Question

One of your best friends from childhood, Hermione, is an entrepreneur that opened a pizza restaurant (called The Crusty Crookshanks) five years ago. It has

One of your best friends from childhood, Hermione, is an entrepreneur that opened a pizza restaurant (called The Crusty Crookshanks) five years ago. It has been a huge success, and she is currently considering investing to expand her operations. The property next door to her restaurant is for sale, so she is evaluating whether she should purchase that property, which would greatly expand the seating capacity, as well as allowing her to double the kitchen space, so she'd be able to cook many more pizzas daily (in the past few months she's had trouble keeping up with demand).

Hermione has hired you to help her with the financial analysis of this potential expansion project. As you're putting your 10-year projections together, you estimate the following:

The up-front cost of the new building, construction, and kitchen remodeling will be $5,550,000, and will take approximately one year. You estimate this can be depreciated over the first 5 years, using the following accelerated annual depreciation schedule: 35%, 30%, 20%, 10%, and 5%.

? Year 1 will have a sales reduction of $850,000 relative to not doing the expansion.

? Years 2 through 10 will have an increase in sales of $900,000 in year 2, growing by 8% per year.

? Costs will increase by $25,000 in year 2, growing by 5% per year.

? NWC investment of $350,000 today (recovered at the end).

? Salvage value of $1,750,000 at the end.

? Tax rate of 29%.

? The appropriate discount rate is 14%

Using your assumptions, find the NPV of the restaurant expansion. What is your recommendation to Hermione?

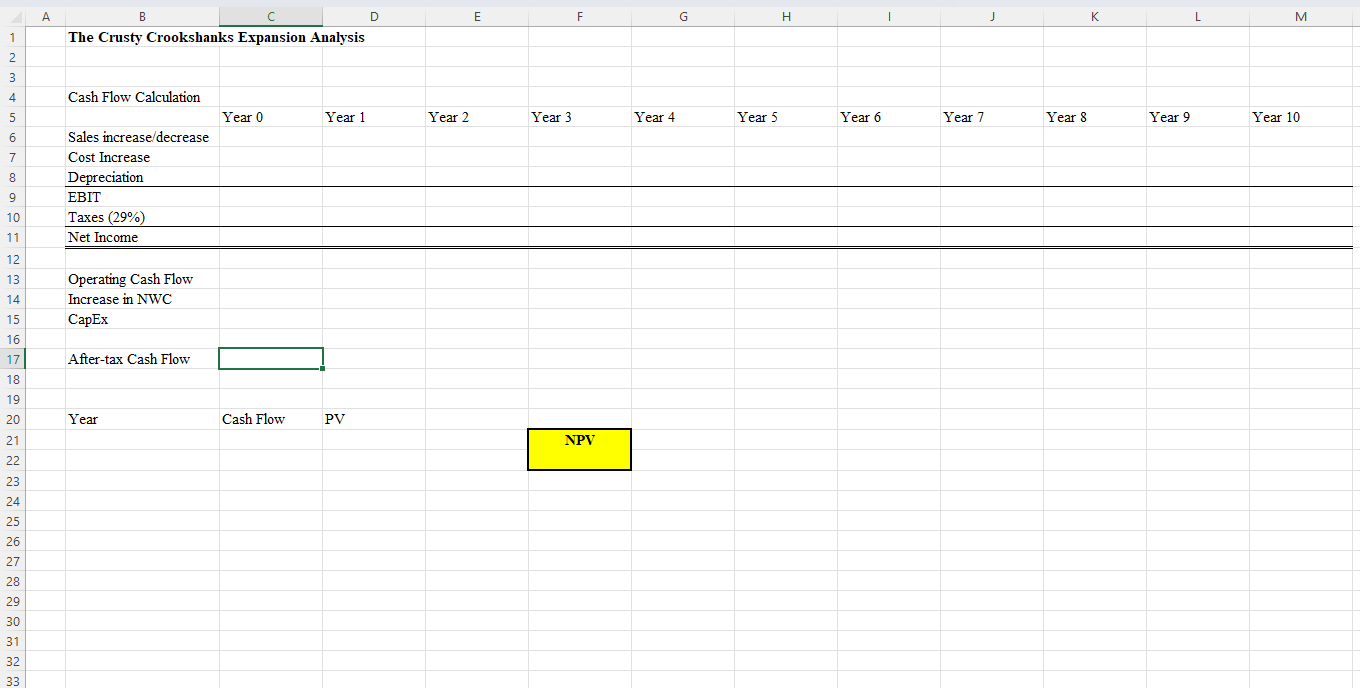

A B E F H K L M 1 The Crusty Crookshanks Expansion Analysis 2 3 4 Cash Flow Calculation 5 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 6 Sales increase/decrease 7 Cost Increase 8 Depreciation 9 EBIT 10 Taxes (29%) 11 Net Income 12 13 Operating Cash Flow 14 Increase in NWC 15 CapEx 16 17 After-tax Cash Flow 18 19 20 Year 21 Cash Flow PV NPV 22 23 24 25 26 27 28 29 30 31 32 33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started