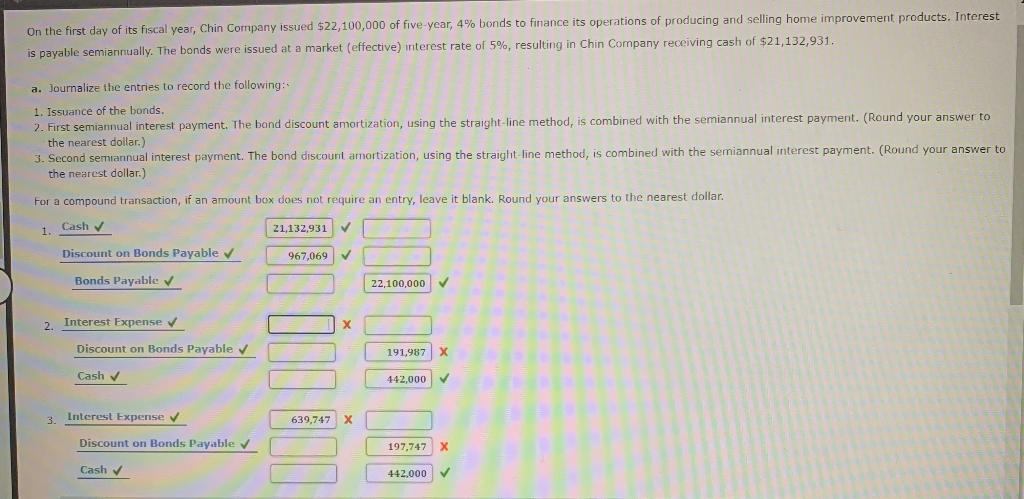

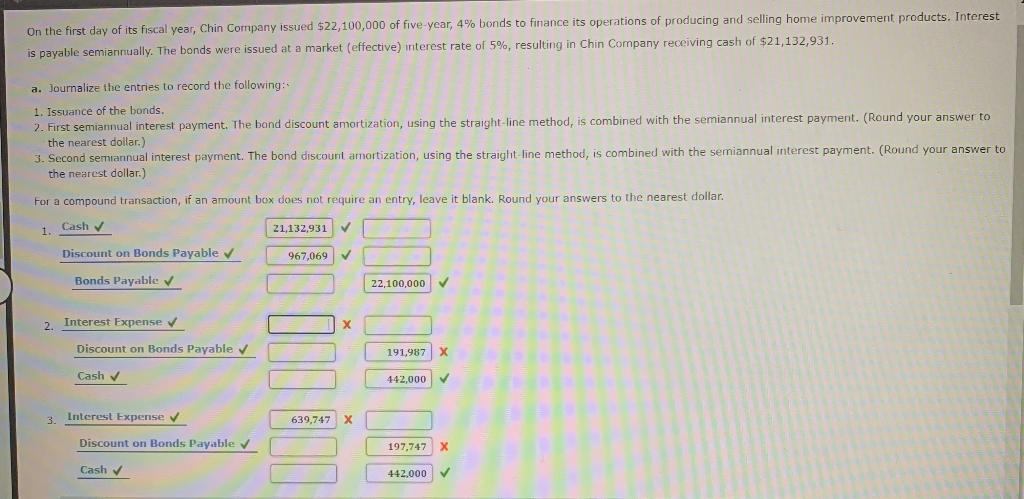

On the first day of its fiscal year, Chin Company issued $22,100,000 of five year, 4% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 5%, resulting in Chin Company receiving cash of $21,132,931. a. Journalize the entries to record the following: 1. Issuance of the bonds. 7. First semiannual interest payment. The band discount amortization, using the straight-line method, is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) 3. Second semiannual interest payment. The bond discount amortization, using the straight line method, is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) For a compound transaction, if an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar Cash 1 21,132,931 7 Discount on Bonds Payable 967,069 Bonds Payable 22,100,000 2. Interest Expense X Discount on Bonds Payable 191,987 x Cash 442,000 3 Interest Expense 639,747 Discount on Bonds Payable 197,747 Cash 442.000 On the first day of its fiscal year, Chin Company issued $22,100,000 of five year, 4% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 5%, resulting in Chin Company receiving cash of $21,132,931. a. Journalize the entries to record the following: 1. Issuance of the bonds. 7. First semiannual interest payment. The band discount amortization, using the straight-line method, is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) 3. Second semiannual interest payment. The bond discount amortization, using the straight line method, is combined with the semiannual interest payment. (Round your answer to the nearest dollar.) For a compound transaction, if an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar Cash 1 21,132,931 7 Discount on Bonds Payable 967,069 Bonds Payable 22,100,000 2. Interest Expense X Discount on Bonds Payable 191,987 x Cash 442,000 3 Interest Expense 639,747 Discount on Bonds Payable 197,747 Cash 442.000