Answered step by step

Verified Expert Solution

Question

1 Approved Answer

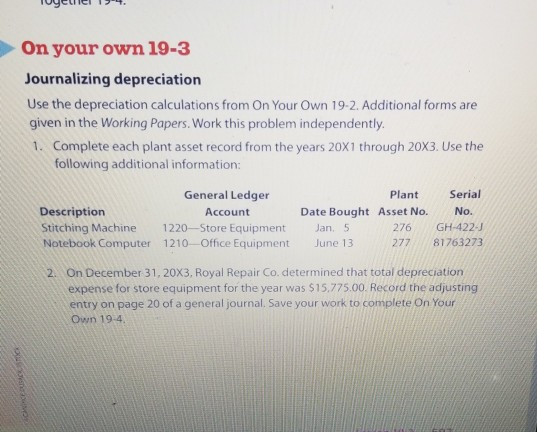

| | | | On your own 19-3 Journalizing depreciation Use the depreciation calculations from On Your Own 19-2. Additional forms are given in the

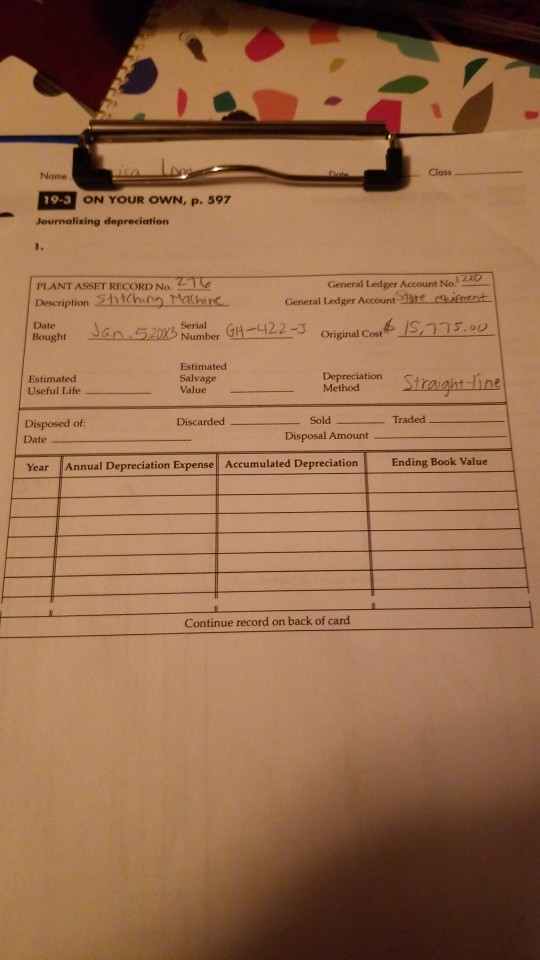

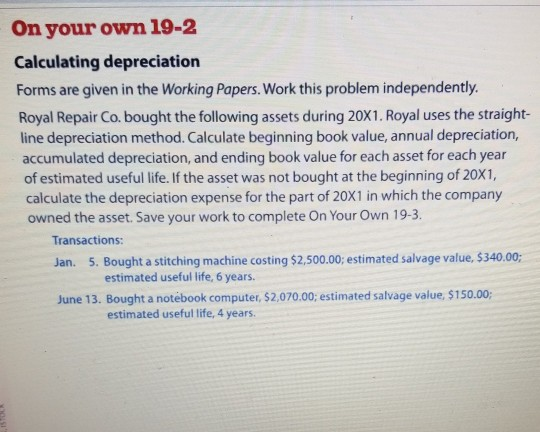

| | | | On your own 19-3 Journalizing depreciation Use the depreciation calculations from On Your Own 19-2. Additional forms are given in the Working Papers. Work this problem independently. 1. Complete each plant asset record from the years 20X1 through 20X3. Use the following additional information: General Ledger Description Account Stitching Machine 1220-Store Equipment Notebook Computer 1210-Office Equipment Plant Serial Date Bought Asset No. No. Jan. 5 276 GH-422-J June 13 27781763273 2. On December 31, 20X3, Royal Repair Co. determined that total depreciation expense for store equipment for the year was $15.775.00. Record the adjusting entry on page 20 of a general journal. Save your work to complete On Your Own 19-4 Name Lope 19-3 ON YOUR OWN, p. 597 Journalizing depreciation PLANT ASSET RECORD No. 216 General Ledger Account No.1220 Description Stiching Machine General Ledger Account Tore curent. Date Bought Jan.5.20X3 Number GH-422-3 Original Cost IS, 775.00 Estimated Useful Life Estimated Salvage Value Depreciation Method " Straight line Disposed of: Date Discarded Traded Sold Disposal Amount Year Annual Depreciation Expense Accumulated Depreciation Ending Book Value Continue record on back of card On your own 19-2 Calculating depreciation Forms are given in the Working Papers. Work this problem independently. Royal Repair Co. bought the following assets during 20X1. Royal uses the straight- line depreciation method. Calculate beginning book value, annual depreciation, accumulated depreciation, and ending book value for each asset for each year of estimated useful life. If the asset was not bought at the beginning of 20X1, calculate the depreciation expense for the part of 20X1 in which the company owned the asset. Save your work to complete On Your Own 19-3. Transactions: Jan. 5. Bought a stitching machine costing $2,500.00; estimated salvage value, $340.00; estimated useful life, 6 years. June 13. Bought a notebook computer, $2,070.00; estimated salvage value, $150.00; estimated useful life, 4 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started