Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Once again we are interested in the same company above. Suppose that the degree of operating leverage, unit costs and prices have not changed. What

Once again we are interested in the same company above. Suppose that the degree of operating leverage, unit costs and prices have not changed. What would be the new sales revenue level, then? [PLEASE ANSWER ONLY THIS QUESTION PREVIOUS QUESTIONS ARE ABOVE]

A) 1.950.000 TL

B) 1.925.000 TL

C) 1.900.000 TL

D) 1.875.000 TL

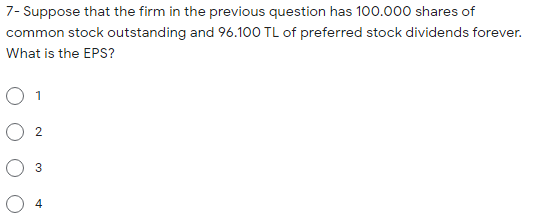

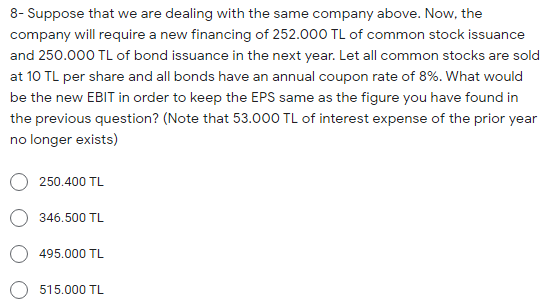

7- Suppose that the firm in the previous question has 100.000 shares of common stock outstanding and 96.100 TL of preferred stock dividends forever. What is the EPS? 2 3 4 8- Suppose that we are dealing with the same company above. Now, the company will require a new financing of 252.000 TL of common stock issuance and 250.000 TL of bond issuance in the next year. Let all common stocks are sold at 10 TL per share and all bonds have an annual coupon rate of 8%. What would be the new EBIT in order to keep the EPS same as the figure you have found in the previous question? (Note that 53.000 TL of interest expense of the prior year no longer exists) 250.400 TL 346.500 TL 495.000 TL 515.000 TL 7- Suppose that the firm in the previous question has 100.000 shares of common stock outstanding and 96.100 TL of preferred stock dividends forever. What is the EPS? 2 3 4 8- Suppose that we are dealing with the same company above. Now, the company will require a new financing of 252.000 TL of common stock issuance and 250.000 TL of bond issuance in the next year. Let all common stocks are sold at 10 TL per share and all bonds have an annual coupon rate of 8%. What would be the new EBIT in order to keep the EPS same as the figure you have found in the previous question? (Note that 53.000 TL of interest expense of the prior year no longer exists) 250.400 TL 346.500 TL 495.000 TL 515.000 TLStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started