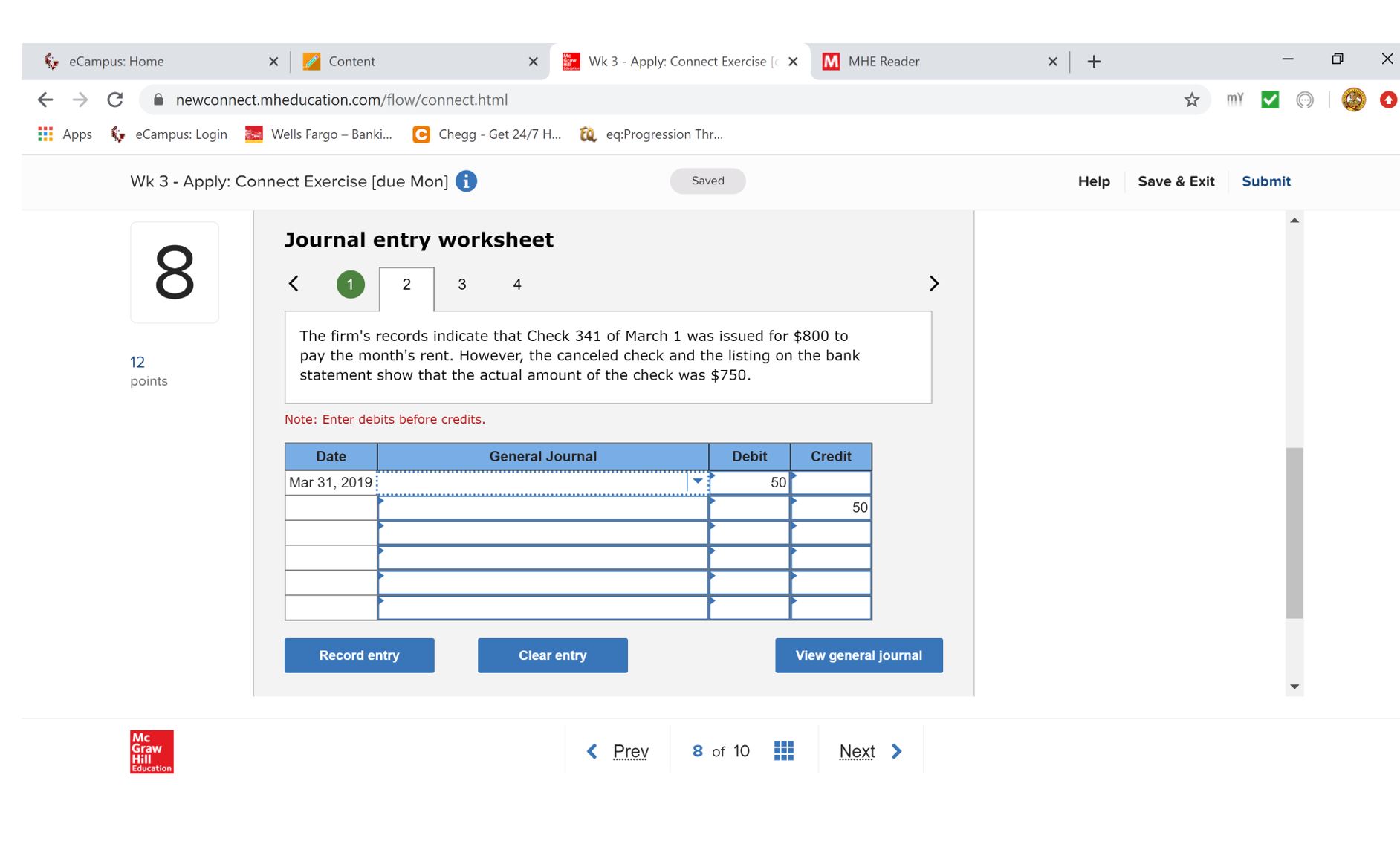

On this week's problem- I chose rent expense for debit and cash for the credit in my drop downs and got counted wrong- the amts

On this week's problem- I chose rent expense for debit and cash for the credit in my drop downs and got counted wrong- the amts were correct. Why wouldn't it be considered a rent expense/cash entry, that to me would be the only option since it is talking about the rent expense? drop down options are Accounts payable, Accounts Receivable/D. Jaris, Cash, Cash short or over, Delivery expense, Equipment, Interest Expense, Interest Income, Merchandise inventory, Miscellaneous expense, Notes Payable, notes receivable, petty cash, purchases, purchases discounts, purchases returns and allowances, rent expense, salaries expense, sales, sales discounts, sales returns and allowances, sales tax payable, supplies, telephone expense and utilities expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started