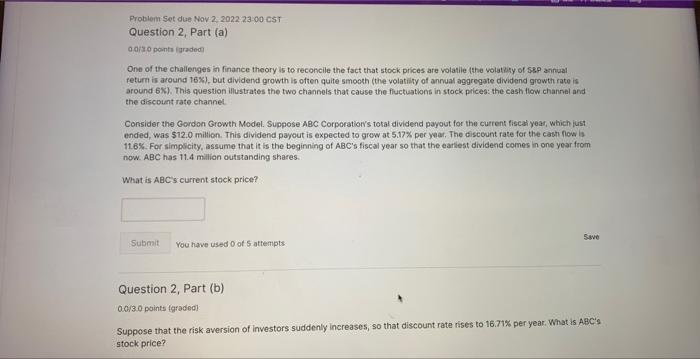

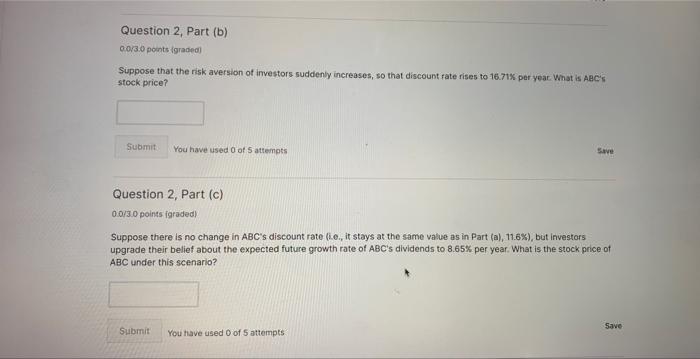

One of the chalienges in finance theory is to reconcile the fact that stock prices are volatile the volatety of ssp aniual return is around 168), but dividend growth is often quite smosth (the volatiity of annual aggregate dividend growth rate is around 6 ). This qoestion illustrates the two channels that cause the fluctuations in stock prices: the cash flow channal and the discoint rate channel. Consider the Gordon Growth Model. Suppose ABC Corporation's total dividend payout for the current fiscat year, which fust ended, was 512.0 million. This dividend payout is expected to grow at 5.17% per year, The discount rate for the cash flow is 11.65. For simplicity, assume that it is the beginning of ABC's fiscal year so that the earlest dividend comes in one year from now. ABC has 11.4 million outstanding shares. What is AEC's current stock price? You have used 0 of 5 attempts. Ssve Question 2, Part (b) 0.0/3.0 points fgraded] Suppose that the risk aversion of investors suddenly increases, so that discount rate rises to 16.71% per year, What is ABC's stock price? Suppose that the risk aversion of investors suddenly increases, so that discount fate rises to 16.71K per yeat. What is Aacis stock price? You have used 0 of 5 attempts Question 2, Part (c) 0.0/3.0 points igraded) Suppose there is no change in ABC's discount rate (i..., it stays at the same value as in Part (a), 11.68), but investors upgrade their belief about the expected future growth rate of ABC 's dividends to 8.65% per year. What is the stock price of ABC under this scenario? You have used 0 of 5 attempts One of the chalienges in finance theory is to reconcile the fact that stock prices are volatile the volatety of ssp aniual return is around 168), but dividend growth is often quite smosth (the volatiity of annual aggregate dividend growth rate is around 6 ). This qoestion illustrates the two channels that cause the fluctuations in stock prices: the cash flow channal and the discoint rate channel. Consider the Gordon Growth Model. Suppose ABC Corporation's total dividend payout for the current fiscat year, which fust ended, was 512.0 million. This dividend payout is expected to grow at 5.17% per year, The discount rate for the cash flow is 11.65. For simplicity, assume that it is the beginning of ABC's fiscal year so that the earlest dividend comes in one year from now. ABC has 11.4 million outstanding shares. What is AEC's current stock price? You have used 0 of 5 attempts. Ssve Question 2, Part (b) 0.0/3.0 points fgraded] Suppose that the risk aversion of investors suddenly increases, so that discount rate rises to 16.71% per year, What is ABC's stock price? Suppose that the risk aversion of investors suddenly increases, so that discount fate rises to 16.71K per yeat. What is Aacis stock price? You have used 0 of 5 attempts Question 2, Part (c) 0.0/3.0 points igraded) Suppose there is no change in ABC's discount rate (i..., it stays at the same value as in Part (a), 11.68), but investors upgrade their belief about the expected future growth rate of ABC 's dividends to 8.65% per year. What is the stock price of ABC under this scenario? You have used 0 of 5 attempts