- One of the strongest associations that consumers have been trained to make is between "price" and "quality." Discuss why do you think that is the case. Share with everyone your experiences where this association was not true.

- Do you think the demand for gasoline is considered an "inelastic" or "elastic" demand? Explain why.

- Refer to the "Pricing Tactics" in the textbook, p. 365-368. pick two pricing tactics out of those available in the textbook, and give an example of the products or brands that adopt each of those two pricing tactics (so two examples, total). Also, discuss if you think those two pricing tactics are appropriate.

- Share with everyone the most unfair pricing strategy that you have experienced by any company. Explain why you thought it is unfair.

This is a discussion question. You can provide answers according to your point of view for each question related to it. But for a part third of this discussion, I've uploaded the mentioned pages as well. Please refer to those pages accordingly.

Below are the information from the book:

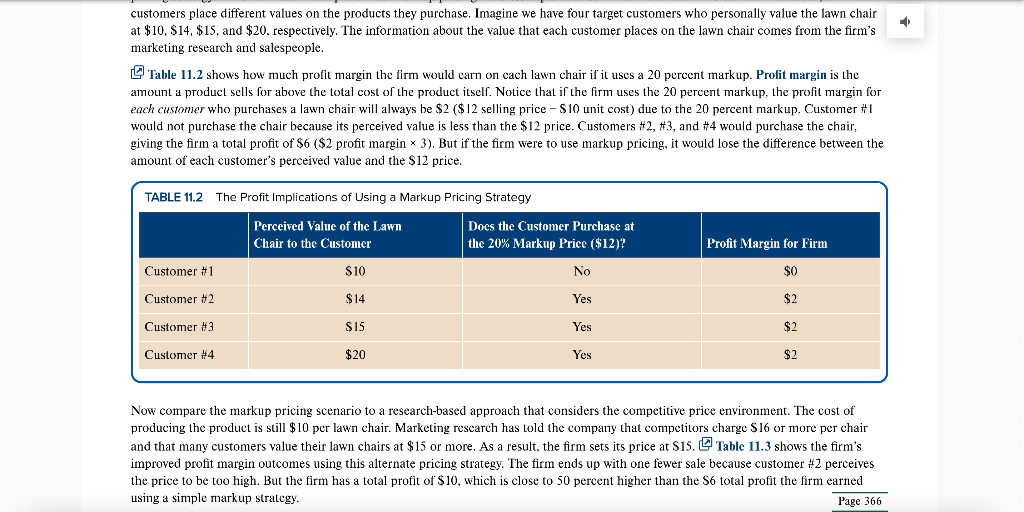

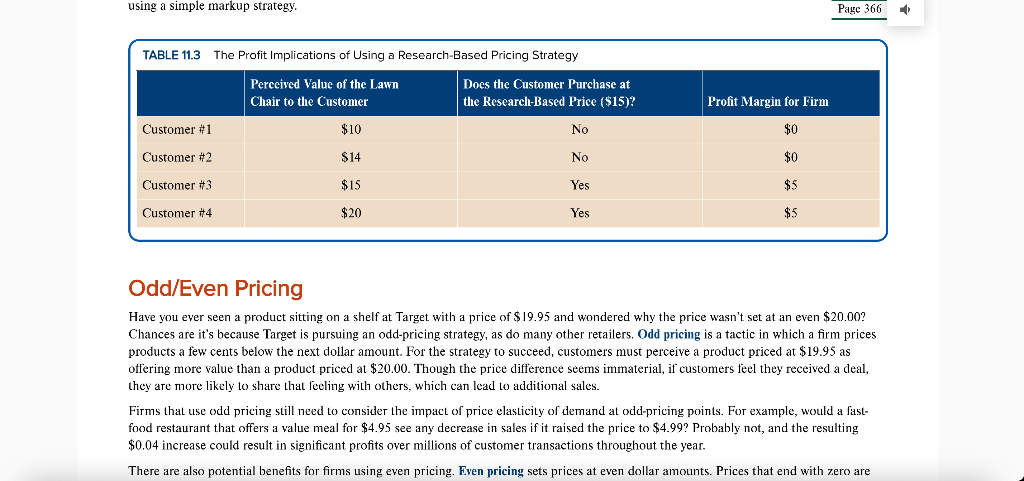

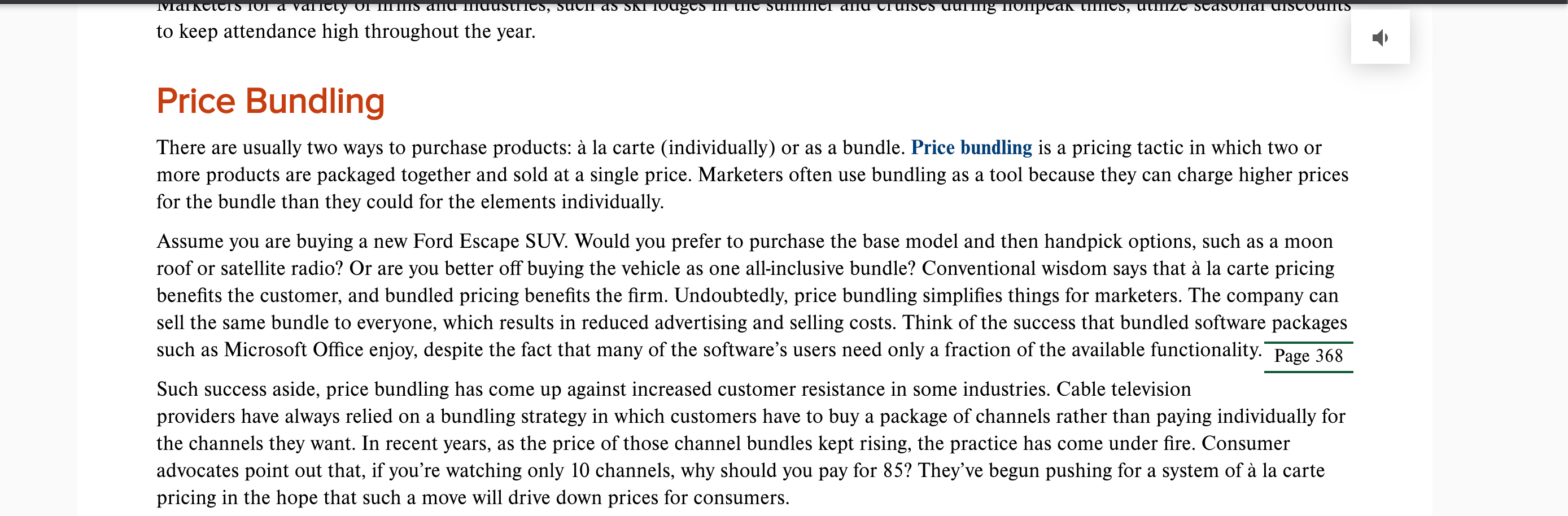

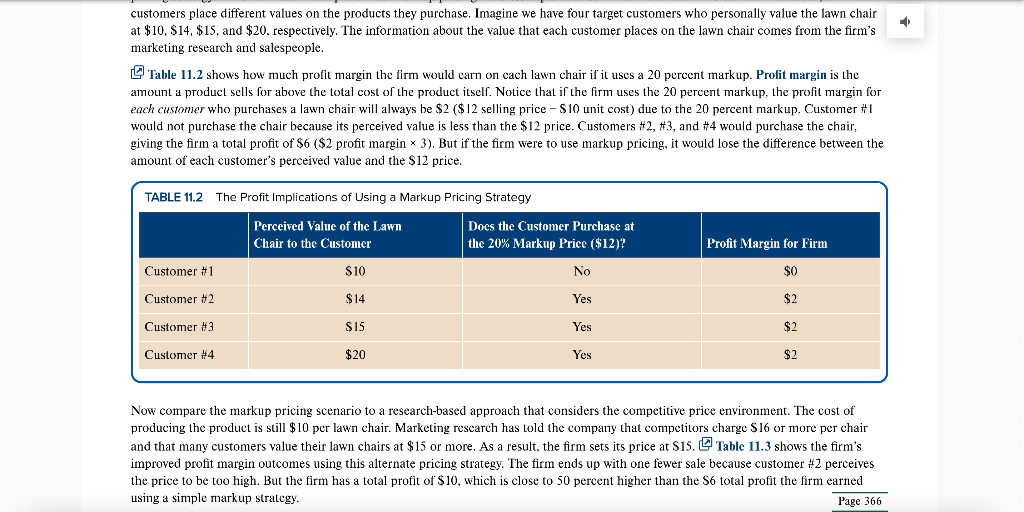

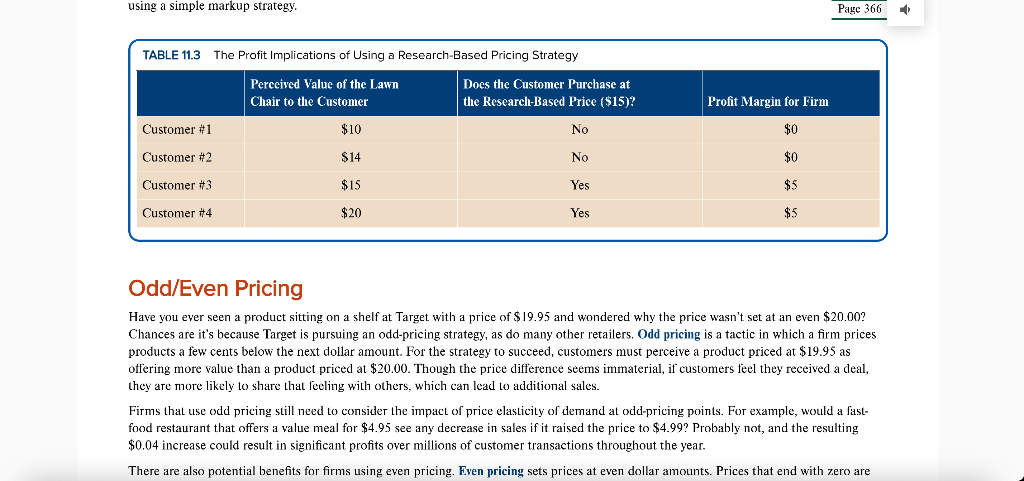

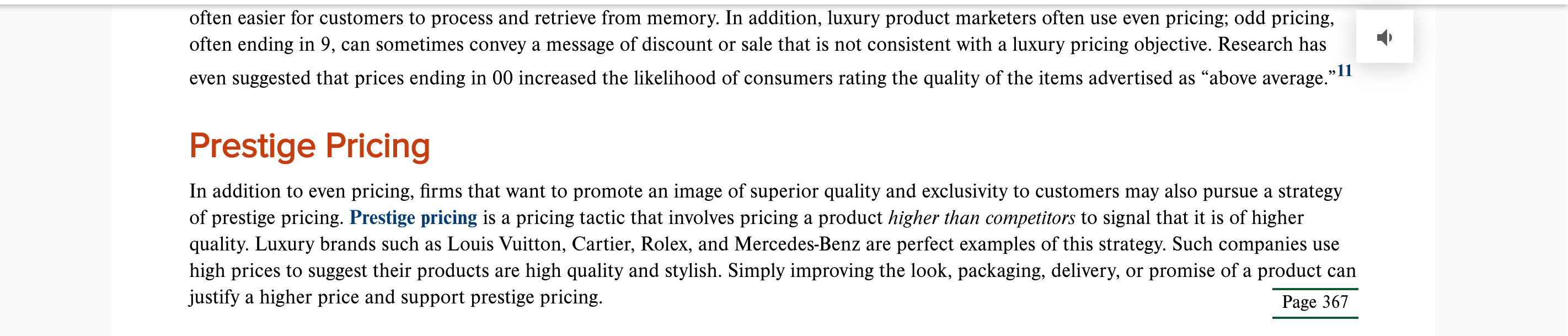

LO PRICING TACTICS LO 11-3 Compare the pricing tactics marketers can use. Once marketers have completed their analysis of demand, costs, and the competitive environment, they can use a number of different tactics to choose a final price. In this section, we will discuss several of the most common methods and discuss the advantages and disadvantages of each. Pricing tactics are short or long-term attempts to adjust the pricing of a product to achieve a particular pricing objective. Which tactic to use depends on the value customers perceive the product to have their ability to pay, and how they intend to use the product. Page 365 Markup Pricing Markup pricing (also known as cost-plus pricing) is one of the most commonly used pricing tactics, largely because it is easy. In markup pricin g, marketers add a certain amount, usually a percentage. to the cost of the product, to set the final price. The general formula for calculating markup price is: Markup price = Unit cost of product + (Desired retum x Unit cost) For example, a pricing analyst can easily implement markup pricing by reviewing a spreadsheet and adding 20 percent to the cost of each item, such as a lawn chair, as illustrated in the following equation: Markup price = $10 unit cost of lawn chair + (0.2 x $10) = $12 Though markup pricing has the advantage of being easy, it's not very effective at maximizing profits, which is the ultimate objective of a good pricing strategy. Let's look at an example of how markup pricing does not capture value for our lawn chair. As we have discussed, different using a simple markup strategy, Page 366 TABLE 11.3 The Profit Implications of Using a Research-Based Pricing Strategy Perceived Value of the Lawn Chair to the Customer Does the Customer Purchase at the Research-Based Price ($15)? Profit Margin for Firm Customer #1 $10 No $0 Customer #2 $14 No $0 Customer #3 $15 Yes $S Customer #4 $20 Yes $5 Odd/Even Pricing Have you ever seen a product sitting on a shelf at Target with a price of $19.95 and wondered why the price wasn't set at an even $20.00? Chances are it's because Target is pursuing an odd-pricing strategy, as do many other retailers. Odd pricing is a tactic in which a firm prices products a few cents below the next dollar amount. For the strategy to succeed, customers must perceive a product priced at $19.95 as offering more value than a product priced at $20.00. Though the price difference seems immaterial, if customers feel they received a deal, they are more likely to share that feeling with others, which can lead to additional sales. Firms that use odd pricing still need to consider the impact of price elasticity of demand at odd-pricing points. For example, would a fast- food restaurant that offers a value meal for $4.95 see any decrease in sales if it raised the price to $4.99? Probably not, and the resulting $0.04 increase could result in significant profits over millions of customer transactions throughout the year. There are also potential benefits for firms using even pricing. Even pricing sets prices at even dollar amounts. Prices that end with zero are Starbucks pursues prestige pricing by setting its prices high to convey increased value compared to other coffee purveyors like Dunkin' Donuts. iler. Xiang yangimeginechina/AP meges right Joe Raedle/Getty mages News/Getty meges Loss-Leader Pricing Loss-leader pricing involves selling a product at a price that causes the firm a financial loss. Although the firm may lose money selling the product at that price, it might attract customers who will also buy other, more profitable products in the future. For example, departinent stores often drop the price of well-known products to increase overall store traffic. This worked better at a time when consumers would do most of their shopping on-site; their additional purchases at the store would make up for the loss-leader item. However, consumers today have more pricing information at their fingertips and more options for purchasing online. The result can be that firms sell only the loss- leader product and never make up the profits, as customers go elsewhere to buy the more profitable products. Seasonal Discounts Price reductions given to customers purchasing goods or services out of season are called seasonal discounts. Disney World pursues this strategy by offering its best rates when demand is at its lowest due to cold weather (e.g., January and February) and the fact that children are in school.12 Scasonal discounts enable Disney World to maintain a steady stream of visitors to its parks year-round. The strategy also exposes new customers to the brand. Young families (those with children younger than school age) can try Disney World during its value season; many go on to become loyal customers, purchasing Disney vacations during the peak summer seasons once their children start school. Marketers for a variety of firms and industries, such as ski lodges in the summer and cruises during nonpeak times, utilize seasonal discounts to keep attendance high throughout the year. Price Bundling There are usually two ways to purchase products: la carte (individually) or as a bundle. Price bundling is a pricing tactic in which two or more products are packaged together and sold at a single price. Marketers often use bundling as a tool because they can charge higher prices for the bundle than they could for the elements individually. TAIKOTOISTO1 a variety on HTS MUUSUTUS, Suur AS Klougos III W SUMUT anu Turses uurm Tionpoan MS, UMZ Svasonar unsoumis to keep attendance high throughout the year. Price Bundling There are usually two ways to purchase products: la carte (individually) or as a bundle. Price bundling is a pricing tactic in which two or more products are packaged together and sold at a single price. Marketers often use bundling as a tool because they can charge higher prices for the bundle than they could for the elements individually. Assume you are buying a new Ford Escape SUV. Would you prefer to purchase the base model and then handpick options, such as a moon roof or satellite radio? Or are you better off buying the vehicle as one all-inclusive bundle? Conventional wisdom says that la carte pricing benefits the customer, and bundled pricing benefits the firm. Undoubtedly, price bundling simplifies things for marketers. The company can sell the same bundle to everyone, which results in reduced advertising and selling costs. Think of the success that bundled software packages such as Microsoft Office enjoy, despite the fact that many of the software's users need only a fraction of the available functionality. Page 368 Such success aside, price bundling has come up against increased customer resistance in some industries. Cable television providers have always relied on a bundling strategy in which customers have to buy a package of channels rather than paying individually for the channels they want. In recent years, as the price of those channel bundles kept rising, the practice has come under fire. Consumer advocates point out that, if you're watching only 10 channels, why should you pay for 85? They've begun pushing for a system of la carte pricing in the hope that such a move will drive down prices for consumers. LO PRICING TACTICS LO 11-3 Compare the pricing tactics marketers can use. Once marketers have completed their analysis of demand, costs, and the competitive environment, they can use a number of different tactics to choose a final price. In this section, we will discuss several of the most common methods and discuss the advantages and disadvantages of each. Pricing tactics are short or long-term attempts to adjust the pricing of a product to achieve a particular pricing objective. Which tactic to use depends on the value customers perceive the product to have their ability to pay, and how they intend to use the product. Page 365 Markup Pricing Markup pricing (also known as cost-plus pricing) is one of the most commonly used pricing tactics, largely because it is easy. In markup pricin g, marketers add a certain amount, usually a percentage. to the cost of the product, to set the final price. The general formula for calculating markup price is: Markup price = Unit cost of product + (Desired retum x Unit cost) For example, a pricing analyst can easily implement markup pricing by reviewing a spreadsheet and adding 20 percent to the cost of each item, such as a lawn chair, as illustrated in the following equation: Markup price = $10 unit cost of lawn chair + (0.2 x $10) = $12 Though markup pricing has the advantage of being easy, it's not very effective at maximizing profits, which is the ultimate objective of a good pricing strategy. Let's look at an example of how markup pricing does not capture value for our lawn chair. As we have discussed, different using a simple markup strategy, Page 366 TABLE 11.3 The Profit Implications of Using a Research-Based Pricing Strategy Perceived Value of the Lawn Chair to the Customer Does the Customer Purchase at the Research-Based Price ($15)? Profit Margin for Firm Customer #1 $10 No $0 Customer #2 $14 No $0 Customer #3 $15 Yes $S Customer #4 $20 Yes $5 Odd/Even Pricing Have you ever seen a product sitting on a shelf at Target with a price of $19.95 and wondered why the price wasn't set at an even $20.00? Chances are it's because Target is pursuing an odd-pricing strategy, as do many other retailers. Odd pricing is a tactic in which a firm prices products a few cents below the next dollar amount. For the strategy to succeed, customers must perceive a product priced at $19.95 as offering more value than a product priced at $20.00. Though the price difference seems immaterial, if customers feel they received a deal, they are more likely to share that feeling with others, which can lead to additional sales. Firms that use odd pricing still need to consider the impact of price elasticity of demand at odd-pricing points. For example, would a fast- food restaurant that offers a value meal for $4.95 see any decrease in sales if it raised the price to $4.99? Probably not, and the resulting $0.04 increase could result in significant profits over millions of customer transactions throughout the year. There are also potential benefits for firms using even pricing. Even pricing sets prices at even dollar amounts. Prices that end with zero are Starbucks pursues prestige pricing by setting its prices high to convey increased value compared to other coffee purveyors like Dunkin' Donuts. iler. Xiang yangimeginechina/AP meges right Joe Raedle/Getty mages News/Getty meges Loss-Leader Pricing Loss-leader pricing involves selling a product at a price that causes the firm a financial loss. Although the firm may lose money selling the product at that price, it might attract customers who will also buy other, more profitable products in the future. For example, departinent stores often drop the price of well-known products to increase overall store traffic. This worked better at a time when consumers would do most of their shopping on-site; their additional purchases at the store would make up for the loss-leader item. However, consumers today have more pricing information at their fingertips and more options for purchasing online. The result can be that firms sell only the loss- leader product and never make up the profits, as customers go elsewhere to buy the more profitable products. Seasonal Discounts Price reductions given to customers purchasing goods or services out of season are called seasonal discounts. Disney World pursues this strategy by offering its best rates when demand is at its lowest due to cold weather (e.g., January and February) and the fact that children are in school.12 Scasonal discounts enable Disney World to maintain a steady stream of visitors to its parks year-round. The strategy also exposes new customers to the brand. Young families (those with children younger than school age) can try Disney World during its value season; many go on to become loyal customers, purchasing Disney vacations during the peak summer seasons once their children start school. Marketers for a variety of firms and industries, such as ski lodges in the summer and cruises during nonpeak times, utilize seasonal discounts to keep attendance high throughout the year. Price Bundling There are usually two ways to purchase products: la carte (individually) or as a bundle. Price bundling is a pricing tactic in which two or more products are packaged together and sold at a single price. Marketers often use bundling as a tool because they can charge higher prices for the bundle than they could for the elements individually. TAIKOTOISTO1 a variety on HTS MUUSUTUS, Suur AS Klougos III W SUMUT anu Turses uurm Tionpoan MS, UMZ Svasonar unsoumis to keep attendance high throughout the year. Price Bundling There are usually two ways to purchase products: la carte (individually) or as a bundle. Price bundling is a pricing tactic in which two or more products are packaged together and sold at a single price. Marketers often use bundling as a tool because they can charge higher prices for the bundle than they could for the elements individually. Assume you are buying a new Ford Escape SUV. Would you prefer to purchase the base model and then handpick options, such as a moon roof or satellite radio? Or are you better off buying the vehicle as one all-inclusive bundle? Conventional wisdom says that la carte pricing benefits the customer, and bundled pricing benefits the firm. Undoubtedly, price bundling simplifies things for marketers. The company can sell the same bundle to everyone, which results in reduced advertising and selling costs. Think of the success that bundled software packages such as Microsoft Office enjoy, despite the fact that many of the software's users need only a fraction of the available functionality. Page 368 Such success aside, price bundling has come up against increased customer resistance in some industries. Cable television providers have always relied on a bundling strategy in which customers have to buy a package of channels rather than paying individually for the channels they want. In recent years, as the price of those channel bundles kept rising, the practice has come under fire. Consumer advocates point out that, if you're watching only 10 channels, why should you pay for 85? They've begun pushing for a system of la carte pricing in the hope that such a move will drive down prices for consumers