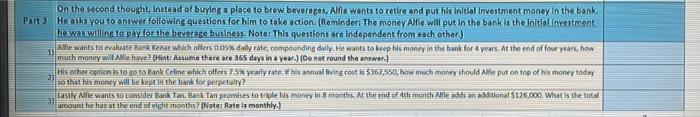

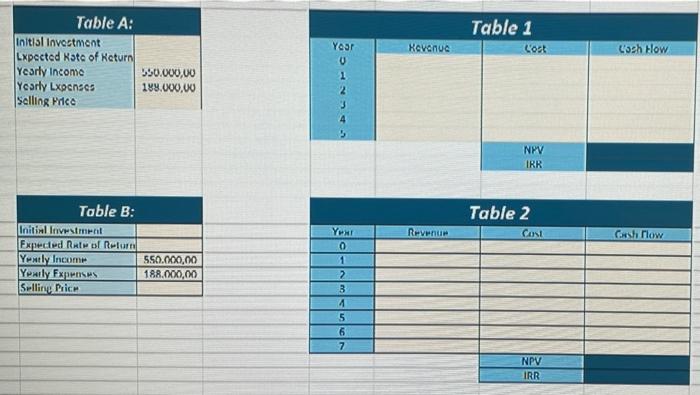

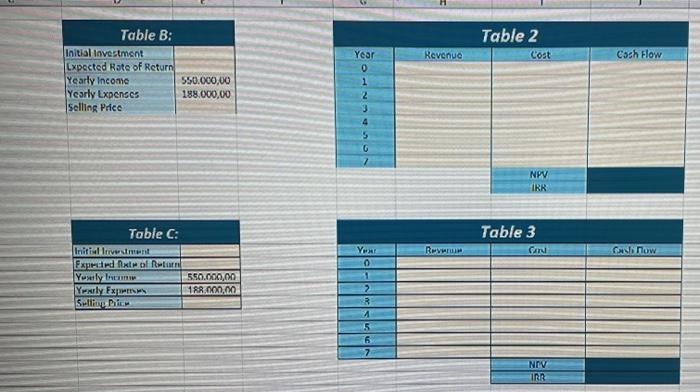

On the second thought, Instead of buying a place to brew beverages, Alfie wants to retire and put his initial Investment money in the bank. Part 3 He asks you to answer following questions for him to take action (Reminder: The money file will put in the bank is the initialInvestment he war willing to pay for the beverage business. Note: This questions are independent from each other.) 1 Allie wants to evaluate Bank Kent which offers cordially rate compounding daly. He wants to keep his money in the bank for 4 years. At the end of four years, how much money will have int. Assume there are 365 days in a year.)(Do not round the anwwer. His other options to poto Bank Celine whichofes 5 yeatlytte his annuali costi 5367,550, how much money should Alle put on top of his money today 2) so that his money will be kept in the bank for perpetuity2 Lastly Allie wants to considerant tan promises to triple liis money in 3 months. At the end of the month Alliedsantona 5126.000. What is the total amount he has at the end of eight months? (Note: Ratels monthly Table 1 Year Xovanud Coct C'sch How Table A: Initial Investment Lxpected ste of Return Yearly Income Yearly Lxpenses Selling Price 550.000,00 189.000,00 U 1 2 NPV IRR Table 2 Cost Revenue Cash Flow Table B: Initial Investment Expected RAP Return Yently Income Ypaily Expenses Selling Price 550.000,00 188.000,00 Year 0 1 2 3 4 5 6 7 NPV IRR Table 2 Revenue Cost Cash Flow Table B: Initial investment Lxpected Rate of Return Yearly Income Yearly Expenses Selling Price 550.000,00 188.000,00 Year 0 1 2 3 4 5 0 2 NPV IRR Table 3 CA Revu Chuw Table C: Initis Irrvestment Exprend Nxt of Return Yently in 550.000,00 Yently Ex 188.000,00 Si Pic Year 0 1 2 3 4 5 6 7 NOV IRR ISIS On the second thought, Instead of buying a place to brew beverages, Alfie wants to retire and put his initial Investment money in the bank. Part 3 He asks you to answer following questions for him to take action (Reminder: The money file will put in the bank is the initialInvestment he war willing to pay for the beverage business. Note: This questions are independent from each other.) 1 Allie wants to evaluate Bank Kent which offers cordially rate compounding daly. He wants to keep his money in the bank for 4 years. At the end of four years, how much money will have int. Assume there are 365 days in a year.)(Do not round the anwwer. His other options to poto Bank Celine whichofes 5 yeatlytte his annuali costi 5367,550, how much money should Alle put on top of his money today 2) so that his money will be kept in the bank for perpetuity2 Lastly Allie wants to considerant tan promises to triple liis money in 3 months. At the end of the month Alliedsantona 5126.000. What is the total amount he has at the end of eight months? (Note: Ratels monthly Table 1 Year Xovanud Coct C'sch How Table A: Initial Investment Lxpected ste of Return Yearly Income Yearly Lxpenses Selling Price 550.000,00 189.000,00 U 1 2 NPV IRR Table 2 Cost Revenue Cash Flow Table B: Initial Investment Expected RAP Return Yently Income Ypaily Expenses Selling Price 550.000,00 188.000,00 Year 0 1 2 3 4 5 6 7 NPV IRR Table 2 Revenue Cost Cash Flow Table B: Initial investment Lxpected Rate of Return Yearly Income Yearly Expenses Selling Price 550.000,00 188.000,00 Year 0 1 2 3 4 5 0 2 NPV IRR Table 3 CA Revu Chuw Table C: Initis Irrvestment Exprend Nxt of Return Yently in 550.000,00 Yently Ex 188.000,00 Si Pic Year 0 1 2 3 4 5 6 7 NOV IRR ISIS