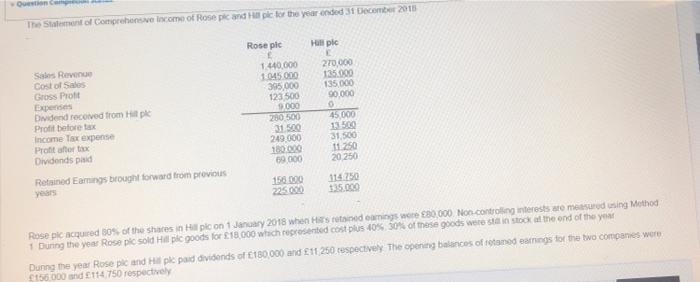

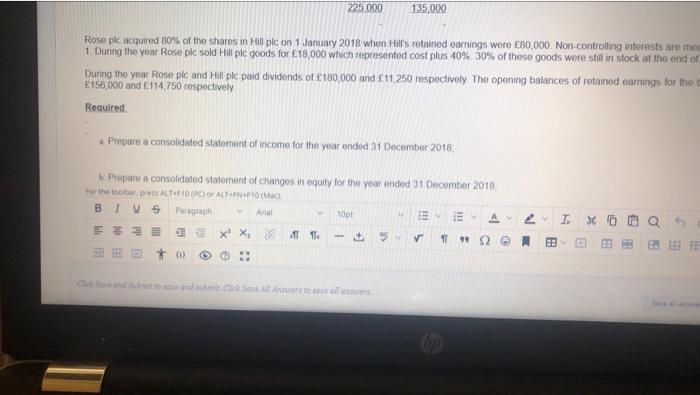

Once The Statement of Comprehensive income of Rose and ple for the year ended 31 December 2015 Rose plc Hall pic 270.000 135.000 135 000 90.000 Sal Revenue Cost of Sales Gross Profit Expenses Dividend received from Hitle Profit before tax Income Tax expense Protator Dividends pid Retained Earnings brought forward from previous 1.440.000 1045000 395.000 123 500 9000 250 500 31.500 249.000 10000 59000 245.000 13.500 31.500 11250 20 250 150 000 225.000 114250 135.000 Rose pic acquired 80% of the shares in a pic on 1 January 2018 when Hits retained oamings were 30,000 Non.controlling interests are measured using Method 1 Duning the year Rose pic sold Hill pic goods for 18,000 which represented cost plus 405 30% of these goods were stato at the end of the year Dunng the year Rose pic and Hill ple pad dividends of 180.000 and 1,250, cespectively. The opening balances of stand earnings for the two companies were 156 000 and 114750 respectively 225 000 135,000 Rose plc acquired 80% of the shares in Hill pic on 1 January 2018 when Hill's retained earnings were 80,000 Non-controlling interests are me 1 During the year Rose pic sold Hill ple goods for 18,000 which represented cost plus 40% 30% of these goods were still in stock at the end of During the year Rose pic and Hill pic paid dividends of 180,000 and 11 250 respectively. The opening balances of retained earnings for the E156,000 and 114 750 cespectively Required Prepare a consolidated statement of income for the year ended 31 December 2018 Prepare a consolidated statement of changes in equity for the year anded 31 December 2018, the toolbar, ALT FOG ALT INFO B TYS Paragraph Arial 10pt E A E XX T 11 - 112 T. x + Once The Statement of Comprehensive income of Rose and ple for the year ended 31 December 2015 Rose plc Hall pic 270.000 135.000 135 000 90.000 Sal Revenue Cost of Sales Gross Profit Expenses Dividend received from Hitle Profit before tax Income Tax expense Protator Dividends pid Retained Earnings brought forward from previous 1.440.000 1045000 395.000 123 500 9000 250 500 31.500 249.000 10000 59000 245.000 13.500 31.500 11250 20 250 150 000 225.000 114250 135.000 Rose pic acquired 80% of the shares in a pic on 1 January 2018 when Hits retained oamings were 30,000 Non.controlling interests are measured using Method 1 Duning the year Rose pic sold Hill pic goods for 18,000 which represented cost plus 405 30% of these goods were stato at the end of the year Dunng the year Rose pic and Hill ple pad dividends of 180.000 and 1,250, cespectively. The opening balances of stand earnings for the two companies were 156 000 and 114750 respectively 225 000 135,000 Rose plc acquired 80% of the shares in Hill pic on 1 January 2018 when Hill's retained earnings were 80,000 Non-controlling interests are me 1 During the year Rose pic sold Hill ple goods for 18,000 which represented cost plus 40% 30% of these goods were still in stock at the end of During the year Rose pic and Hill pic paid dividends of 180,000 and 11 250 respectively. The opening balances of retained earnings for the E156,000 and 114 750 cespectively Required Prepare a consolidated statement of income for the year ended 31 December 2018 Prepare a consolidated statement of changes in equity for the year anded 31 December 2018, the toolbar, ALT FOG ALT INFO B TYS Paragraph Arial 10pt E A E XX T 11 - 112 T. x +