Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One and same question please give answer in brief Part A Noel Maxwell & Co commenced the construction of their new clothes store on April

One and same question please give answer in brief

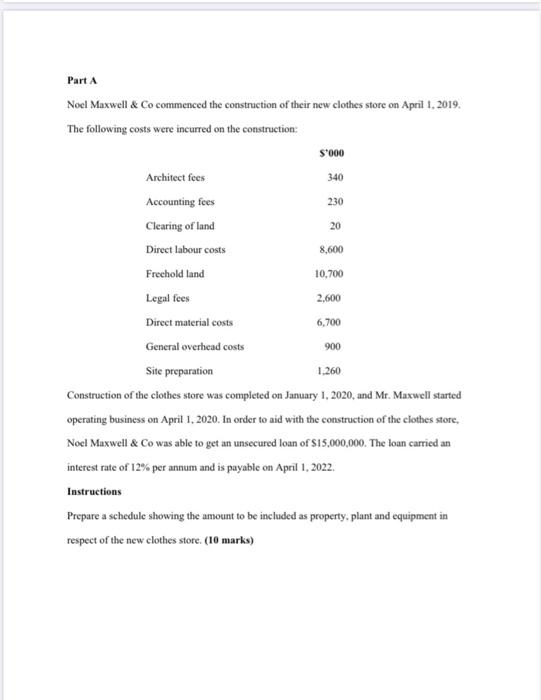

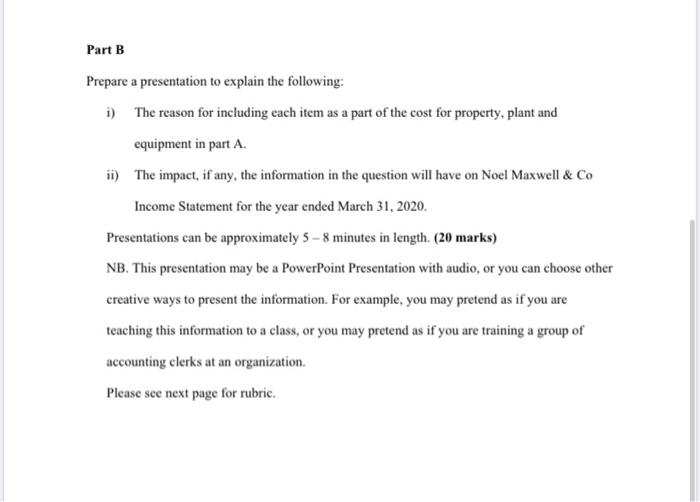

Part A Noel Maxwell & Co commenced the construction of their new clothes store on April 1, 2019. The following costs were incurred on the construction: S'000 Architect foes 340 Accounting fees 230 Clearing of land 20 Direct labour costs 8,600 Freehold land 10,700 Legal fees 2,600 Direct material costs 6,700 General overhead costs 900 Site preparation 1.260 Construction of the clothes store was completed on January 1, 2020, and Mr. Maxwell started operating business on April 1, 2020. In order to aid with the construction of the clothes store, Noel Maxwell & Co was able to get an unsecured loan of $15,000,000. The loan carried an interest rate of 12% per annum and is payable on April 1, 2022. Instructions Prepare a schedule showing the amount to be included as property, plant and equipment in respect of the new clothes store. (10 marks) Part B Prepare a presentation to explain the following: i) The reason for including each item as a part of the cost for property, plant and equipment in part A. ii) The impact, if any, the information in the question will have on Noel Maxwell & Co Income Statement for the year ended March 31, 2020. Presentations can be approximately 5 - 8 minutes in length. (20 marks) NB. This presentation may be a PowerPoint Presentation with audio, or you can choose other creative ways to present the information. For example, you may pretend as if you are teaching this information to a class, or you may pretend as if you are training a group of accounting clerks at an organization. Please see next page for rubric

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started