Answered step by step

Verified Expert Solution

Question

1 Approved Answer

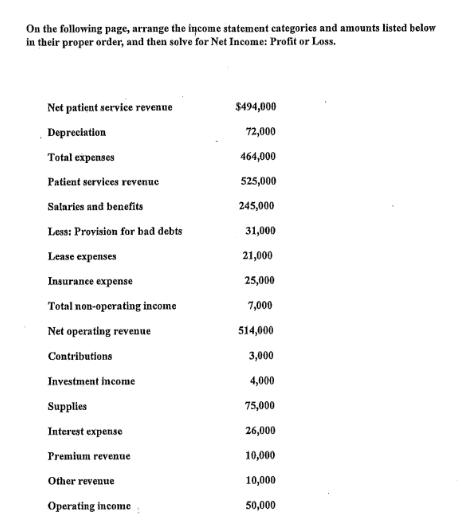

On the following page, arrange the income statement categories and amounts listed below in their proper order, and then solve for Net Income: Profit

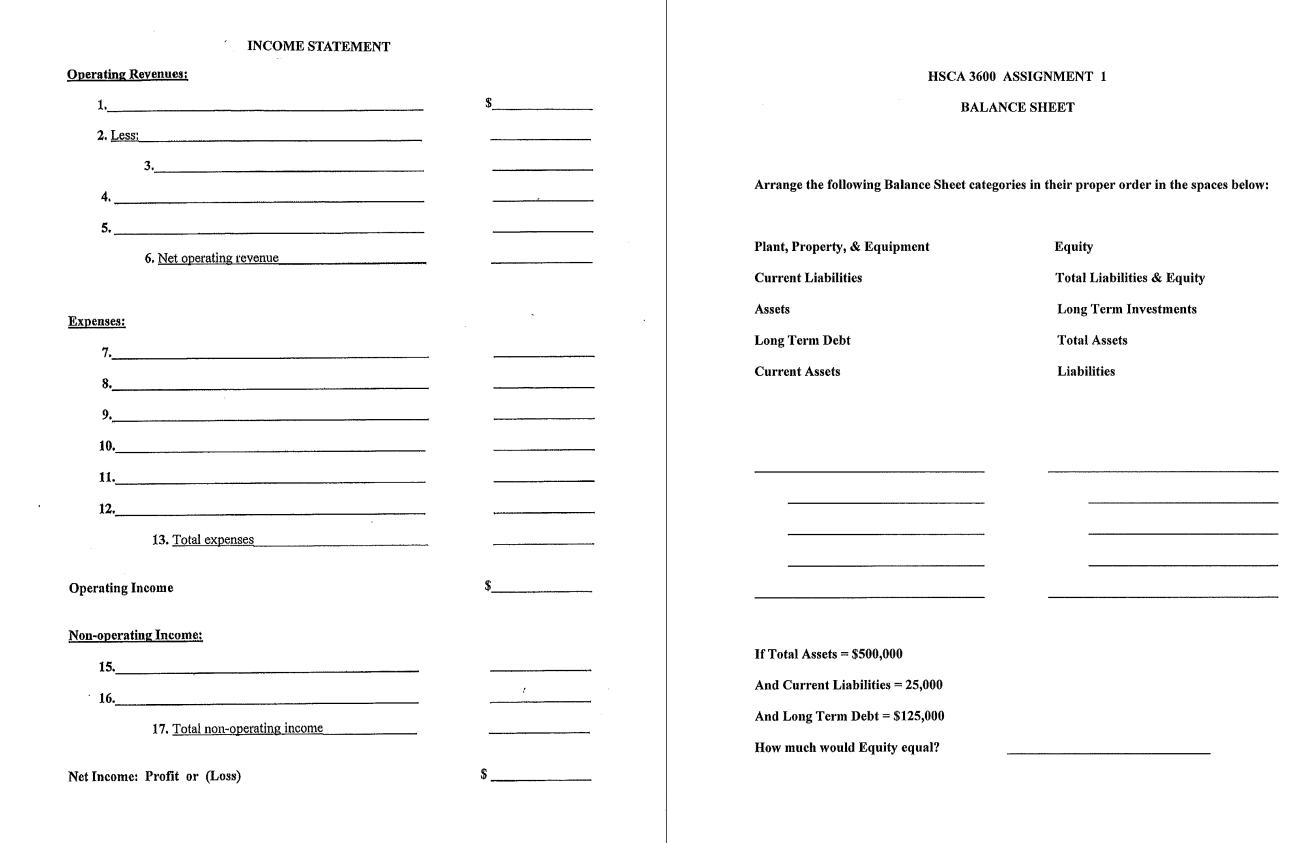

On the following page, arrange the income statement categories and amounts listed below in their proper order, and then solve for Net Income: Profit or Loss. Net patient service revenue Depreciation Total expenses Patient services revenue Salaries and benefits Less: Provision for bad debts Lease expenses Insurance expense Total non-operating income Net operating revenue Contributions Investment income Supplies Interest expense Premium revenue Other revenue Operating income $494,000 72,000 464,000 525,000 245,000 31,000 21,000 25,000 7,000 514,000 3,000 4,000 75,000 26,000 10,000 10,000 50,000 Operating Revenues; 1._ 2. Less: 4. 5. Expenses: 7. 8. 9. 10. 11. 12. 3. 15. Operating Income 16. 6. Net operating revenue Non-operating Income: 13. Total expenses INCOME STATEMENT 17. Total non-operating income Net Income: Profit or (Loss) HSCA 3600 ASSIGNMENT 1 Arrange the following Balance Sheet categories in their proper order in the spaces below: Plant, Property, & Equipment Current Liabilities Assets Long Term Debt Current Assets If Total Assets = $500,000 And Current Liabilities - 25,000 = BALANCE SHEET And Long Term Debt = $125,000 How much would Equity equal? Equity Total Liabilities & Equity Long Term Investments Total Assets Liabilities.

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

INCOME STATEMENT Operating Revenue 1 Patient Service Revenue 525000 2 Less Provision for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started