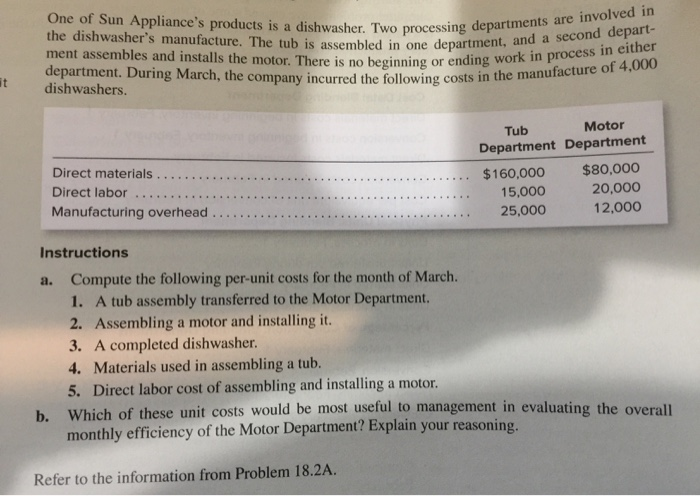

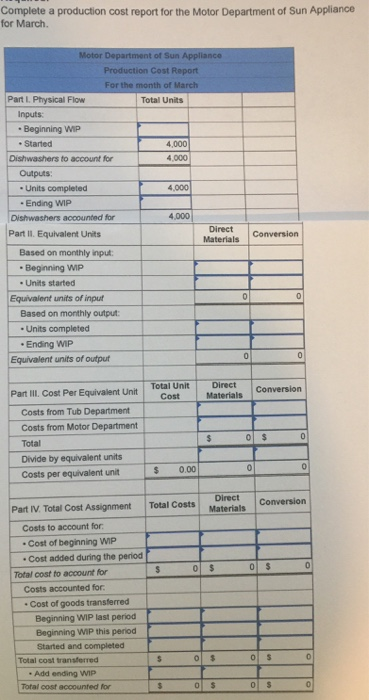

One of Sun Appliance's products is a dishwasher. Two processing depart the dishwasher's manufacture. The tub is assembled in one department ment assembles and installs the motor. There is no beginning or ending department. During March, the company incurred the following costs in dishwashers. processing departments are involved in i one department, and a second depart- nning or ending work in process in either he manufacture of 4,000 Direct materials ..... Direct labor ............ Manufacturing overhead ......... Motor Department Department $ 160,000 $80,000 15,000 20,000 25,000 12,000 25,000 Instructions a. Compute the following per-unit costs for the month of March. 1. A tub assembly transferred to the Motor Department. 2. Assembling a motor and installing it. 3. A completed dishwasher. 4. Materials used in assembling a tub. 5. Direct labor cost of assembling and installing a motor. b. Which of these unit costs would be most useful to management in evaluating the overall monthly efficiency of the Motor Department? Explain your reasoning. Refer to the information from Problem 18.2A. Complete a production cost report for the Motor Department of Sun Appliance for March Motor Department of Sun Appliance Production Cost Report For the month of March Part L Physical Flow Total Units Inputs - Beginning WIP . Started 4,000 Dishwashers to account for 4,000 Outputs: Units completed 4,000 - Ending WIP Dishwashers accounted for 4,000 Part II. Equivalent Units Based on monthly input - Beginning WIP Units started Equivalent units of input Based on monthly output: -Units completed Ending WIP Equivalent units of output Materials Conversion 0 0 0 0 Total Unit Cost Direct Materials Conversion Part III. Cost Per Equivalent Unit Costs from Tub Department Costs from Motor Department Total Divide by equivalent units Costs per equivalent unit $ 0 $ 0 $ 0.00 0 0 Direct Conversion Total Costs Materials $ 0 $ 0 $ Part IV. Total Cost Assignment Costs to account for - Cost of beginning WIP . Cost added during the period Total cost to account for Costs accounted for Cost of goods transferred Beginning WIP last period Beginning WIP this period Started and completed Total cost transferred . Add ending WIP Total cost accounted for 3 5 0 % 0 % 0 0 $ 0 S 0