Question

One of Natalies friends, Curtis Lesperance, runs a coffee shop where he sells specialty coffees and prepares and sells muffins and cookies. He is eager

One of Natalies friends, Curtis Lesperance, runs a coffee shop where he sells specialty coffees and prepares and sells muffins and cookies. He is eager to buy one of Natalie's fine European mixers, which would enable him to make larger batches of muffins and cookies. However, Curtis cannot afford to pay for the mixer for at least 30 days. He asks Natalie if she would be willing to sell him the mixer on credit. The following transactions occurred in June through August.

| June 1 | After much thought, Natalie sells a mixer to Curtis on credit, terms n/30, for $1,100 (cost of mixer $600). | |

| 2 | Natalie meets with the bank manager and arranges to get access to a credit card account. The terms of credit card transactions are 3% of the sales transactions and a monthly equipment rental charge of $75. | |

| 30 | Natalie teaches 13 classes in June. Seven classes were paid for in cash, $1,050; the other six classes were paid for by credit card, $900. | |

| 30 | Natalie receives and reconciles her bank statement. She makes sure that the bank has correctly processed the monthly $75 charge for the rental of the credit card equipment and the 3% fee on the credit card transactions. | |

| 30 | Curtis calls Natalie. He is unable to pay the amount outstanding for another month, so he signs a one-month, 6% note receivable. | |

| July 15 | Natalie sells a mixer to a friend of Curtis's. The friend pays $1,100 for the mixer by credit card (cost of mixer $600). | |

| 30 | Natalie teaches 16 classes in July. Eight classes are paid for in cash, $1,200; eight classes are paid for by credit card, $1,200. | |

| 31 | Natalie reconciles her bank statement and makes sure the bank has recorded the correct amounts for the rental of the credit card equipment and the credit card sales. | |

| 31 | Curtis calls Natalie. He cannot pay today but hopes to have a check for her at the end of the week. Natalie accrues July interest. | |

| Aug. 10 | Curtis calls again and Natalie agrees to extend the note to two months. Curtis will repay the note on August 31, including interest for 2 months. | |

| 31 | Natalie receives a check from Curtis in payment of his balance plus interest outstanding. |

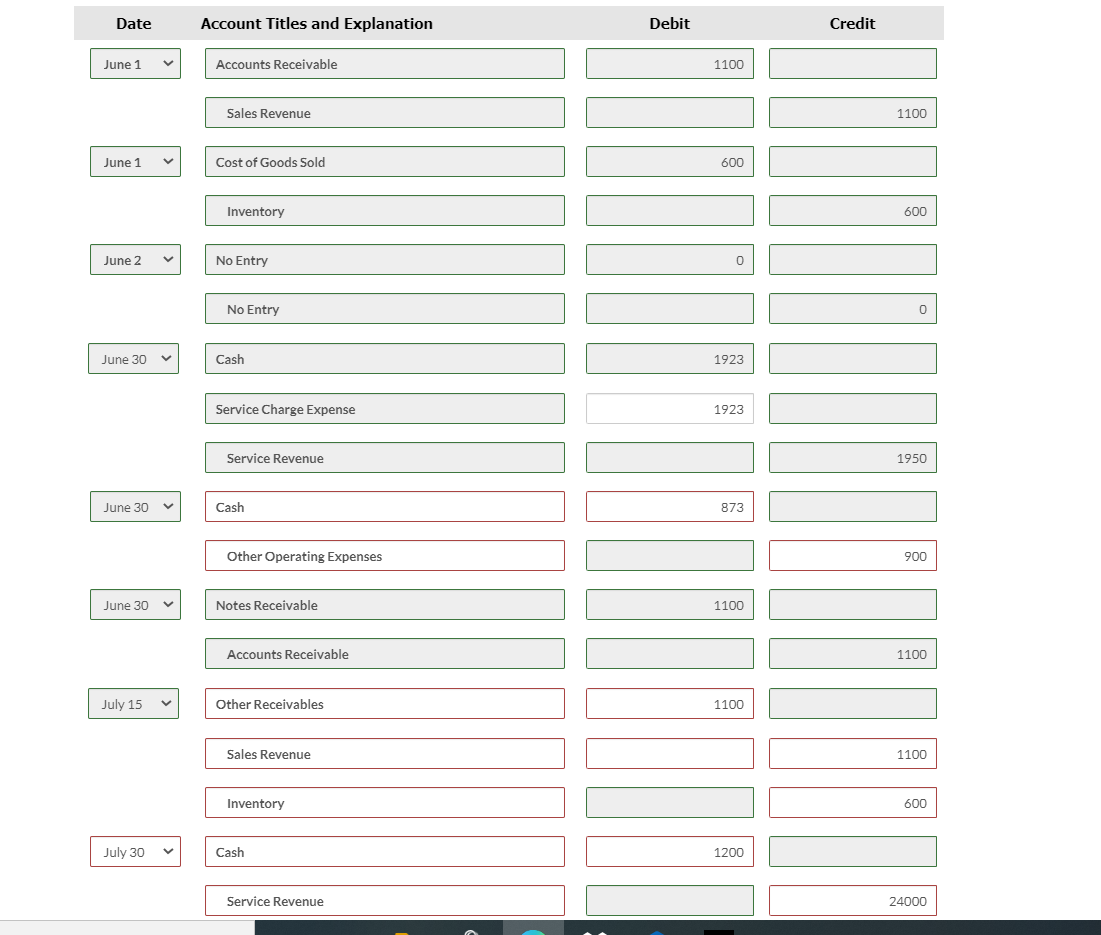

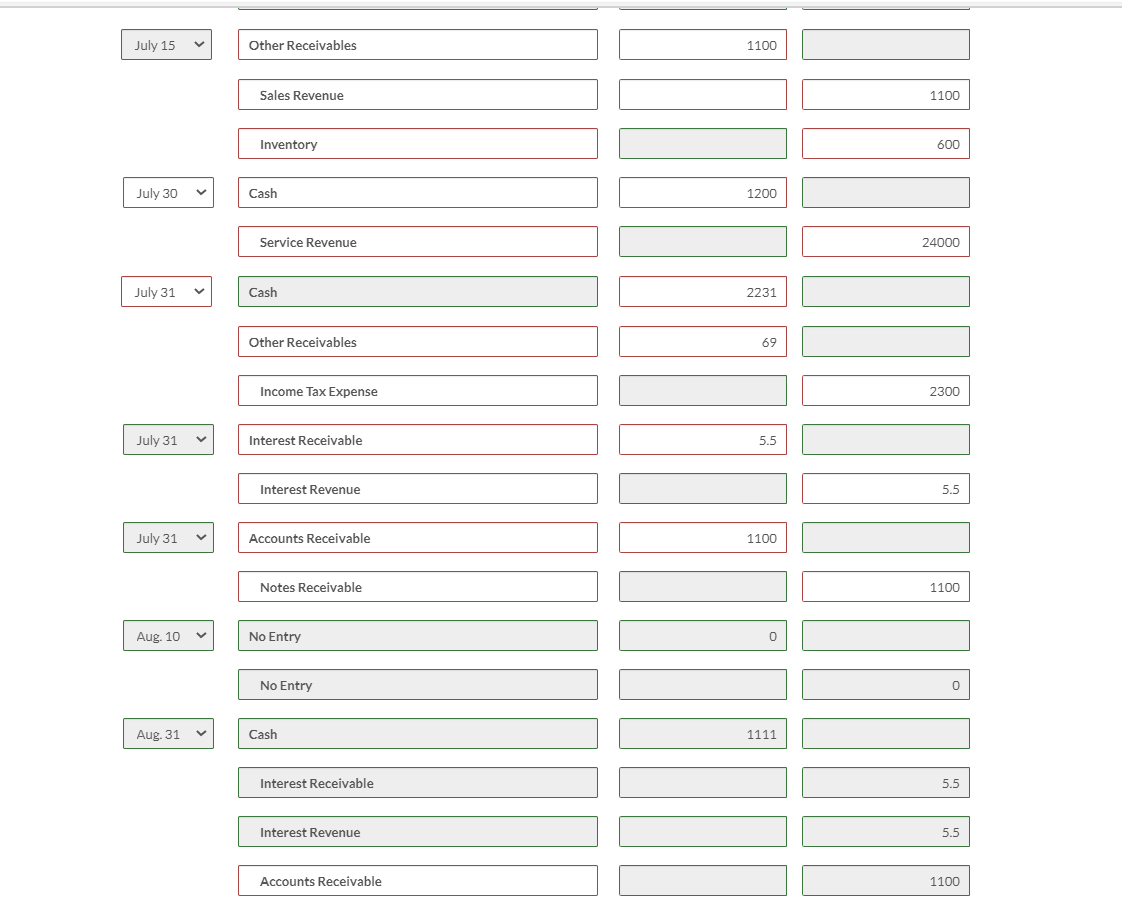

Prepare journal entries for the transactions that occurred in June, July, and August. The company uses a perpetual inventory system.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 2 decimal places, e.g. 25.20. Record journal entries in the order presented in the problem.)

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 2 decimal places, e.g. 25.20. Record journal entries in the order presented in the problem.)

Can anyone help me out on these? I'm having trouble with it.

Date Account Titles and Explanation Debit Credit June 1 Accounts Receivable 1100 Sales Revenue 1100 June 1 Cost of Goods Sold 600 Inventory 600 June 2 No Entry 0 No Entry 0 June 30 Cash 1923 Service Charge Expense 1923 Service Revenue 1950 June 30 Cash 873 Other Operating Expenses 900 June 30 Notes Receivable 1100 Accounts Receivable 1100 July 15 V Other Receivables 1100 Sales Revenue 1100 Inventory 600 July 30 Cash 1200 Service Revenue 24000 July 15 Other Receivables 1100 Sales Revenue 1100 Inventory 600 July 30 Cash 1200 Service Revenue 24000 July 31 Cash 2231 Other Receivables 69 Income Tax Expense 2300 July 31 Interest Receivable 5.5 Interest Revenue 5.5 July 31 Accounts Receivable 1100 Notes Receivable 1100 Aug. 10 No Entry 0 No Entry 0 Aug. 31 Cash 1111 Interest Receivable 5.5 Interest Revenue 5.5 Accounts Receivable 1100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started