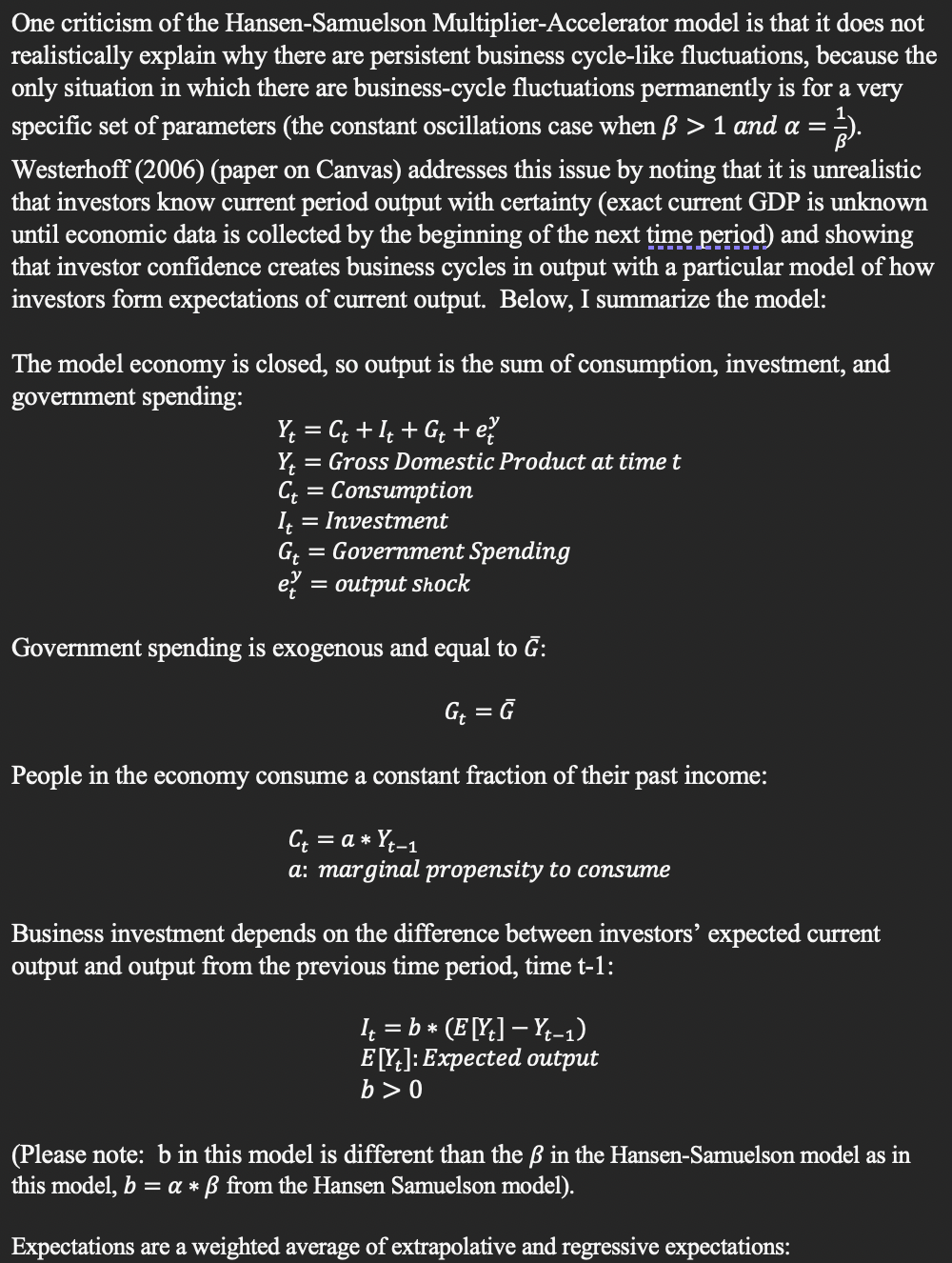

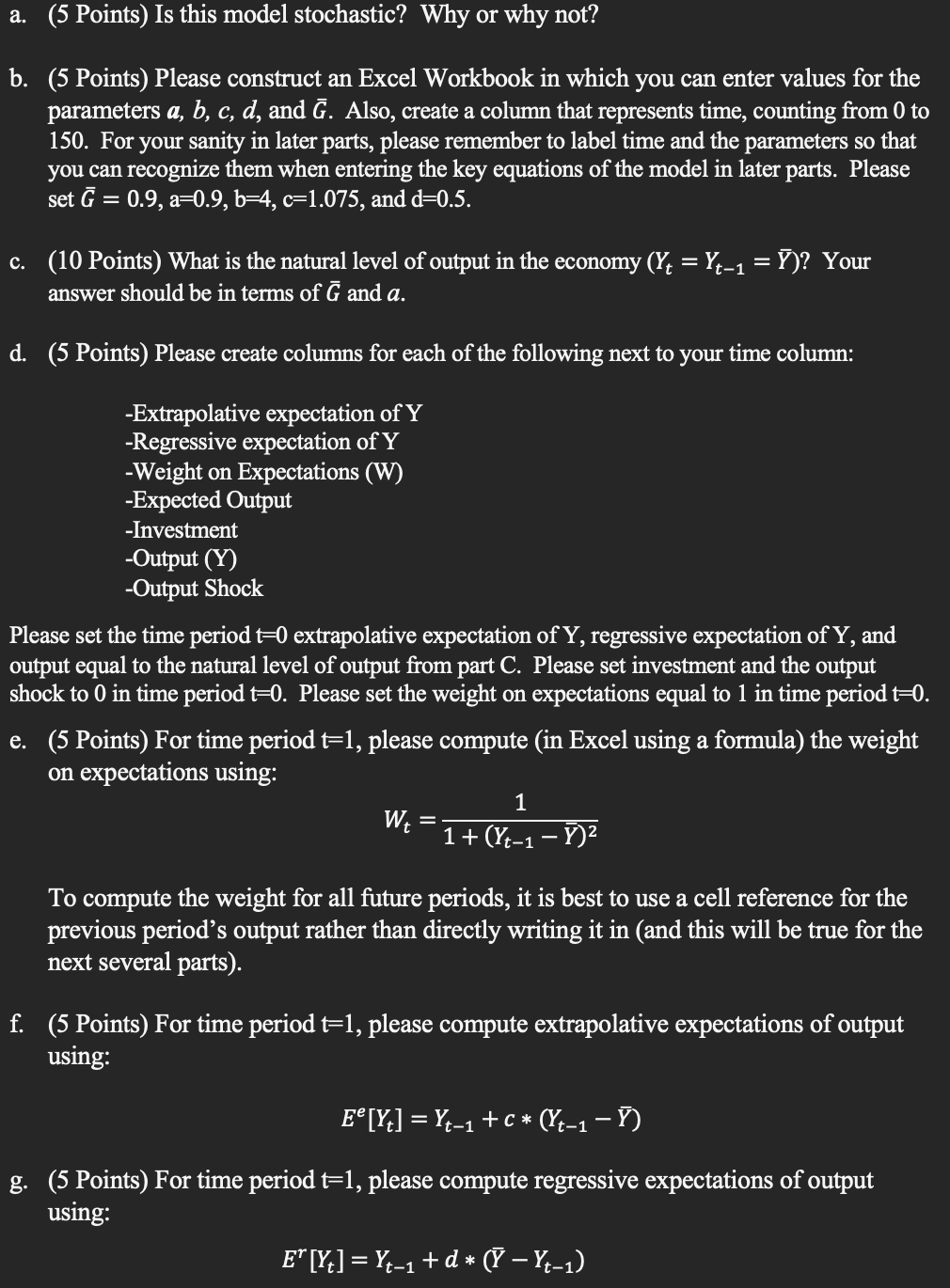

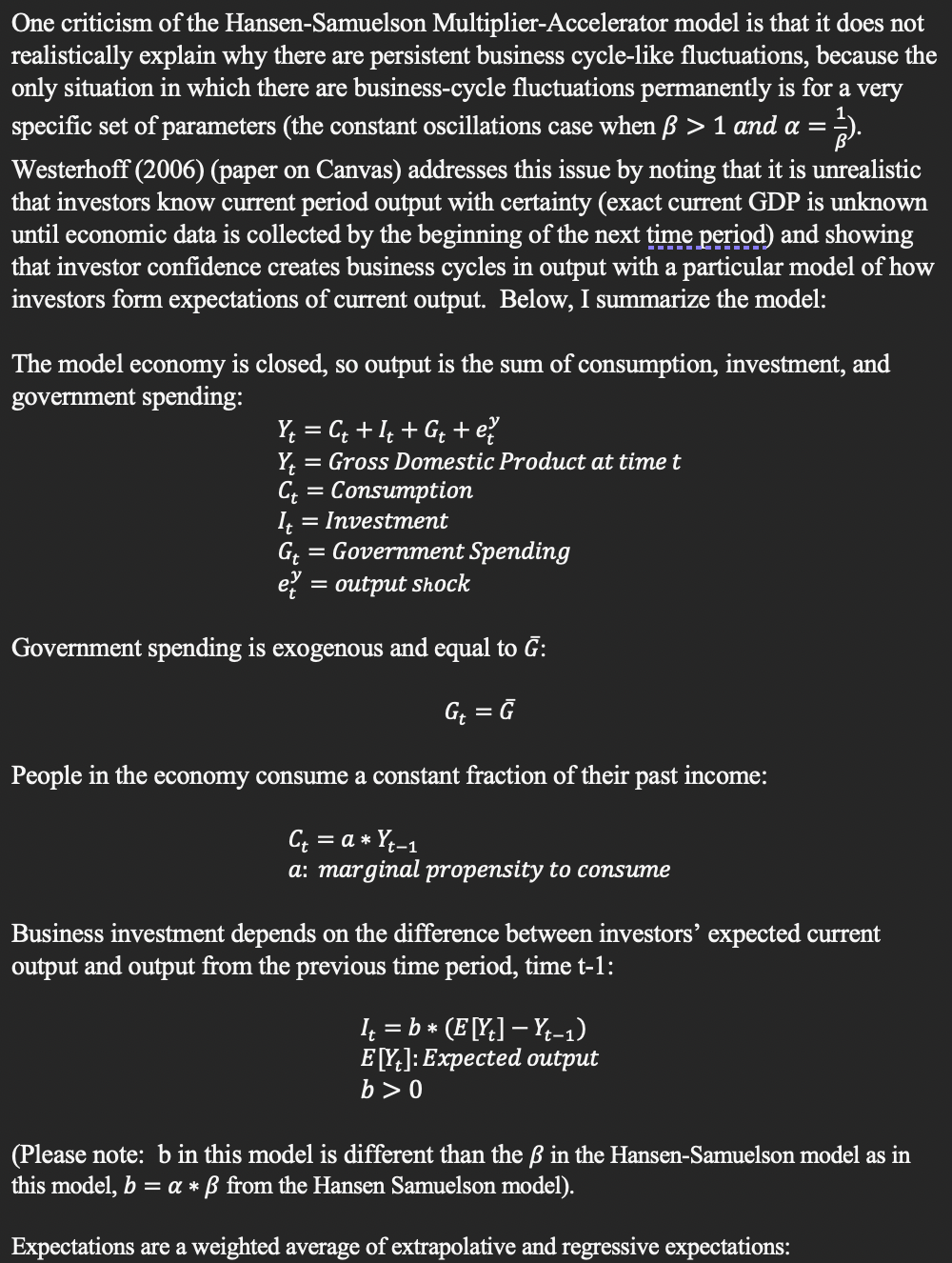

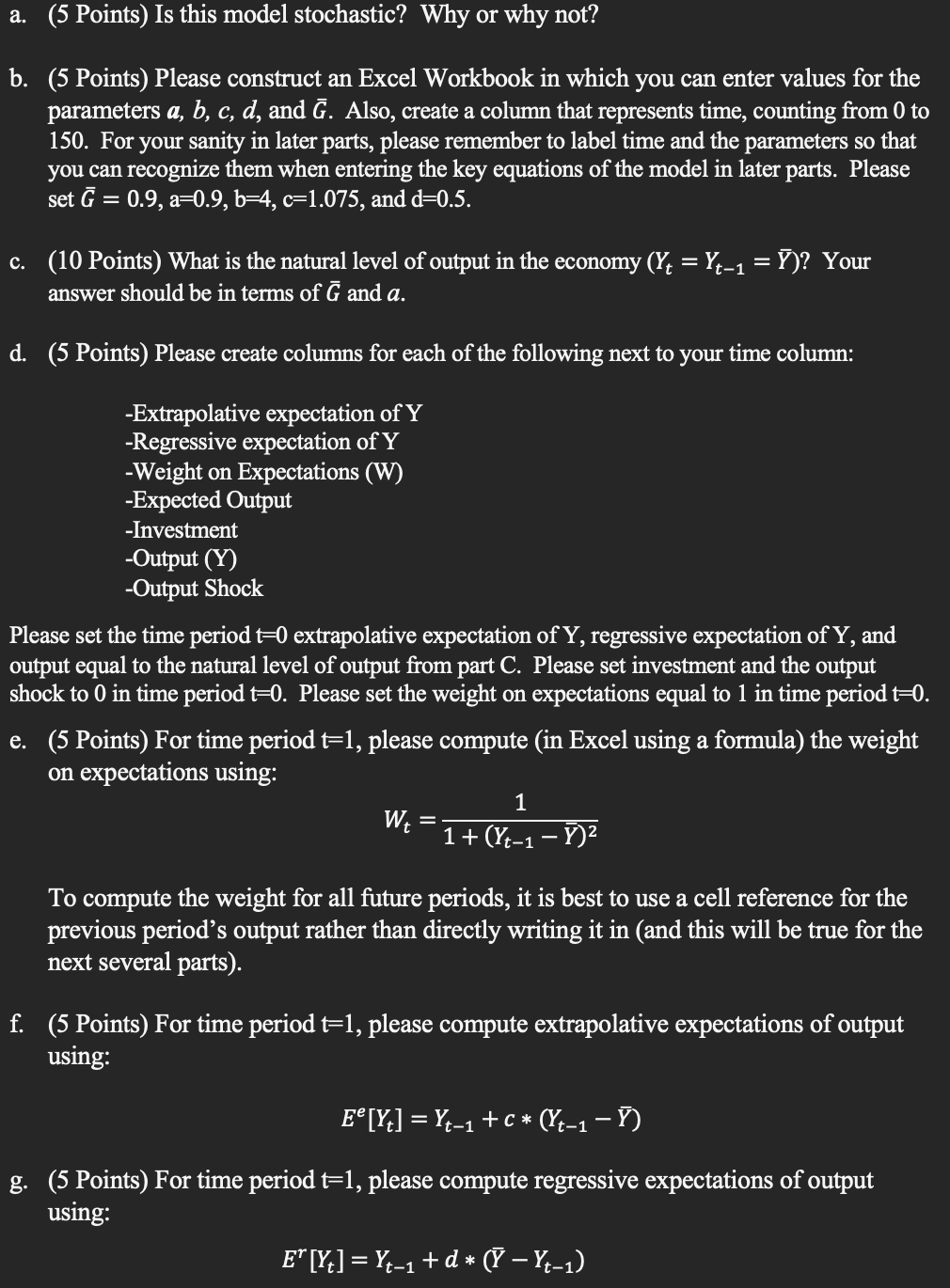

One criticism of the Hansen-Samuelson Multiplier-Accelerator model is that it does not realistically explain why there are persistent business cycle-like fluctuations, because the only situation in which there are business-cycle fluctuations permanently is for a very specific set of parameters (the constant oscillations case when > 1 and a =: =. Westerhoff (2006) (paper on Canvas) addresses this issue by noting that it is unrealistic that investors know current period output with certainty (exact current GDP is unknown until economic data is collected by the beginning of the next time period) and showing that investor confidence creates business cycles in output with a particular model of how investors form expectations of current output. Below, I summarize the model: The model economy is closed, so output is the sum of consumption, investment, and government spending: Yt = C4 + 1+ + G+ + ez Y+ = = Gross Domestic Product at time t Ct = Consumption It = Investment Gt = Government Spending ez = output shock = Government spending is exogenous and equal to G: G+ = G = People in the economy consume a constant fraction of their past income: Ct = a * Yt-1 a: marginal propensity to consume Business investment depends on the difference between investors' expected current output and output from the previous time period, time t-1: It = b * (E[Y] Yt-1) E[Y]: Expected output b> 0 (Please note: b in this model is different than the in the Hansen-Samuelson model as in this model, b = a* from the Hansen Samuelson model). Expectations are a weighted average of extrapolative and regressive expectations: E[Yt] = W * E [Y] + (1 Wt) * E" [Y] E [Y]: Extrapolative expectations E' [Y/]: Regressive expectations W:: Weight investors place on extrapolative expectations The expectations are the trickiest part of the model. Investors with extrapolative expectations believe that output will continue to boom and rise above the natural level when the previous period's output and continue to fall when output falls below the natural level. In equations: E [Y:] =Yt-1 +c* (Yt-1 - 7) C>O Y: natural level of output Investors with regressive expectations believe that output will tend to return to the natural level over time. When output is above the natural level, they expect output to fall, and vice versa. In equations: E"[YE] =Y-1+d + ( -Y-1) 0

1 and a =: =. Westerhoff (2006) (paper on Canvas) addresses this issue by noting that it is unrealistic that investors know current period output with certainty (exact current GDP is unknown until economic data is collected by the beginning of the next time period) and showing that investor confidence creates business cycles in output with a particular model of how investors form expectations of current output. Below, I summarize the model: The model economy is closed, so output is the sum of consumption, investment, and government spending: Yt = C4 + 1+ + G+ + ez Y+ = = Gross Domestic Product at time t Ct = Consumption It = Investment Gt = Government Spending ez = output shock = Government spending is exogenous and equal to G: G+ = G = People in the economy consume a constant fraction of their past income: Ct = a * Yt-1 a: marginal propensity to consume Business investment depends on the difference between investors' expected current output and output from the previous time period, time t-1: It = b * (E[Y] Yt-1) E[Y]: Expected output b> 0 (Please note: b in this model is different than the in the Hansen-Samuelson model as in this model, b = a* from the Hansen Samuelson model). Expectations are a weighted average of extrapolative and regressive expectations: E[Yt] = W * E [Y] + (1 Wt) * E" [Y] E [Y]: Extrapolative expectations E' [Y/]: Regressive expectations W:: Weight investors place on extrapolative expectations The expectations are the trickiest part of the model. Investors with extrapolative expectations believe that output will continue to boom and rise above the natural level when the previous period's output and continue to fall when output falls below the natural level. In equations: E [Y:] =Yt-1 +c* (Yt-1 - 7) C>O Y: natural level of output Investors with regressive expectations believe that output will tend to return to the natural level over time. When output is above the natural level, they expect output to fall, and vice versa. In equations: E"[YE] =Y-1+d + ( -Y-1) 0