Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on these two i have changed if the revenue or sales fell 20% or were 20% higher now, I would like to do the net

on these two i have changed if the revenue or sales fell 20% or were 20% higher now, I would like to do the net present value, internal rate of return and payback value. please explain the time value of money affects the calculations and analysis.

on these two i have changed if the revenue or sales fell 20% or were 20% higher now, I would like to do the net present value, internal rate of return and payback value. please explain the time value of money affects the calculations and analysis. if you use any calculation for an excel sheet, please let me know them as well.

what needs to be done is to find the net present value, internal rate of return, and payback values from my base scenerio and the sales variation scenerios. please explain how the time value of money efects the calculations and analysis.

the information on the two attached sheets is not the information needed. where di i find the cost of capital?

i thought it was for future predictions

where would i find the. cost of capital?

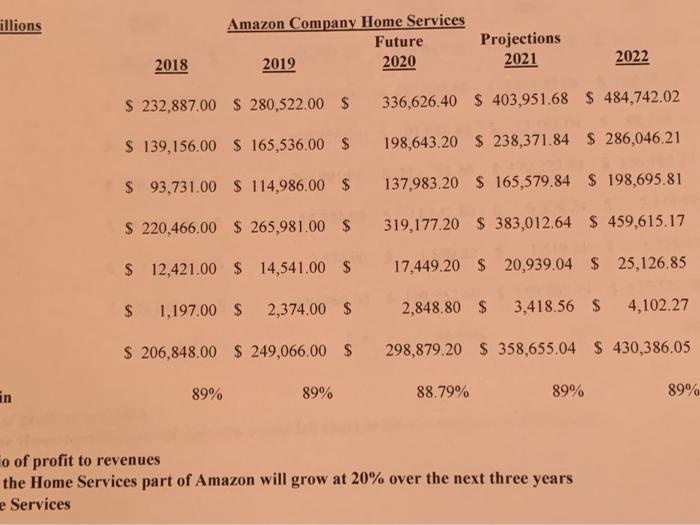

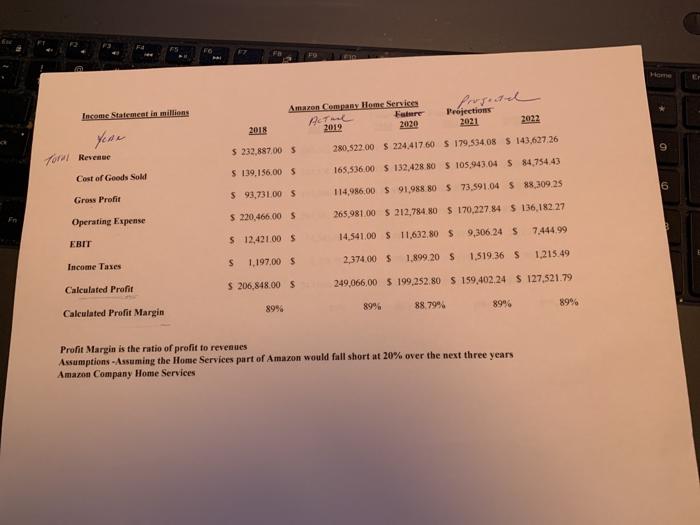

illions Amazon Company Home Services Future 2019 2020 Projections 2021 2022 2018 $ 232,887.00 $ 280,522.00 S 336,626.40 $ 403,951.68 $ 484,742.02 $ 139,156.00 $ 165,536.00 $ 198,643.20 $ 238,371.84 $ 286,046.21 $ 93,731.00 $ 114,986.00 $ 137,983.20 $ 165,579.84 $ 198,695.81 $ 220,466.00 $ 265,981.00 $ 319,177.20 $ 383,012.64 $ 459,615.17 $ 12,421.00 $ 14,541.00 $ 17,449.20 $ 20,939.04 $ 25,126.85 $ 1,197.00 $ 2,374.00 $ 2,848.80 $ 3,418.56 $ 4,102.27 $ 206,848.00 $ 249,066.00 $ 298,879.20 $ 358,655.04 $ 430,386.05 En 89% 89% 88.79% 89% 89% fo of profit to revenues the Home Services part of Amazon will grow at 20% over the next three years e Services * Amazon Company Home Services A Feature 2019 2020 Projections 2021 2022 2018 Income Statement in millions Year for Revenue Cost of Goods Sold D $ 232,887.00 5 280,522.00 S 224,417 60 S 179,534.08 $ 143,627 26 165,536.00 $ 132,428 80 $ 105,943.04 584.754 43 $ 139,156,00 5 6 $ 93,731.00 $ 114,986,00 $ 91,988 80 5 73,591,04 $ 88,309.25 Gross Profit $ 220,466.00 $ 265,981.00 $ 212,784.80 $ 170,227 84 S 136,182.27 Operating Expense 9,306,24 5 7.444.99 14,54100 $ 11,632.80 $ EBIT $ 12,421.00 $ 1.215 49 2,374.00 $ 1.899.20 S 1.519 36 S 1.197.00 $ Income Taxes Calculated Profit $ 206,848.00 S 249,066,00 $ 199,252.80 S 159,402.24 $ 127,521.79 8996 89% 88 7994 8996 89% Calculated Profit Margin Profit Margin is the ratio of profit to revenues Assumptions - Assuming the Home Services part of Amazon would fall short at 20% over the next three years Amazon Company Home Services illions Amazon Company Home Services Future 2019 2020 Projections 2021 2022 2018 $ 232,887.00 $ 280,522.00 S 336,626.40 $ 403,951.68 $ 484,742.02 $ 139,156.00 $ 165,536.00 $ 198,643.20 $ 238,371.84 $ 286,046.21 $ 93,731.00 $ 114,986.00 $ 137,983.20 $ 165,579.84 $ 198,695.81 $ 220,466.00 $ 265,981.00 $ 319,177.20 $ 383,012.64 $ 459,615.17 $ 12,421.00 $ 14,541.00 $ 17,449.20 $ 20,939.04 $ 25,126.85 $ 1,197.00 $ 2,374.00 $ 2,848.80 $ 3,418.56 $ 4,102.27 $ 206,848.00 $ 249,066.00 $ 298,879.20 $ 358,655.04 $ 430,386.05 En 89% 89% 88.79% 89% 89% fo of profit to revenues the Home Services part of Amazon will grow at 20% over the next three years e Services * Amazon Company Home Services A Feature 2019 2020 Projections 2021 2022 2018 Income Statement in millions Year for Revenue Cost of Goods Sold D $ 232,887.00 5 280,522.00 S 224,417 60 S 179,534.08 $ 143,627 26 165,536.00 $ 132,428 80 $ 105,943.04 584.754 43 $ 139,156,00 5 6 $ 93,731.00 $ 114,986,00 $ 91,988 80 5 73,591,04 $ 88,309.25 Gross Profit $ 220,466.00 $ 265,981.00 $ 212,784.80 $ 170,227 84 S 136,182.27 Operating Expense 9,306,24 5 7.444.99 14,54100 $ 11,632.80 $ EBIT $ 12,421.00 $ 1.215 49 2,374.00 $ 1.899.20 S 1.519 36 S 1.197.00 $ Income Taxes Calculated Profit $ 206,848.00 S 249,066,00 $ 199,252.80 S 159,402.24 $ 127,521.79 8996 89% 88 7994 8996 89% Calculated Profit Margin Profit Margin is the ratio of profit to revenues Assumptions - Assuming the Home Services part of Amazon would fall short at 20% over the next three years Amazon Company Home Services Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started