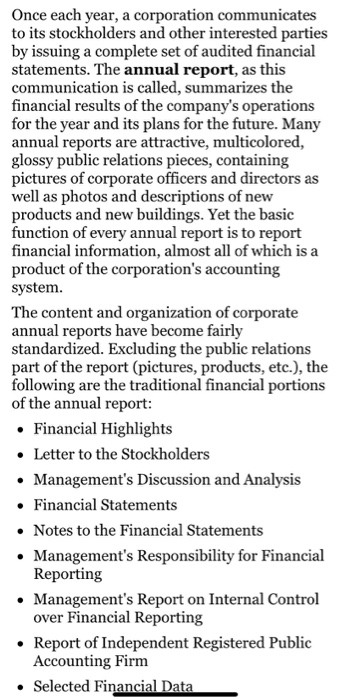

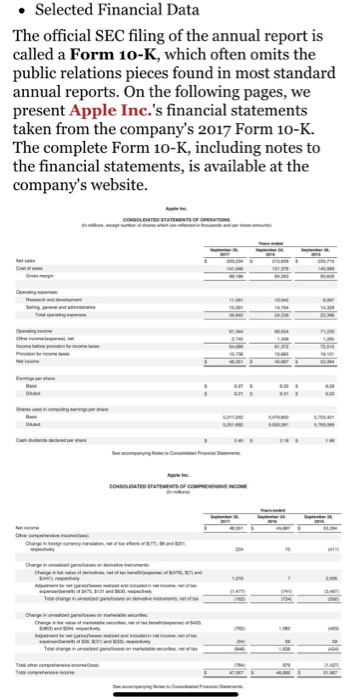

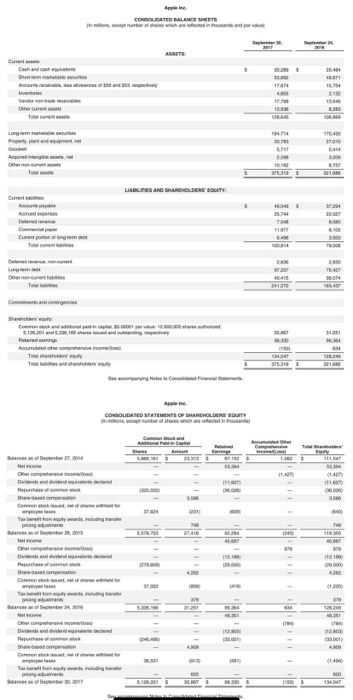

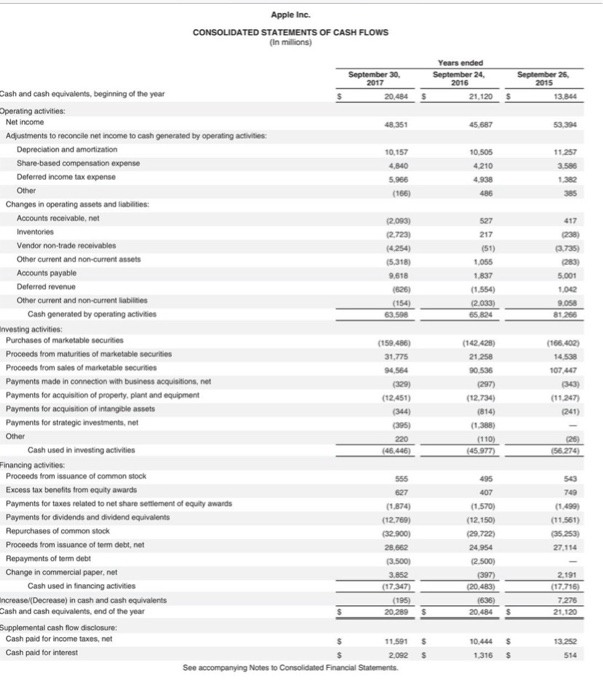

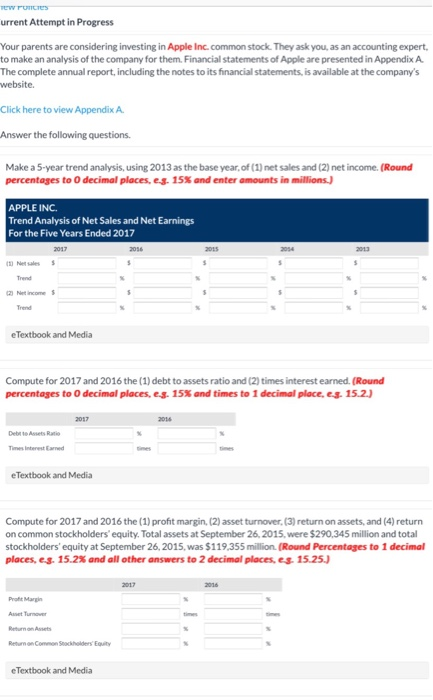

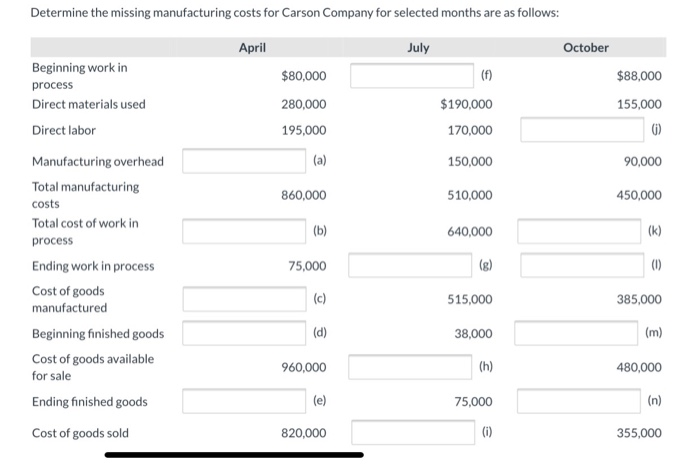

Once each year, a corporation communicates to its stockholders and other interested parties by issuing a complete set of audited financial statements. The annual report, as this communication is called, summarizes the financial results of the company's operations for the year and its plans for the future. Many annual reports are attractive, multicolored, glossy public relations pieces, containing pictures of corporate officers and directors as well as photos and descriptions of new products and new buildings. Yet the basic function of every annual report is to report financial information, almost all of which is a product of the corporation's accounting system. The content and organization of corporate annual reports have become fairly standardized. Excluding the public relations part of the report (pictures, products, etc.), the following are the traditional financial portions of the annual report: Financial Highlights Letter to the Stockholders Management's Discussion and Analysis Financial Statements Notes to the Financial Statements Management's Responsibility for Financial Reporting Management's Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Selected Financial Data Selected Financial Data The official SEC filing of the annual report is called a Form 10-K, which often omits the public relations pieces found in most standard annual reports. On the following pages, we present Apple Inc.'s financial statements taken from the company's 2017 Form 10-K. The complete Form 10-K, including notes to the financial statements, is available at the company's website. CONSOLIDATIO BALANCE SHEETS Two CONSOLBARD ATMINS OF S OLD OUTY TE ill Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS September 30. September 24 $ 21.120 45,687 10 SOS 4.210 4.938 151) 15 90 65 824 81200 Cash and cash equivalents, beginning of the year 20.484 Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization 10.157 Share-based compensation expense 4,840 Deferred income tax expense S. Other (165) Changes in operating assets and abilities: Accounts receivablenet Inventories Vendor non-trade recebe Other current and non-current 15 Accounts payable Deferred revenue Other current and non-current abilities (154) Cash generated by operating activities 63.500 vesting activities: Purchases of marketable securities (150.486) Proceeds from maturities of marketable securities 31.775 Proceeds from sales of marketable securities 94.564 Payments made in connection with business acquisitions, net (3291 Payments for acquisition of property, plant and equipment (12.451) Payments for acquisition of intangible assets M Payments for strategic investments.net Other Cash used in investing activities Financing activities Proceeds rom a nce of common stock Excess tax benefits from equity awards Payments fortes related to not share soment of guilty awards Payments for dividends and dividend equivalents (12.780 Repurchases of common stock (32.000 Proceeds from issuance of term debit.net 28.662 Repayments of term debt 3.500 Change in commercial paper, net 3.852 Cash used in financing activities (1737) ncrease Decrease in cash and cash equivalents (195) Sash and cash equivalents, and of the year 20.289 Supplemental cash flow disclosure Cash paid for income taxes.net 11.501 Cash paid for interest 2012 See accompanying Notes to Consolidated Financial Statements (162.428) 21.258 90.536 (297) (12.734) (166.002) 14.538 107 447 (112) 241 (110) (11 561) (1.570) (12.150) (29.722) 24954 2.500) 397) 20 483) (35.253 27.114 20484 10.44 1316 $ 5 W PORCES urrent Attempt in Progress Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix A Answer the following questions. Make a 5-year trend analysis, using 2013 as the base year, of (1) net sales and (2) net income. (Round percentages to decimal places, s. 15% and enter amounts in millions.) APPLE INC Trend Analysis of Net Sales and Net Earnings For the Five Years Ended 2017 2017 e Textbook and Media Compute for 2017 and 2016 the (1) debt to assets ratio and (2) times interest earned. (Round percentages to O decimal places, e-s. 15% and times to 1 decimal place, s. 15.2.) 2017 Deb a ti Tested e Textbook and Media Compute for 2017 and 2016 the (1) profit margin, (2) asset turnover, (3) return on assets, and (4) return on common stockholders' equity. Total assets at September 26, 2015 were $290,345 million and total stockholders' equity at September 26, 2015, was $119,355 million (Round Percentages to 1 decimal places, s. 15.2% and all other answers to 2 decimal places, es 15.25.) eTextbook and Media Determine the missing manufacturing costs for Carson Company for selected months are as follows: April July October $80,000 $88,000 Beginning work in process Direct materials used 280,000 $190,000 155,000 Direct labor 195,000 170,000 150,000 90,000 Manufacturing overhead Total manufacturing costs Total cost of work in process 860,000 510,000 450,000 (b) 640,000 Ending work in process 75,000 Cost of goods manufactured 515,000 385,000 Beginning finished goods 38,000 (m) Cost of goods available for sale 960,000 in 480,000 Ending finished goods 75,000 (n) Cost of goods sold 820,000 355,000 Once each year, a corporation communicates to its stockholders and other interested parties by issuing a complete set of audited financial statements. The annual report, as this communication is called, summarizes the financial results of the company's operations for the year and its plans for the future. Many annual reports are attractive, multicolored, glossy public relations pieces, containing pictures of corporate officers and directors as well as photos and descriptions of new products and new buildings. Yet the basic function of every annual report is to report financial information, almost all of which is a product of the corporation's accounting system. The content and organization of corporate annual reports have become fairly standardized. Excluding the public relations part of the report (pictures, products, etc.), the following are the traditional financial portions of the annual report: Financial Highlights Letter to the Stockholders Management's Discussion and Analysis Financial Statements Notes to the Financial Statements Management's Responsibility for Financial Reporting Management's Report on Internal Control over Financial Reporting Report of Independent Registered Public Accounting Firm Selected Financial Data Selected Financial Data The official SEC filing of the annual report is called a Form 10-K, which often omits the public relations pieces found in most standard annual reports. On the following pages, we present Apple Inc.'s financial statements taken from the company's 2017 Form 10-K. The complete Form 10-K, including notes to the financial statements, is available at the company's website. CONSOLIDATIO BALANCE SHEETS Two CONSOLBARD ATMINS OF S OLD OUTY TE ill Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS September 30. September 24 $ 21.120 45,687 10 SOS 4.210 4.938 151) 15 90 65 824 81200 Cash and cash equivalents, beginning of the year 20.484 Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization 10.157 Share-based compensation expense 4,840 Deferred income tax expense S. Other (165) Changes in operating assets and abilities: Accounts receivablenet Inventories Vendor non-trade recebe Other current and non-current 15 Accounts payable Deferred revenue Other current and non-current abilities (154) Cash generated by operating activities 63.500 vesting activities: Purchases of marketable securities (150.486) Proceeds from maturities of marketable securities 31.775 Proceeds from sales of marketable securities 94.564 Payments made in connection with business acquisitions, net (3291 Payments for acquisition of property, plant and equipment (12.451) Payments for acquisition of intangible assets M Payments for strategic investments.net Other Cash used in investing activities Financing activities Proceeds rom a nce of common stock Excess tax benefits from equity awards Payments fortes related to not share soment of guilty awards Payments for dividends and dividend equivalents (12.780 Repurchases of common stock (32.000 Proceeds from issuance of term debit.net 28.662 Repayments of term debt 3.500 Change in commercial paper, net 3.852 Cash used in financing activities (1737) ncrease Decrease in cash and cash equivalents (195) Sash and cash equivalents, and of the year 20.289 Supplemental cash flow disclosure Cash paid for income taxes.net 11.501 Cash paid for interest 2012 See accompanying Notes to Consolidated Financial Statements (162.428) 21.258 90.536 (297) (12.734) (166.002) 14.538 107 447 (112) 241 (110) (11 561) (1.570) (12.150) (29.722) 24954 2.500) 397) 20 483) (35.253 27.114 20484 10.44 1316 $ 5 W PORCES urrent Attempt in Progress Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix A Answer the following questions. Make a 5-year trend analysis, using 2013 as the base year, of (1) net sales and (2) net income. (Round percentages to decimal places, s. 15% and enter amounts in millions.) APPLE INC Trend Analysis of Net Sales and Net Earnings For the Five Years Ended 2017 2017 e Textbook and Media Compute for 2017 and 2016 the (1) debt to assets ratio and (2) times interest earned. (Round percentages to O decimal places, e-s. 15% and times to 1 decimal place, s. 15.2.) 2017 Deb a ti Tested e Textbook and Media Compute for 2017 and 2016 the (1) profit margin, (2) asset turnover, (3) return on assets, and (4) return on common stockholders' equity. Total assets at September 26, 2015 were $290,345 million and total stockholders' equity at September 26, 2015, was $119,355 million (Round Percentages to 1 decimal places, s. 15.2% and all other answers to 2 decimal places, es 15.25.) eTextbook and Media Determine the missing manufacturing costs for Carson Company for selected months are as follows: April July October $80,000 $88,000 Beginning work in process Direct materials used 280,000 $190,000 155,000 Direct labor 195,000 170,000 150,000 90,000 Manufacturing overhead Total manufacturing costs Total cost of work in process 860,000 510,000 450,000 (b) 640,000 Ending work in process 75,000 Cost of goods manufactured 515,000 385,000 Beginning finished goods 38,000 (m) Cost of goods available for sale 960,000 in 480,000 Ending finished goods 75,000 (n) Cost of goods sold 820,000 355,000