Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Once you have completed the assignment below, you must submit your answers using the answer sheet provided in Canvas; not all answers will be turned

Once you have completed the assignment below, you must submit your answers using the answer sheet provided in

Canvas; not all answers will be turned in Once submitted, your answers cannot be changed, but where appropriate,

partial credit will be given. For future reference, you should keep a copy of your answers outside of Canvas as they

will not be available to view given the nature of the grading process.

For all time value of money calculations, use time value of money factors with at least four decimal places and then

round your final answer but not intermediate steps to the nearest whole dollar.

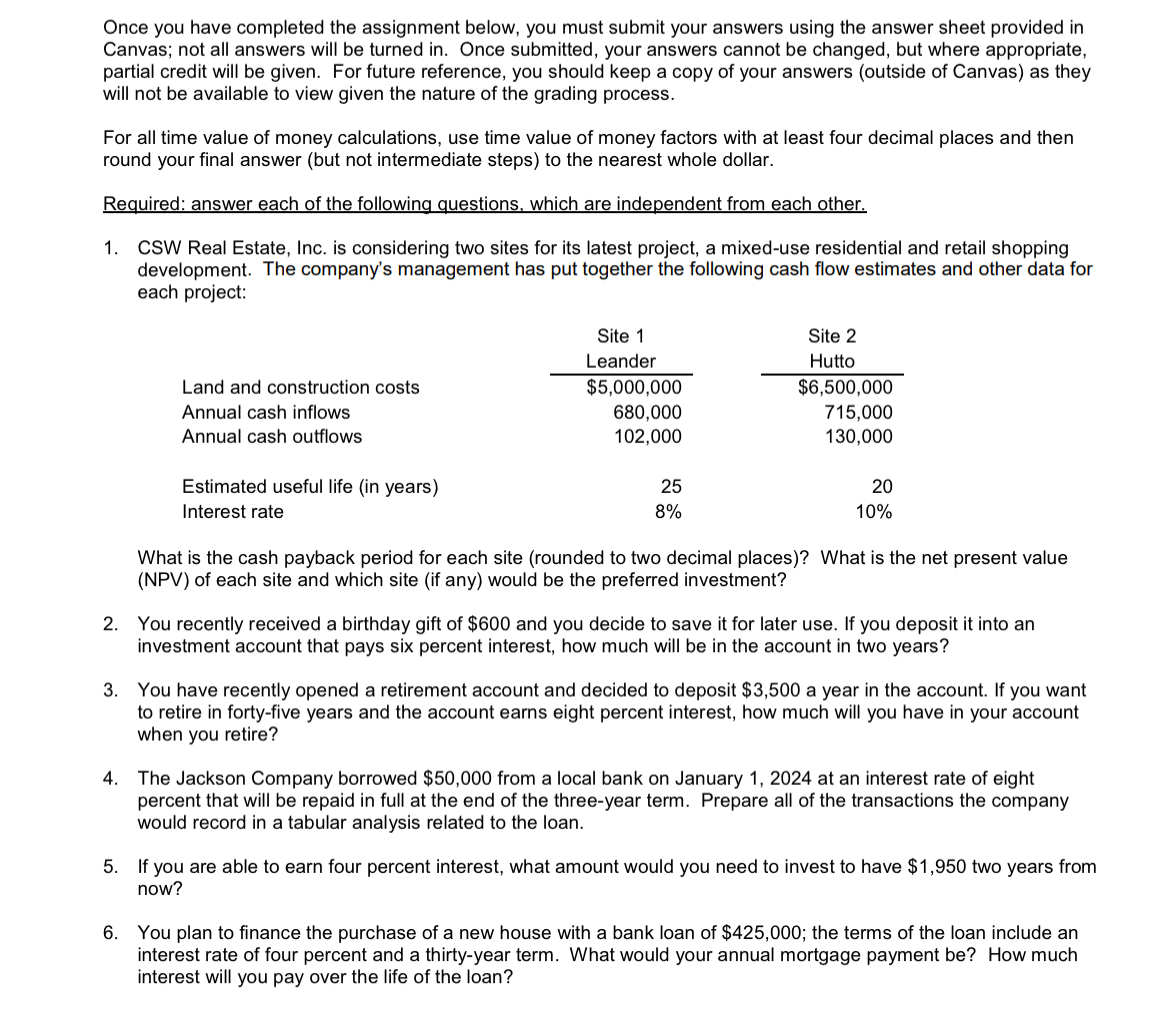

Required: answer each of the following questions, which are independent from each other.

CSW Real Estate, Inc. is considering two sites for its latest project, a mixeduse residential and retail shopping

development. The company's management has put together the following cash flow estimates and other data for

each project:

What is the cash payback period for each site rounded to two decimal places What is the net present value

NPV of each site and which site if any would be the preferred investment?

You recently received a birthday gift of $ and you decide to save it for later use. If you deposit it into an

investment account that pays six percent interest, how much will be in the account in two years?

You have recently opened a retirement account and decided to deposit $ a year in the account. If you want

to retire in fortyfive years and the account earns eight percent interest, how much will you have in your account

when you retire?

The Jackson Company borrowed $ from a local bank on January at an interest rate of eight

percent that will be repaid in full at the end of the threeyear term. Prepare all of the transactions the company

would record in a tabular analysis related to the loan.

If you are able to earn four percent interest, what amount would you need to invest to have $ two years from

now?

You plan to finance the purchase of a new house with a bank loan of $; the terms of the loande an

interest rate of four percent and a thirtyyear term. What would your annual mortgage payment be How much

interest will you pay over the life of the loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started