Question

On the first of January 2019, Mound, Co paid 100.000 cash for a 100% investment in Woods td. Other costs arise from the acquisition are

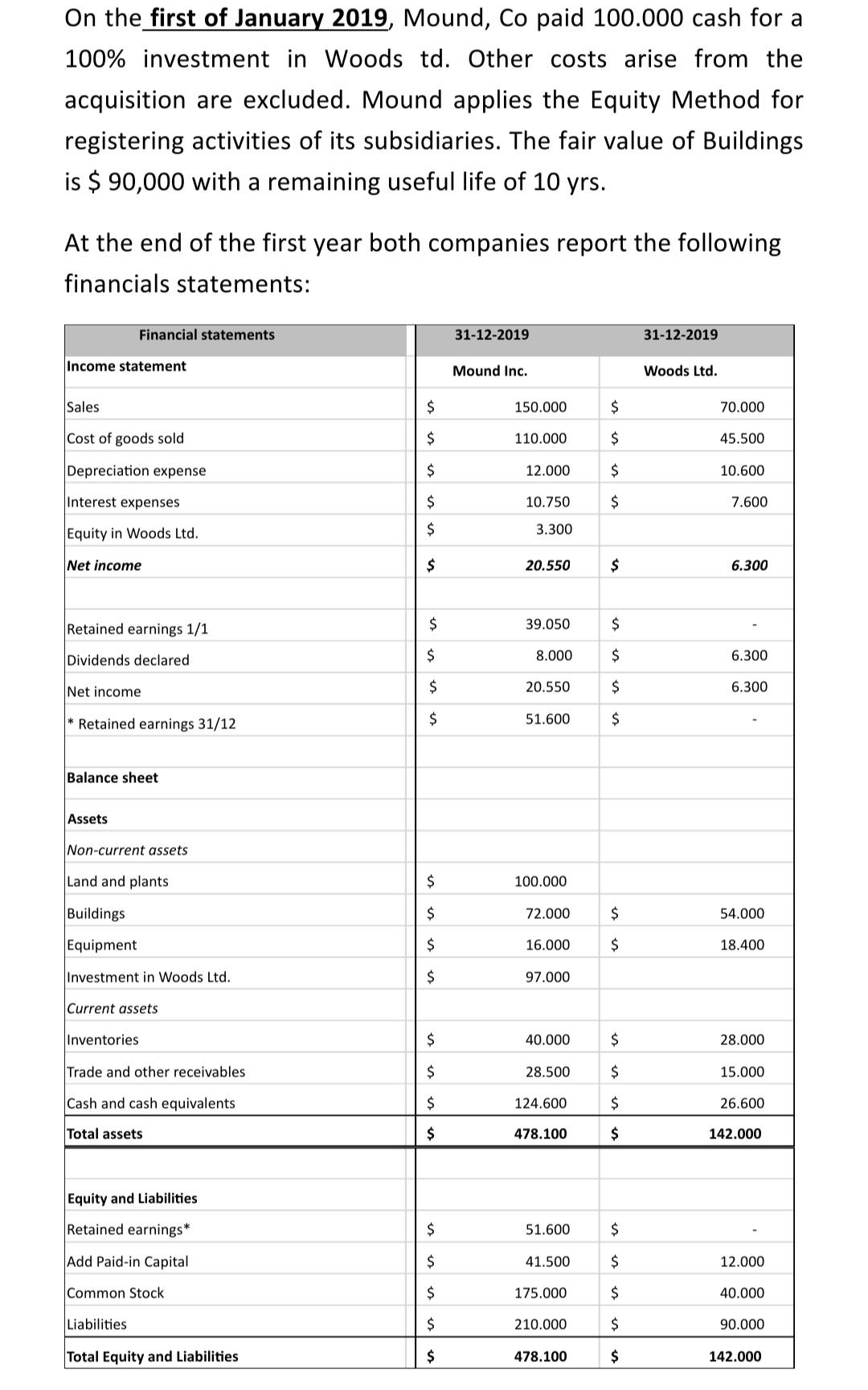

On the first of January 2019, Mound, Co paid 100.000 cash for a

100%investment in Woods td. Other costs arise from the acquisition are excluded. Mound applies the Equity Method for registering activities of its subsidiaries. The fair value of Buildings is

$90,000with a remaining useful life of

10yrs.\ At the end of the first year both companies report the following financials statements:\ \\\\table[[\\\\table[[Financial statements],[Income statement],[Sales]],31-12-2019,31-12-2019],[Mound Inc.,Woods Ltd.],[

$,150.000,

$,70.000],[Cost of goods sold,

$,110.000,

$,45.500],[Depreciation expense,

$,12.000,

$,10.600],[Interest expenses,

$,10.750,

$,7.600],[Equity in Woods Ltd.,

$,3.300,,],[Net income,

$,20.550,

$,6.300],[Retained earnings

(1)/(1),

$,39.050,

$,-],[Dividends declared,

$,8.000,

$,6.300],[Net income,

$,20.550,

$,6.300],[* Retained earnings 31/12,

$,51.600,

$,-],[Balance sheet],[Assets],[Non-current assets],[Land and plants,

$,100.000,,],[Buildings,

$,72.000,

$,54.000],[Equipment,

$,16.000,

$,18.400],[Investment in Woods Ltd.,

$,97.000,,],[Current assets],[Inventories,

$,40.000,

$,28.000],[Trade and other receivables,

$,28.500,

$,15.000],[Cash and cash equivalents,

$,124.600,

$,26.600],[Total assets,

$,478.100,

$,142.000],[Equity and Liabilities],[Retained earnings*,

$,51.600,

$,-],[Add Paid-in Capital,

$,41.500,

$,12.000],[Common Stock,

$,175.000,

$,40.000],[Liabilities,

$,210.000,

$,90.000],[Total Equity and Liabilities,

$,478.100,

$,142.000]]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started