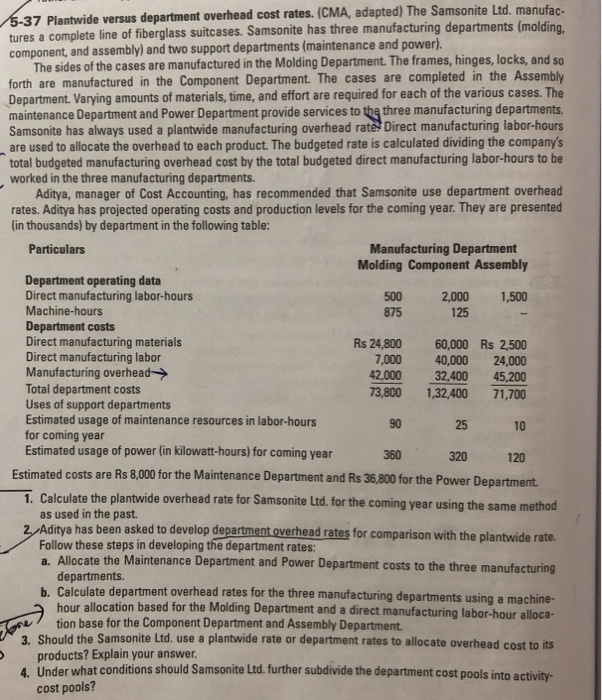

one hour allocation based for the Molding Department and a direct manufacturing labor-hour alloca- 5-37 Plantwide versus department overhead cost rates. (CMA, adapted) The Samsonite Ltd. manufac- tures a complete line of fiberglass suitcases. Samsonite has three manufacturing departments (molding, component, and assembly) and two support departments (maintenance and power). The sides of the cases are manufactured in the Molding Department. The frames, hinges, locks, and so forth are manufactured in the Component Department. The cases are completed in the Assembly Department. Varying amounts of materials, time, and effort are required for each of the various cases. The maintenance Department and Power Department provide services to the three manufacturing departments. Samsonite has always used a plantwide manufacturing overhead rates Direct manufacturing labor-hours are used to allocate the overhead to each product. The budgeted rate is calculated dividing the company's total budgeted manufacturing overhead cost by the total budgeted direct manufacturing labor-hours to be worked in the three manufacturing departments. Aditya, manager of Cost Accounting, has recommended that Samsonite use department overhead rates. Aditya has projected operating costs and production levels for the coming year. They are presented (in thousands) by department in the following table: Particulars Manufacturing Department Molding Component Assembly Department operating data Direct manufacturing labor-hours 500 2,000 1,500 Machine-hours 875 125 Department costs Direct manufacturing materials Rs 24,800 60,000 Rs 2,500 Direct manufacturing labor 7,000 40,000 24,000 Manufacturing overhead> 42,000 32,400 45,200 Total department costs 73,800 1,32,400 71,700 Uses of support departments Estimated usage of maintenance resources in labor-hours 90 25 10 for coming year Estimated usage of power in kilowatt-hours) for coming year 360 320 120 Estimated costs are Rs 8,000 for the Maintenance Department and Rs 36,800 for the Power Department. 1. Calculate the plantwide overhead rate for Samsonite Ltd. for the coming year using the same method as used in the past. 2. Aditya has been asked to develop department overhead rates for comparison with the plantwide rate. Follow these steps in developing the department rates: a. Allocate the Maintenance Department and Power Department costs to the three manufacturing departments. b. Calculate department overhead rates for the three manufacturing departments using a machine- tion base for the Component Department and Assembly Department. 3. Should the Samsonite Ltd, use a plantwide rate or department rates to allocate overhead cost to its products? Explain your answer. 4. Under what conditions should Samsonite Ltd. further subdivide the department cost pools into activity- cost pools