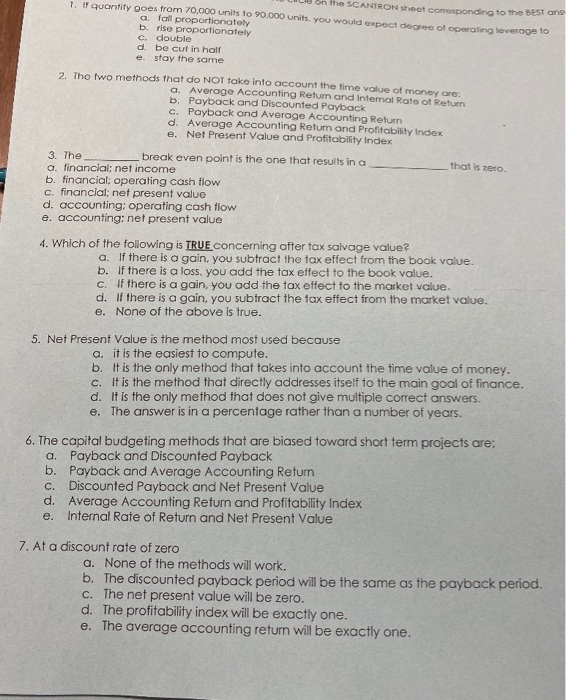

on the SCANTRON sheet componding to the best one 1. I quantity goes from 70,000 units to 90.000 units, you would expect degree of operating loverage to a fall proportionately b rise proportionately c. double d be cut in half e stay the same 2. The two methods that do NOT take into account the time value of money ore a. Average Accounting Return and Internal Rate of Return b. Payback and Discounted Payback c. Payback and Average Accounting Return d. Average Accounting Return and Profitability Index e. Net Present Value and Profitability Index that is zero 3. The break even point is the one that results in a a financial; net income b. financial, operating cash flow c. financial, net present value d. accounting: operating cash flow e. accounting: net present value 4. Which of the following is TRUE concerning after tax salvage value? a. If there is a gain, you subtract the tax effect from the book value. b. If there is a loss, you add the tax effect to the book value. c. If there is a gain, you add the tax effect to the market value. d. If there is a gain, you subtract the fax effect from the market value. e. None of the above is true. 5. Net Present Value is the method most used because a. it is the easiest to compute. b. it is the only method that takes into account the time value of money. C. It is the method that directly addresses itself to the main goal of finance. d. It is the only method that does not give multiple correct answers, e. The answer is in a percentage rather than a number of years. 6. The capital budgeting methods that are biased toward short term projects are: a. Payback and Discounted Payback b. Payback and Average Accounting Return c. Discounted Payback and Net Present Value d. Average Accounting Return and Profitability Index e. Internal Rate of Return and Net Present Value 7. At a discount rate of zero a. None of the methods will work. b. The discounted payback period will be the same as the payback period. C. The net present value will be zero. d. The profitability index will be exactly one. e. The average accounting return will be exactly one