Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One of the popular trading strategy in Finance is called Risk Arbitrage Trading or Merger Arbitrage Trading. It is an event driven speculative trading strategy,

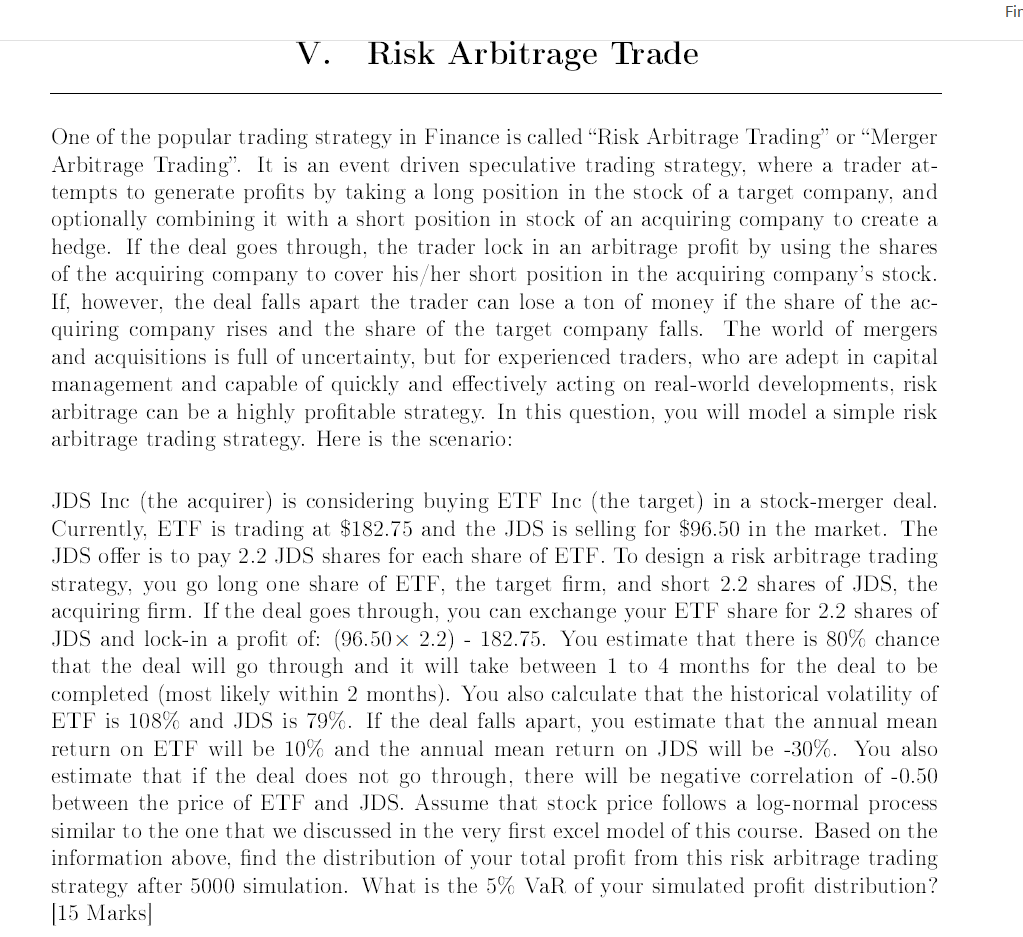

One of the popular trading strategy in Finance is called "Risk Arbitrage Trading" or "Merger Arbitrage Trading". It is an event driven speculative trading strategy, where a trader attempts to generate profits by taking a long position in the stock of a target company, and optionally combining it with a short position in stock of an acquiring company to create a hedge. If the deal goes through, the trader lock in an arbitrage profit by using the shares of the acquiring company to cover his/her short position in the acquiring company's stock. If, however, the deal falls apart the trader can lose a ton of money if the share of the acquiring company rises and the share of the target company falls. The world of mergers and acquisitions is full of uncertainty, but for experienced traders, who are adept in capital management and capable of quickly and effectively acting on real-world developments, risk arbitrage can be a highly profitable strategy. In this question, you will model a simple risk arbitrage trading strategy. Here is the scenario: JDS Inc (the acquirer) is considering buying ETF Inc (the target) in a stock-merger deal. Currently, ETF is trading at $182.75 and the JDS is selling for $96.50 in the market. The JDS offer is to pay 2.2 JDS shares for each share of ETF. To design a risk arbitrage trading strategy, you go long one share of ETF, the target firm, and short 2.2 shares of JDS, the acquiring firm. If the deal goes through, you can exchange your ETF share for 2.2 shares of JDS and lock-in a profit of: (96.502.2)182.75. You estimate that there is 80% chance that the deal will go through and it will take between 1 to 4 months for the deal to be completed (most likely within 2 months). You also calculate that the historical volatility of ETF is 108% and JDS is 79%. If the deal falls apart, you estimate that the annual mean return on ETF will be 10% and the annual mean return on JDS will be 30%. You also estimate that if the deal does not go through, there will be negative correlation of -0.50 between the price of ETF and JDS. Assume that stock price follows a log-normal process similar to the one that we discussed in the very first excel model of this course. Based on the information above, find the distribution of your total profit from this risk arbitrage trading strategy after 5000 simulation. What is the 5% VaR of your simulated profit distribution? [15 Marks]

One of the popular trading strategy in Finance is called "Risk Arbitrage Trading" or "Merger Arbitrage Trading". It is an event driven speculative trading strategy, where a trader attempts to generate profits by taking a long position in the stock of a target company, and optionally combining it with a short position in stock of an acquiring company to create a hedge. If the deal goes through, the trader lock in an arbitrage profit by using the shares of the acquiring company to cover his/her short position in the acquiring company's stock. If, however, the deal falls apart the trader can lose a ton of money if the share of the acquiring company rises and the share of the target company falls. The world of mergers and acquisitions is full of uncertainty, but for experienced traders, who are adept in capital management and capable of quickly and effectively acting on real-world developments, risk arbitrage can be a highly profitable strategy. In this question, you will model a simple risk arbitrage trading strategy. Here is the scenario: JDS Inc (the acquirer) is considering buying ETF Inc (the target) in a stock-merger deal. Currently, ETF is trading at $182.75 and the JDS is selling for $96.50 in the market. The JDS offer is to pay 2.2 JDS shares for each share of ETF. To design a risk arbitrage trading strategy, you go long one share of ETF, the target firm, and short 2.2 shares of JDS, the acquiring firm. If the deal goes through, you can exchange your ETF share for 2.2 shares of JDS and lock-in a profit of: (96.502.2)182.75. You estimate that there is 80% chance that the deal will go through and it will take between 1 to 4 months for the deal to be completed (most likely within 2 months). You also calculate that the historical volatility of ETF is 108% and JDS is 79%. If the deal falls apart, you estimate that the annual mean return on ETF will be 10% and the annual mean return on JDS will be 30%. You also estimate that if the deal does not go through, there will be negative correlation of -0.50 between the price of ETF and JDS. Assume that stock price follows a log-normal process similar to the one that we discussed in the very first excel model of this course. Based on the information above, find the distribution of your total profit from this risk arbitrage trading strategy after 5000 simulation. What is the 5% VaR of your simulated profit distribution? [15 Marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started