Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On Thursday, Justin flies from Baltimore ( where the office for his sole proprietorship is located ) to Cadiz ( Spain ) . He conducts

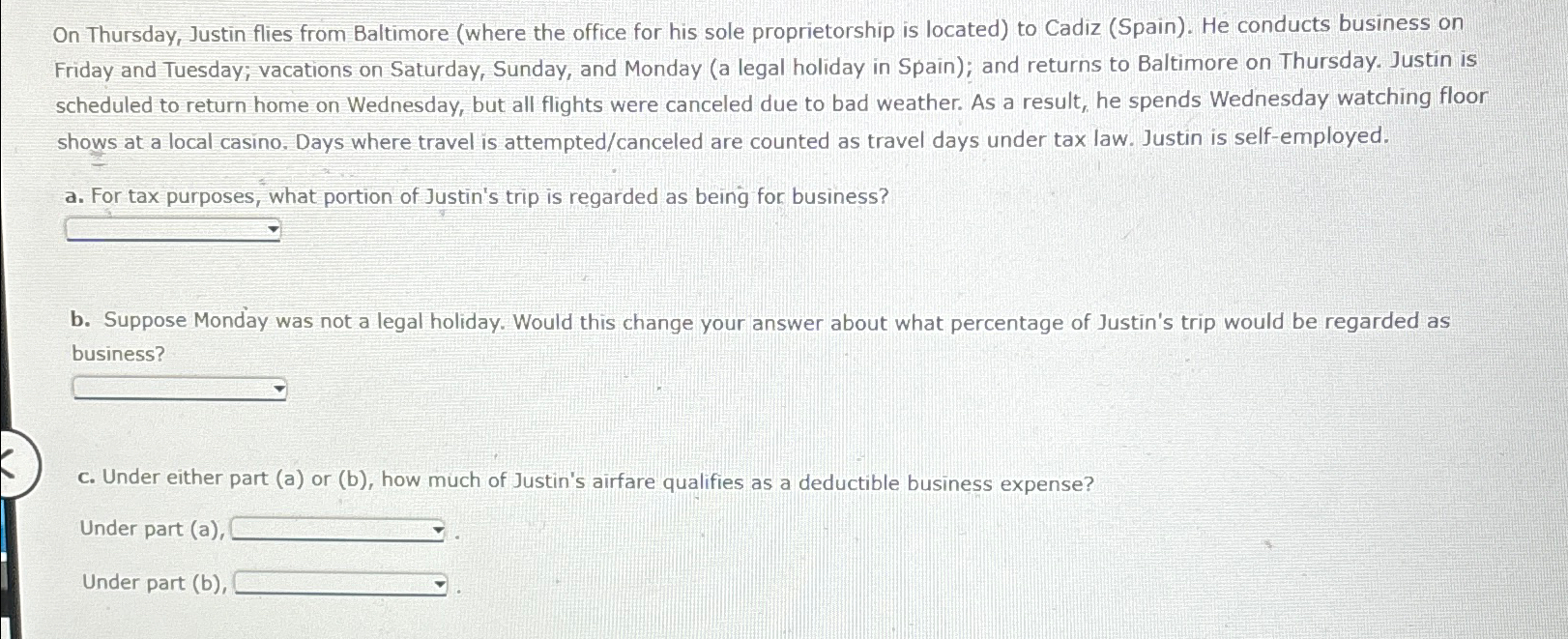

On Thursday, Justin flies from Baltimore where the office for his sole proprietorship is located to Cadiz Spain He conducts business on Friday and Tuesday; vacations on Saturday, Sunday, and Monday a legal holiday in Spain; and returns to Baltimore on Thursday. Justin is scheduled to return home on Wednesday, but all flights were canceled due to bad weather. As a result, he spends Wednesday watching floor shows at a local casino. Days where travel is attemptedcanceled are counted as travel days under tax law. Justin is selfemployed.

a For tax purposes, what portion of Justin's trip is regarded as being for business?

b Suppose Monday was not a legal holiday. Would this change your answer about what percentage of Justin's trip would be regarded as business?

c Under either part a or b how much of Justin's airfare qualifies as a deductible business expense?

Under part a

Under part b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started