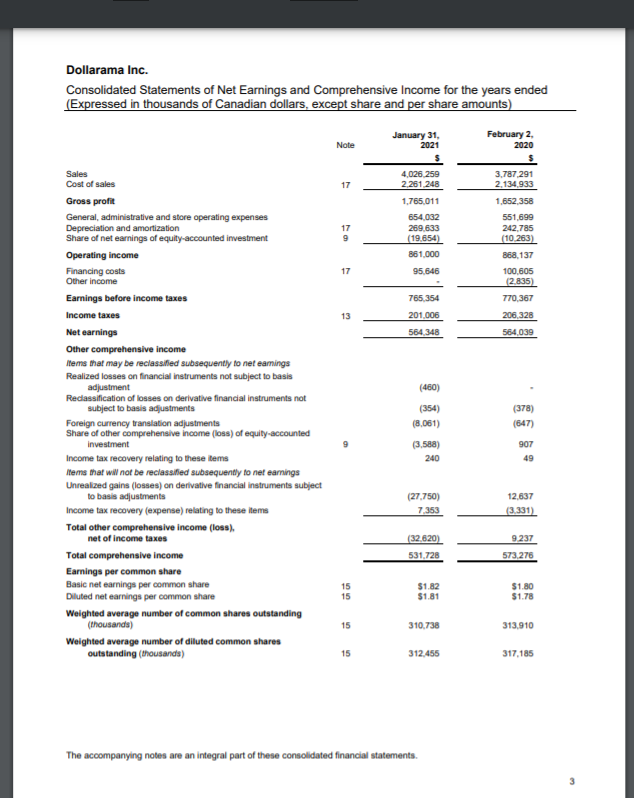

On the consolidated statements of net earnings and comprehensive income on page 3, find the basic earnings per common share amount provided near the bottom,

On the consolidated statements of net earnings and comprehensive income on page 3, find the basic earnings per common share amount provided near the bottom, which is NOT in thousands of dollars. i) Prove the calculation of the basic earnings per share of $1.82 in fiscal 2021 (subject to small rounding error). You will need to know the weighted average number of common shares outstanding in the fiscal year which is also provided at 310,738,000.

ii) Explain WHY earnings per share (EPS) amounts are calculated. That is, what is the purpose in showing EPS? If an investor owned 100,000 Dollarama common shares, what would she conclude from the EPS? iii) The statement of cash flows indicates that Dollarama paid a dividend of $54,770 in fiscal 2021 and $54,144 in fiscal 2020. What percentage of the net earnings for each of fiscal 2021 and fiscal 2020 was paid to investors as a dividend?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started