Question

On your own, create a separate word document and title it as following Westshore University Hospital Cardiology Department. Balance sheet analysis. On this word document

On your own, create a separate word document and title it as following Westshore University Hospital Cardiology Department. Balance sheet analysis. On this word document you will provide minimum of 150 words and using at least one reference source.

1. Explain what asset informs us about a hospital expense

2. States what information the balance sheet shares about hospital expense

3. Review the balance sheet statement and analyze the liabilities of the hospital locate an area where the hospital could make a change to their spending and suggest a remedy.

justify your answer

justify your answer

4 According to total liabilities and fund balance what would be the hospital net worth? is this good or bad and justify your answer.

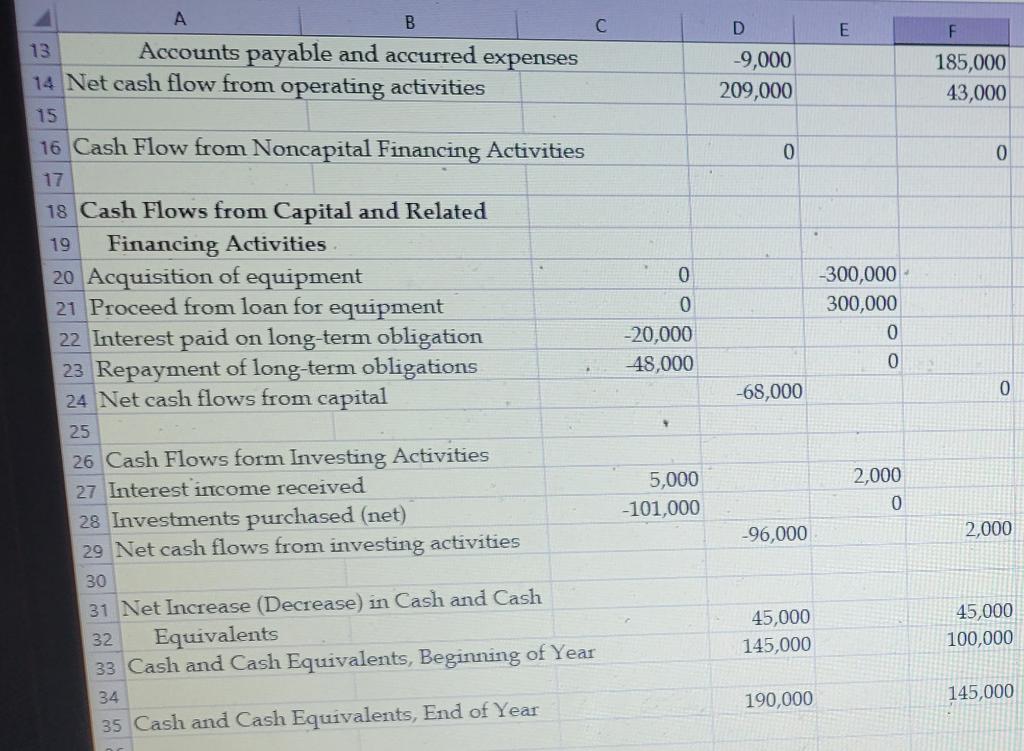

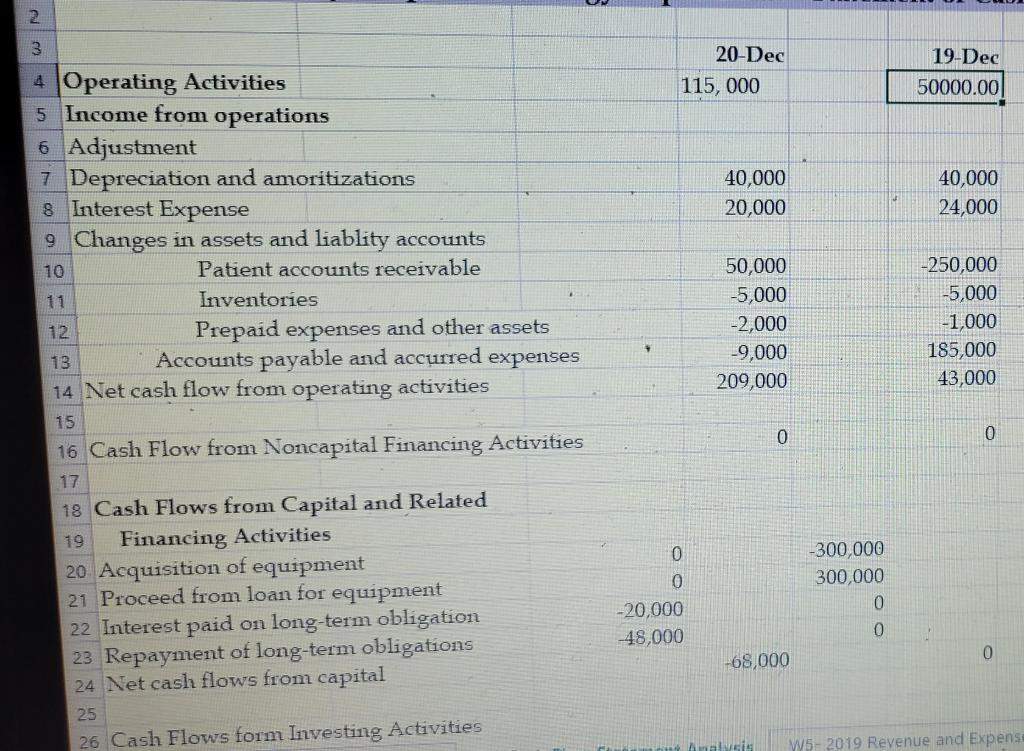

L A B C 13 Accounts payable and accurred expenses 14 Net cash flow from operating activities 15 16 Cash Flow from Noncapital Financing Activities 17 18 Cash Flows from Capital and Related 19 Financing Activities. 20 Acquisition of equipment 21 Proceed from loan for equipment 22 Interest paid on long-term obligation 23 Repayment of long-term obligations 24 Net cash flows from capital 25 26 Cash Flows form Investing Activities 27 Interest income received 28 Investments purchased (net) 29 Net cash flows from investing activities 30 31 Net Increase (Decrease) in Cash and Cash 32 Equivalents 33 Cash and Cash Equivalents, Beginning of Year 34 35 Cash and Cash Equivalents, End of Year 0 0 -20,000 48,000 4 5,000 -101,000 D -9,000 209,000 0 -68,000 -96,000 45,000 145,000 190,000 E -300,000 300,000 0 0 2,000 0 F 185,000 43,000 0 0 2,000 45,000 100,000 145,000 2 3 4 Operating Activities 5 Income from operations 6 Adjustment 7 Depreciation and amoritizations 8 Interest Expense 9 Changes in assets and liablity accounts 10 Patient accounts receivable Inventories 12 Prepaid expenses and other assets 13 Accounts payable and accurred expenses 14 Net cash flow from operating activities 15 16 Cash Flow from Noncapital Financing Activities 17 18 Cash Flows from Capital and Related Financing Activities 19 20 Acquisition of equipment 21 Proceed from loan for equipment 22 Interest paid on long-term obligation 23 Repayment of long-term obligations 24 Net cash flows from capital 25 26 Cash Flows form Investing Activities 4 20-Dec 115, 000 0 0 -20,000 -48,000 40,000 20,000 50,000 -5,000 -2,000 -9,000 209,000 0 -68,000 Analysis 19-Dec 50000.00 40,000 24,000 -250,000 -5,000 -1,000 185,000 43,000 0 -300,000 300,000 0 0 0 W5-2019 Revenue and Expense L A B C 13 Accounts payable and accurred expenses 14 Net cash flow from operating activities 15 16 Cash Flow from Noncapital Financing Activities 17 18 Cash Flows from Capital and Related 19 Financing Activities. 20 Acquisition of equipment 21 Proceed from loan for equipment 22 Interest paid on long-term obligation 23 Repayment of long-term obligations 24 Net cash flows from capital 25 26 Cash Flows form Investing Activities 27 Interest income received 28 Investments purchased (net) 29 Net cash flows from investing activities 30 31 Net Increase (Decrease) in Cash and Cash 32 Equivalents 33 Cash and Cash Equivalents, Beginning of Year 34 35 Cash and Cash Equivalents, End of Year 0 0 -20,000 48,000 4 5,000 -101,000 D -9,000 209,000 0 -68,000 -96,000 45,000 145,000 190,000 E -300,000 300,000 0 0 2,000 0 F 185,000 43,000 0 0 2,000 45,000 100,000 145,000 2 3 4 Operating Activities 5 Income from operations 6 Adjustment 7 Depreciation and amoritizations 8 Interest Expense 9 Changes in assets and liablity accounts 10 Patient accounts receivable Inventories 12 Prepaid expenses and other assets 13 Accounts payable and accurred expenses 14 Net cash flow from operating activities 15 16 Cash Flow from Noncapital Financing Activities 17 18 Cash Flows from Capital and Related Financing Activities 19 20 Acquisition of equipment 21 Proceed from loan for equipment 22 Interest paid on long-term obligation 23 Repayment of long-term obligations 24 Net cash flows from capital 25 26 Cash Flows form Investing Activities 4 20-Dec 115, 000 0 0 -20,000 -48,000 40,000 20,000 50,000 -5,000 -2,000 -9,000 209,000 0 -68,000 Analysis 19-Dec 50000.00 40,000 24,000 -250,000 -5,000 -1,000 185,000 43,000 0 -300,000 300,000 0 0 0 W5-2019 Revenue and Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started