Question

One of the projects Evergreen is considering involves purchasing a new piece of manufacturing equipment. The capital budgeting analysis indicates that the equipment has a

One of the projects Evergreen is considering involves purchasing a new piece of

manufacturing equipment. The capital budgeting analysis indicates that the

equipment has a positive NPV of $500,000. The required initial investment in

working capital for the project amounts to $50,000 payable at the beginning of

the year and is growing at 10% annually over the life of the project. The

equipment costs $1,400,000 to purchase, has a five-year useful economic life,

and is a class 10 asset which has a CCA rate of 30% (assume half year rule

applies). The salvage value of the equipment is $350,000 at the end of the five

year period. The equipment can be leased from Acel Leasing for five years for

$300,000 per year, with the first payment payable at the beginning of the year.

If Evergreen purchases the equipment, it will have annual operating costs of

$50,000 per year. Under the terms of the lease, Acel will be responsible for the

operating costs. Assume that the lease is a tax lease (qualified by the CRA for

tax purposes). Calculate the Net Advantage to Leasing and explain whether the

firm should buy or lease the asset.

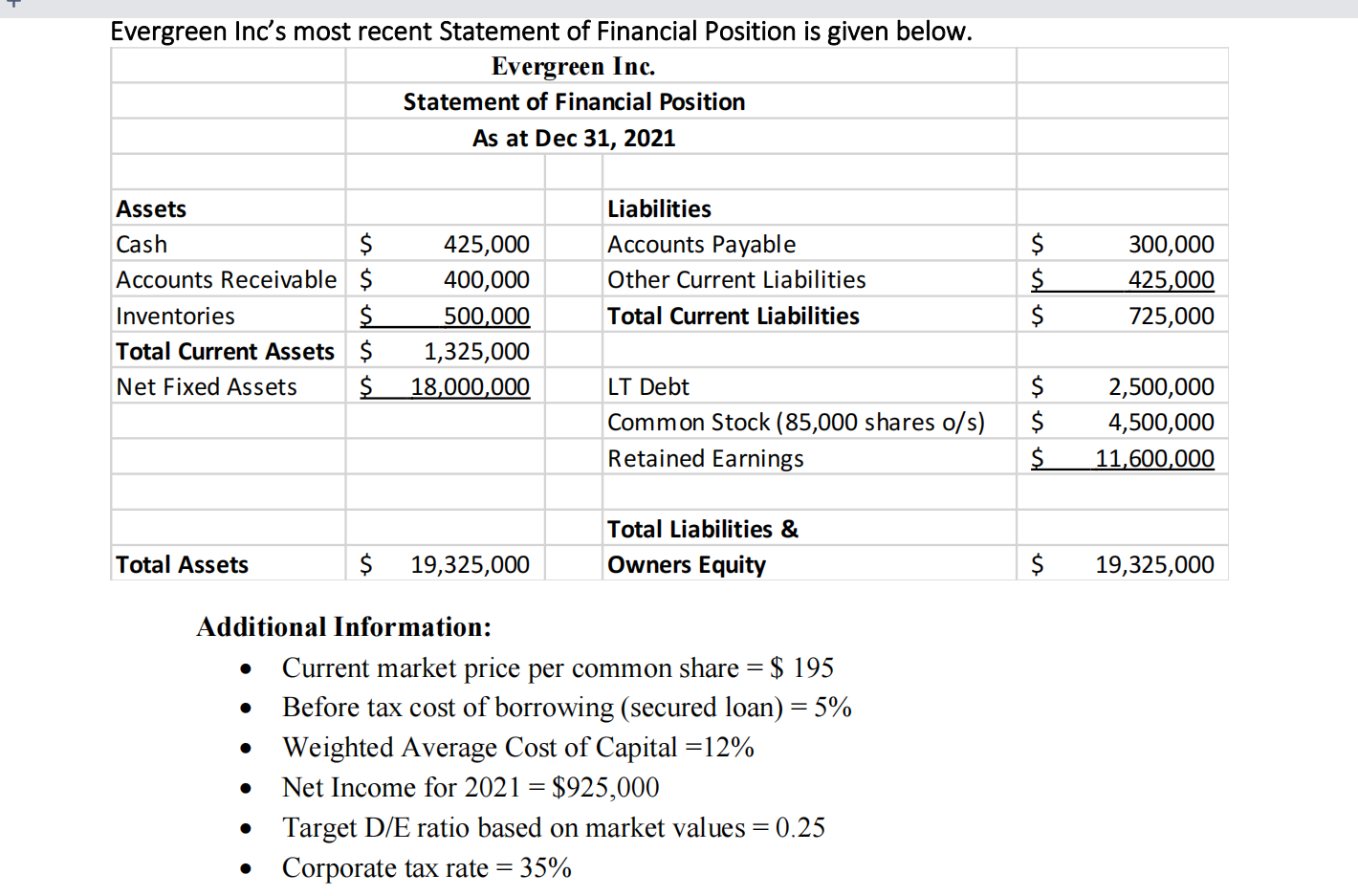

Evergreen Inc's most recent Statement of Financial Position is given below. Evergreen Inc. Statement of Financial Position As at Dec 31, 2021 Assets Cash $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500,000 1,325,000 18,000,000 Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities $ $ $ 300,000 425,000 725,000 LT Debt Common Stock (85,000 shares o/s) Retained Earnings $ $ $ 2,500,000 4,500,000 11,600,000 Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000 Additional Information: Current market price per common share = $ 195 Before tax cost of borrowing (secured loan) = 5% Weighted Average Cost of Capital =12% Net Income for 2021 = $925,000 Target D/E ratio based on market values = 0.25 Corporate tax rate = 35% . . Evergreen Inc's most recent Statement of Financial Position is given below. Evergreen Inc. Statement of Financial Position As at Dec 31, 2021 Assets Cash $ Accounts Receivable $ Inventories $ Total Current Assets $ Net Fixed Assets $ 425,000 400,000 500,000 1,325,000 18,000,000 Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities $ $ $ 300,000 425,000 725,000 LT Debt Common Stock (85,000 shares o/s) Retained Earnings $ $ $ 2,500,000 4,500,000 11,600,000 Total Liabilities & Owners Equity Total Assets $ 19,325,000 $ 19,325,000 Additional Information: Current market price per common share = $ 195 Before tax cost of borrowing (secured loan) = 5% Weighted Average Cost of Capital =12% Net Income for 2021 = $925,000 Target D/E ratio based on market values = 0.25 Corporate tax rate = 35%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started