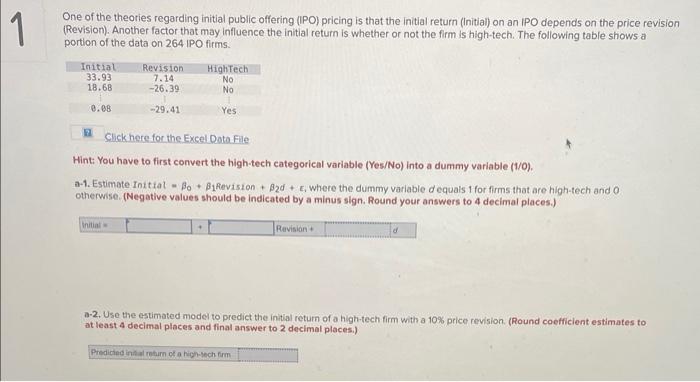

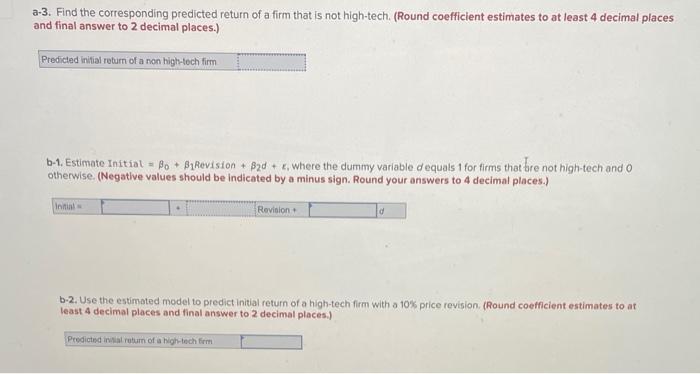

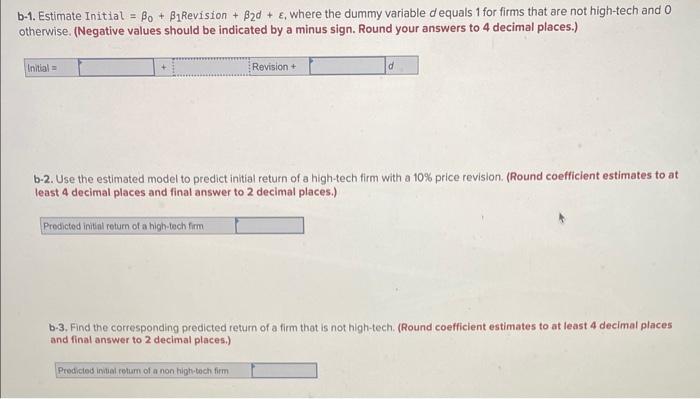

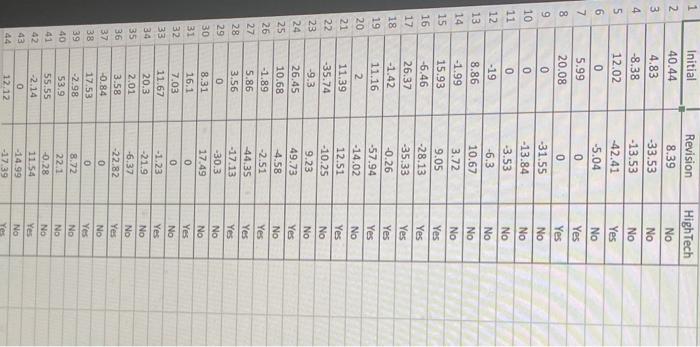

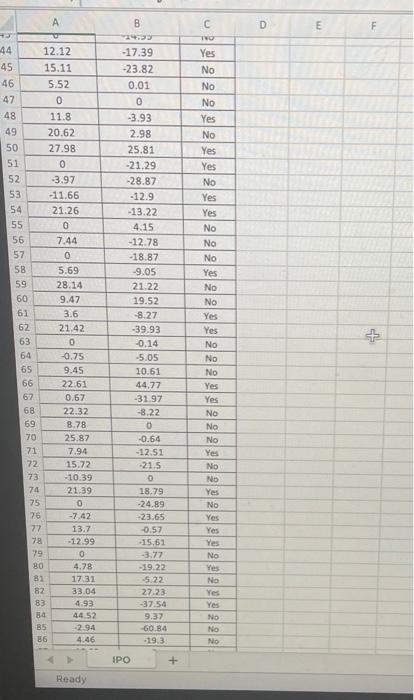

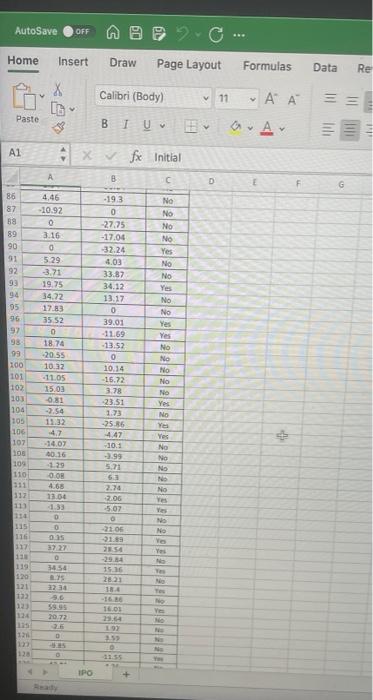

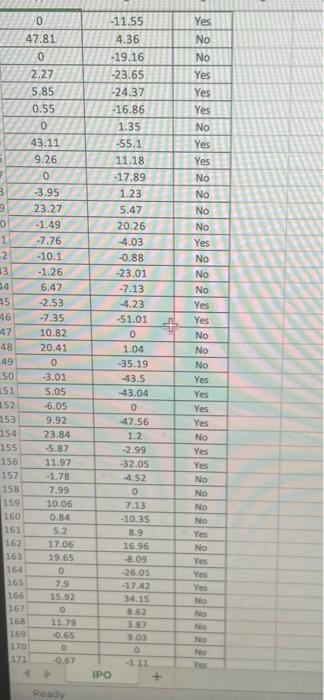

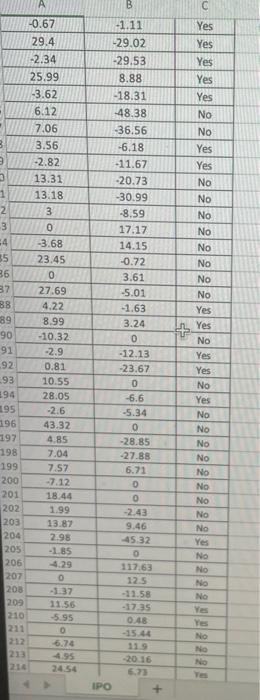

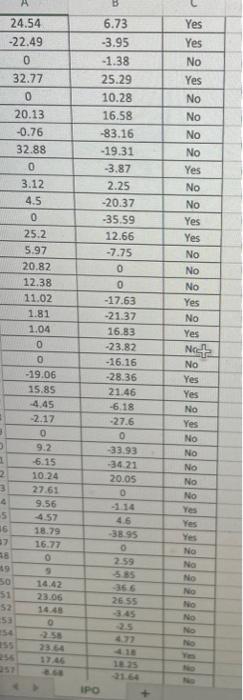

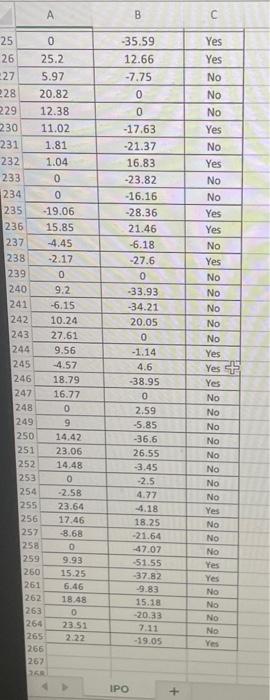

One of the theories regarding initial public offering (IPO) pricing is that the initial return (Initiai) on an IPO depends on the price revision (Revision). Another factor that may influence the initial return is whether or not the firm is high-tech. The following table shows a portion of the data on 264IPO firms. 12 Click here for the Excel Data File Hint: You have to first convert the high-tech categorical variable (Yes/No) into a dummy variable (1/O). a-1. Estimate Initial =0+1 fevision +2d+, where the dummy varlable d equals 1 for firms that are high-tech and 0 otherwise, (Negative values should be indicated by a minus sign. Round your answers to 4 decimal places.) a-2. Use the estimated model to predict the initial return of a high-tech firm with a 10% price revision. (Round coefficlent estimates to at least 4 decimal places and final answer to 2 decimal placesi) -3. Find the corresponding predicted return of a firm that is not high-tech. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) b-1. Estimate Initial =0+1 Revision +2d+, where the dummy variable d equals 1 for firms that are not high-tech and 0 otherwise. (Negative values should be indicated by a minus sign. Round your answers to 4 decimal places.) b-2. Use the estimated model to predict initial return of a high-tech firm with a 10% price revision. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) b-1. Estimate Initial =0+1 Revision +2d+, where the dummy variable d equals 1 for firms that are not high-tech and 0 otherwise. (Negative values should be indicated by a minus sign. Round your answers to 4 decimal places.) b-2. Use the estimated model to predict initial return of a high-tech firm with a 10\% price revision. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) b-3. Find the corresponding predicted return of a firm that is not high-tech. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) One of the theories regarding initial public offering (IPO) pricing is that the initial return (Initiai) on an IPO depends on the price revision (Revision). Another factor that may influence the initial return is whether or not the firm is high-tech. The following table shows a portion of the data on 264IPO firms. 12 Click here for the Excel Data File Hint: You have to first convert the high-tech categorical variable (Yes/No) into a dummy variable (1/O). a-1. Estimate Initial =0+1 fevision +2d+, where the dummy varlable d equals 1 for firms that are high-tech and 0 otherwise, (Negative values should be indicated by a minus sign. Round your answers to 4 decimal places.) a-2. Use the estimated model to predict the initial return of a high-tech firm with a 10% price revision. (Round coefficlent estimates to at least 4 decimal places and final answer to 2 decimal placesi) -3. Find the corresponding predicted return of a firm that is not high-tech. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) b-1. Estimate Initial =0+1 Revision +2d+, where the dummy variable d equals 1 for firms that are not high-tech and 0 otherwise. (Negative values should be indicated by a minus sign. Round your answers to 4 decimal places.) b-2. Use the estimated model to predict initial return of a high-tech firm with a 10% price revision. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) b-1. Estimate Initial =0+1 Revision +2d+, where the dummy variable d equals 1 for firms that are not high-tech and 0 otherwise. (Negative values should be indicated by a minus sign. Round your answers to 4 decimal places.) b-2. Use the estimated model to predict initial return of a high-tech firm with a 10\% price revision. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) b-3. Find the corresponding predicted return of a firm that is not high-tech. (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.)