Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on TI 84 calculator OPTION 3: Planning for retirement As average life spans increase, companies are looking for ways to decrease the total amount they

on TI 84 calculator

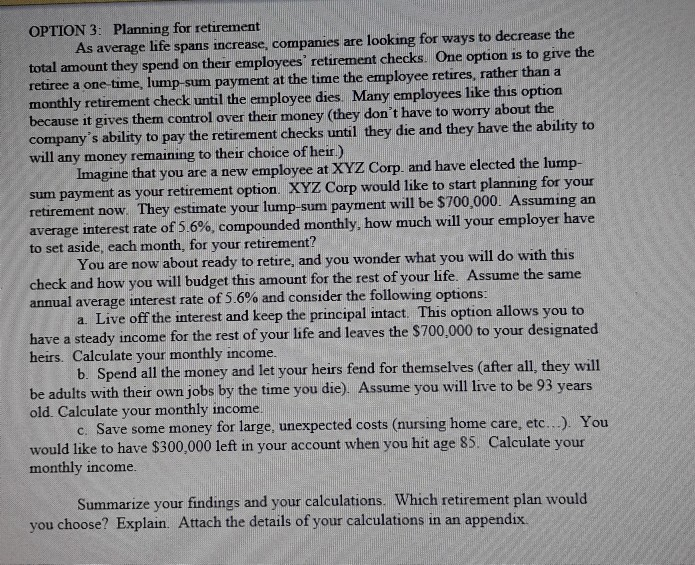

OPTION 3: Planning for retirement As average life spans increase, companies are looking for ways to decrease the total amount they spend on their employees' retirement checks. One option is to give the retiree a one-time, lump-sum payment at the time the employee retires, rather than a monthly retirement check until the employee dies. Many employees like this option because it gives them control over their money (they don't have to worry about the company's ability to pay the retirement checks until they die and they have the ability to will any money remaining to their choice of heir.) Imagine that you are a new employee at XYZ Corp. and have elected the lump- sum payment as your retirement option. XYZ Corp would like to start planning for your retirement now. They estimate your lump-sum payment will be $700,000. Assuming an average interest rate of 5.6%, compounded monthly, how much will your employer have to set aside, each month, for your retirement? You are now about ready to retire, and you wonder what you will do with this check and how you will budget this amount for the rest of your life. Assume the same annual average interest rate of 5.6% and consider the following options: a. Live off the interest and keep the principal intact. This option allows you to have a steady income for the rest of your life and leaves the $700,000 to your designated heirs. Calculate your monthly income. b. Spend all the money and let your heirs fend for themselves (after all, they will be adults with their own jobs by the time you die). Assume you will live to be 93 years old. Calculate your monthly income. c. Save some money for large, unexpected costs (nursing home care, etc...). You would like to have $300,000 left in your account when you hit age 85. Calculate your monthly income Summarize your findings and your calculations. Which retirement plan would you choose? Explain. Attach the details of your calculations in an appendixStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started