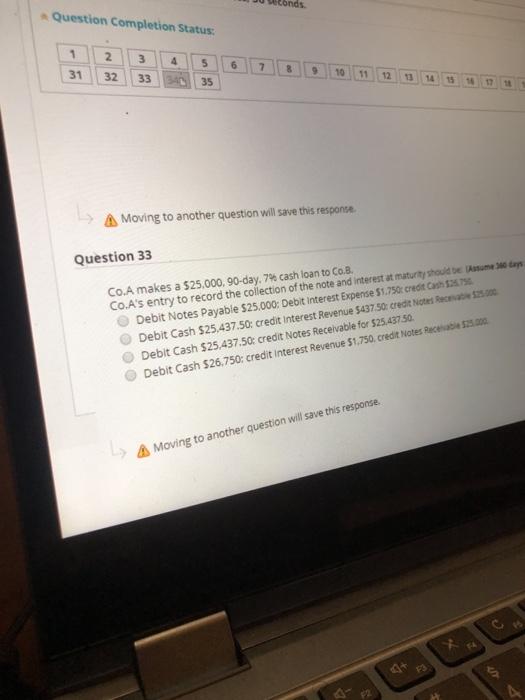

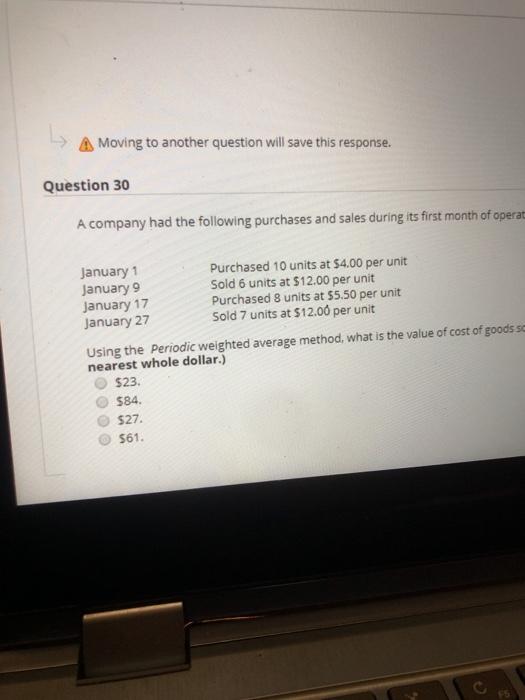

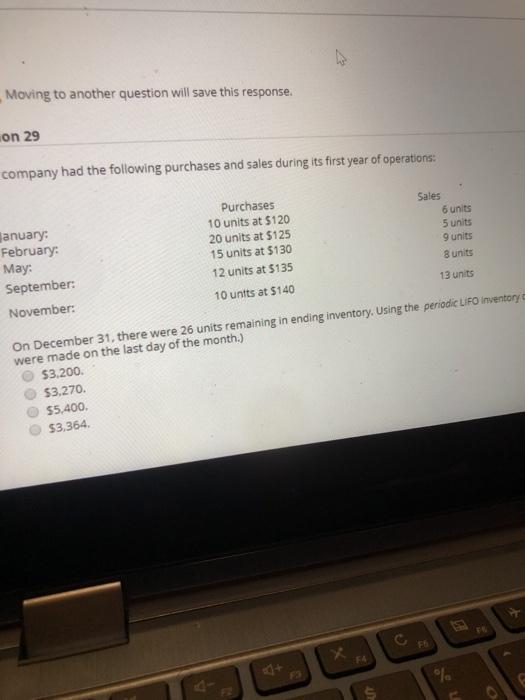

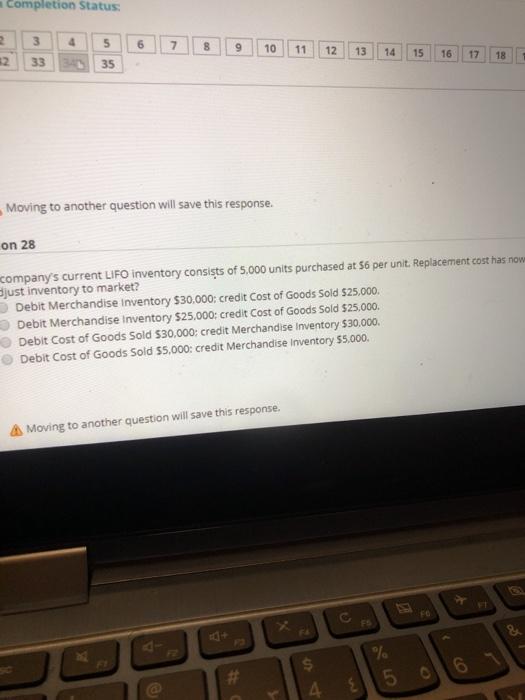

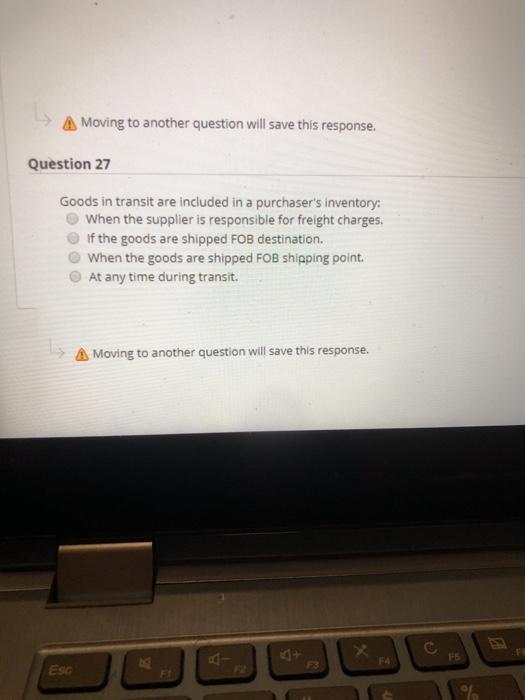

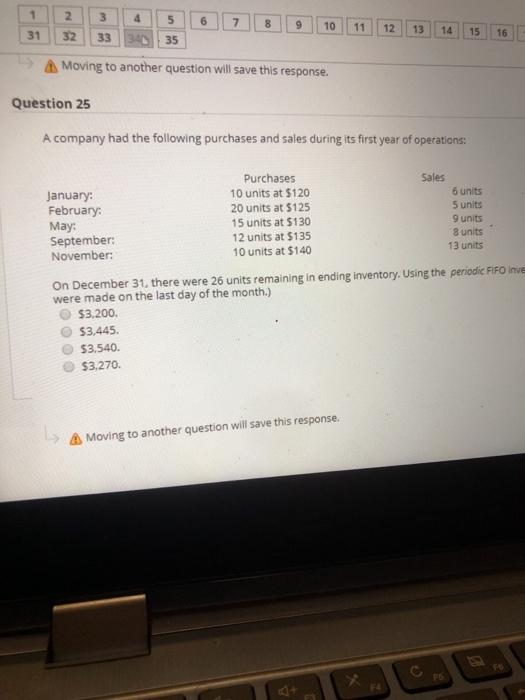

onds Question Completion Status: 1 2 3 4 7 8 31 32 5 35 33 11 13 14 Moving to another question will save this response Question 33 Co.A makes a 525,000, 90-day. 74 cash loan to Co.B. Co.A's entry to record the collection of the note and interest at maturity should be some ty Debit Notes Payable 525.000: Debit interest Expense 51.750 Credit Cam S.T. Debit Cash $25,437.50: credit Interest Revenue $437.50 credit Notes Rec2.0 Debit Cash $25.437.50: credit Notes Receivable for $25.43750. Debit Cash $26,750: credit Interest Revenue 51.750. credit Notes Races 2.000 A Moving to another question will save this response. A Moving to another question will save this response. Question 30 A company had the following purchases and sales during its first month of operat January 1 Purchased 10 units at $4.00 per unit January 9 Sold 6 units at $12.00 per unit January 17 Purchased 8 units at 55.50 per unit January 27 Sold 7 units at $12.00 per unit Using the Periodic weighted average method, what is the value of cost of goods se nearest whole dollar.) $23. $84. $27 $61. Moving to another question will save this response. on 29 company had the following purchases and sales during its first year of operations: Purchases Sales January 10 units at $120 6 units February 20 units at $125 5 units May: 15 units at $130 9 units 8 units 12 units at 5135 September: 13 units November: 10 untts at $140 On December 31, there were 26 units remaining in ending inventory. Using the periodice LIFO inventory were made on the last day of the month.) 53,200. 53.270. $5.400 $3,364 c % Completion Status: 2 4 5 6 7 3 33 8 9 10 11 12 13 14 15 16 17 18 12 35 Moving to another question will save this response. on 28 company's current LIFO inventory consists of 5.000 units purchased at 56 per unit. Replacement cost has now just inventory to market? Debit Merchandise Inventory $30,000 credit cost of Goods Sold $25,000 Debit Merchandise Inventory $25,000 credit cost of Goods Sold $25,000 Debit Cost of Goods Sold 530,000: credit Merchandise Inventory $30,000. Debit Cost of Goods Sold 55,000: credit Merchandise Inventory 55,000. A Moving to another question will save this response. % 5 06 # 4. { A Moving to another question will save this response. Question 27 Goods in transit are included in a purchaser's inventory: When the supplier is responsible for freight charges. If the goods are shipped FOB destination. When the goods are shipped FOB shipping point. At any time during transit A Moving to another question will save this response. FS 73 ESC % 1 3 5 6 7 8 10 11 12 13 14 31 32 15 33 16 340 35 Moving to another question will save this response. Question 25 A company had the following purchases and sales during its first year of operations: Purchases Sales January 10 units at 5120 6 units February 20 units at $125 5 units May: 15 units at $130 9 units September: 12 units at $135 8 units November: 10 units at $140 13 units On December 31, there were 26 units remaining in ending inventory. Using the periodic Fifo Inve were made on the last day of the month.) $3.200. $3,445. $3.540. $3.270 A Moving to another question will save this response