Answered step by step

Verified Expert Solution

Question

1 Approved Answer

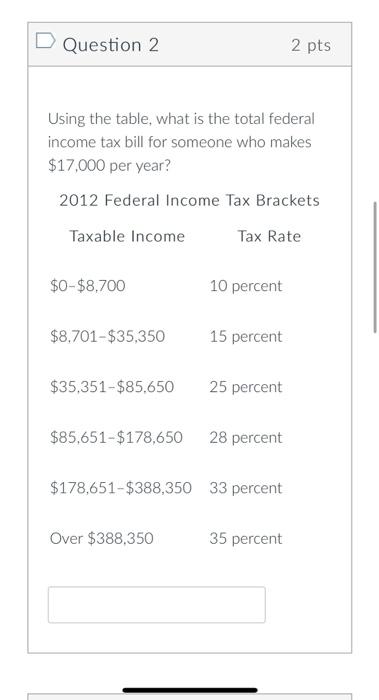

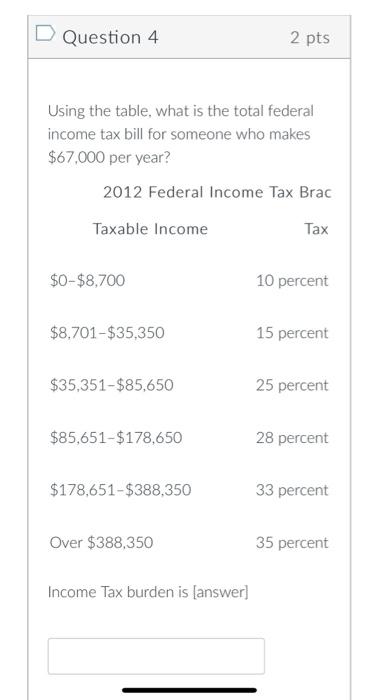

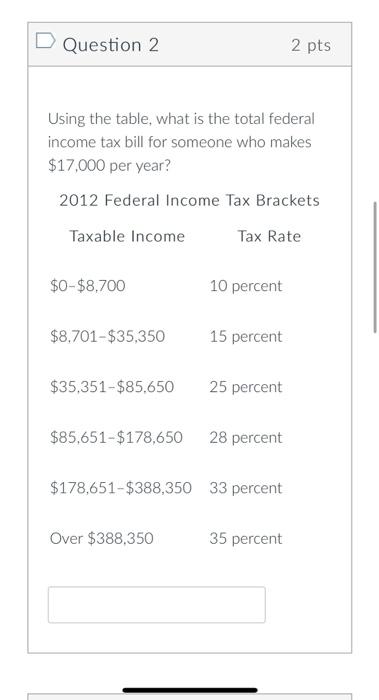

one of the questions was too big so i had to send 2 pictures D Question 2 Using the table, what is the total federal

one of the questions was too big so i had to send 2 pictures

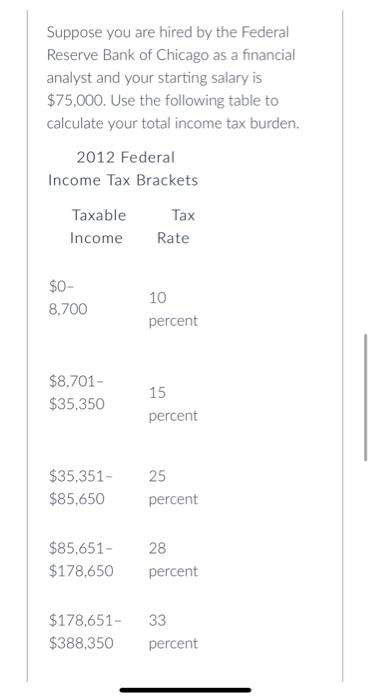

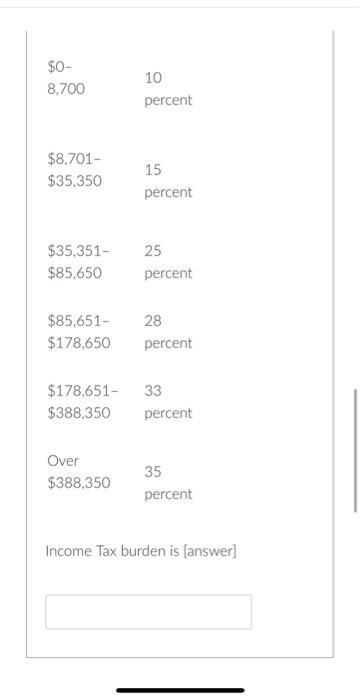

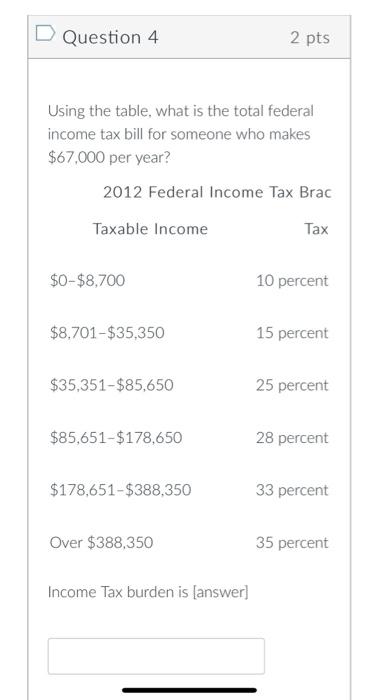

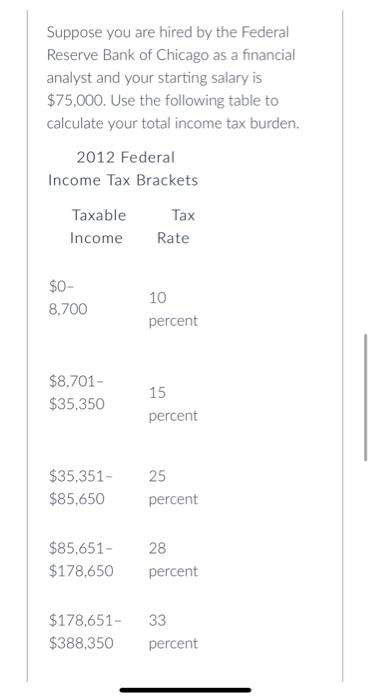

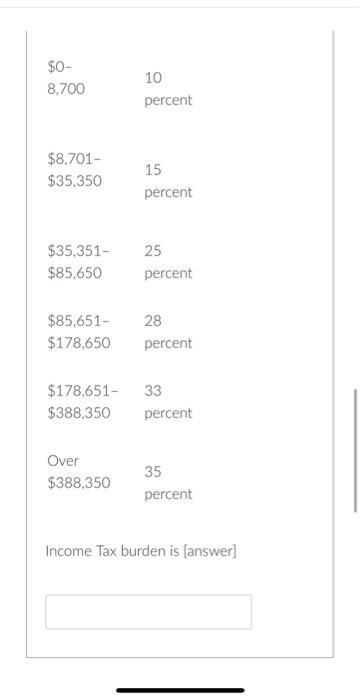

D Question 2 Using the table, what is the total federal income tax bill for someone who makes $17,000 per year? 2012 Federal Income Tax Brackets Tax Rate Taxable Income $0-$8,700 $8.701-$35,350 $35,351-$85,650 $85,651-$178,650 10 percent Over $388,350 15 percent 25 percent 28 percent $178,651-$388,350 33 percent 2 pts 35 percent Question 4 Using the table, what is the total federal income tax bill for someone who makes $67,000 per year? 2012 Federal Income Tax Brac Taxable Income Tax $0-$8,700 $8,701-$35,350 $35,351-$85,650 $85,651-$178,650 $178,651-$388,350 Over $388,350 2 pts Income Tax burden is [answer] 10 percent 15 percent 25 percent 28 percent 33 percent 35 percent Suppose you are hired by the Federal Reserve Bank of Chicago as a financial analyst and your starting salary is $75,000. Use the following table to calculate your total income tax burden. 2012 Federal Income Tax Brackets Taxable Tax Income Rate $0- 8,700 $8,701- $35,350 $35,351- $85,650 10 percent 15 percent 25 percent $85,651- 28 $178,650 percent $178,651- 33 $388,350 percent $0- 8,700 $8,701- $35,350 $35,351- $85,650 10 percent 15 percent Over $388,350 25 percent $85,651- 28 $178,650 percent $178,651- 33 $388,350 percent 35 percent Income Tax burden is [answer]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started