Answered step by step

Verified Expert Solution

Question

1 Approved Answer

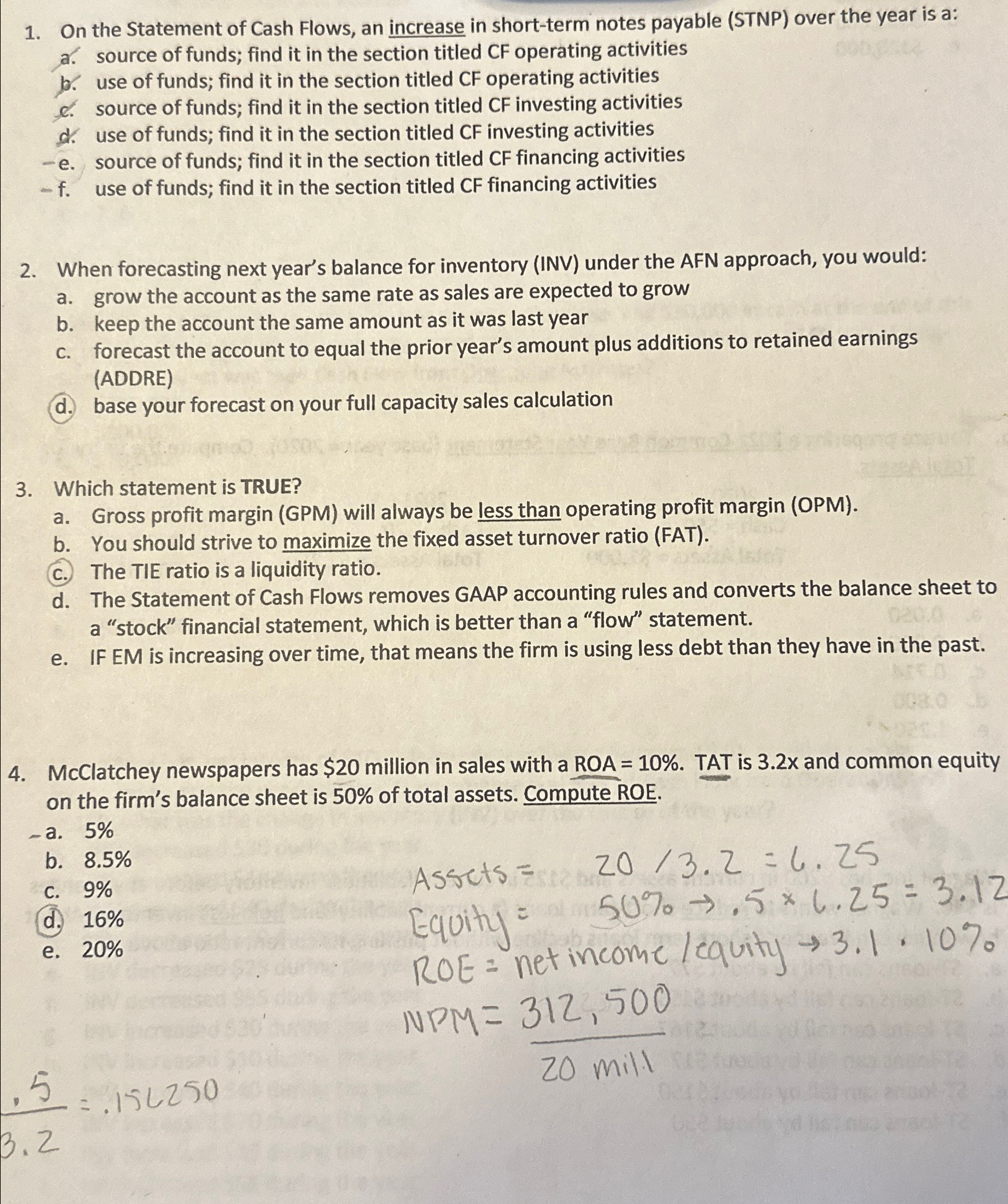

On the Statement of Cash Flows, an increase in short - term notes payable ( STNP ) over the year is a: a . source

On the Statement of Cash Flows, an increase in shortterm notes payable STNP over the year is a:

a source of funds; find it in the section titled CF operating activities

b use of funds; find it in the section titled CF operating activities

c source of funds; find it in the section titled CF investing activities

d use of funds; find it in the section titled CF investing activities

e source of funds; find it in the section titled CF financing activities

f use of funds; find it in the section titled CF financing activities

When forecasting next year's balance for inventory INV under the AFN approach, you would:

a grow the account as the same rate as sales are expected to grow

b keep the account the same amount as it was last year

c forecast the account to equal the prior year's amount plus additions to retained earnings ADDRE

d base your forecast on your full capacity sales calculation

Which statement is TRUE?

a Gross profit margin GPM will always be less than operating profit margin OPM

b You should strive to maximize the fixed asset turnover ratio FAT

c The TIE ratio is a liquidity ratio.

d The Statement of Cash Flows removes GAAP accounting rules and converts the balance sheet to a "stock" financial statement, which is better than a "flow" statement.

e IF EM is increasing over time, that means the firm is using less debt than they have in the past.

McClatchey newspapers has $ million in sales with a ROA TAT is and common equity on the firm's balance sheet is of total assets. Compute ROE.

a

b

c

d

e

Assets

Equity

ROE net income lequity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started