one problem two steps

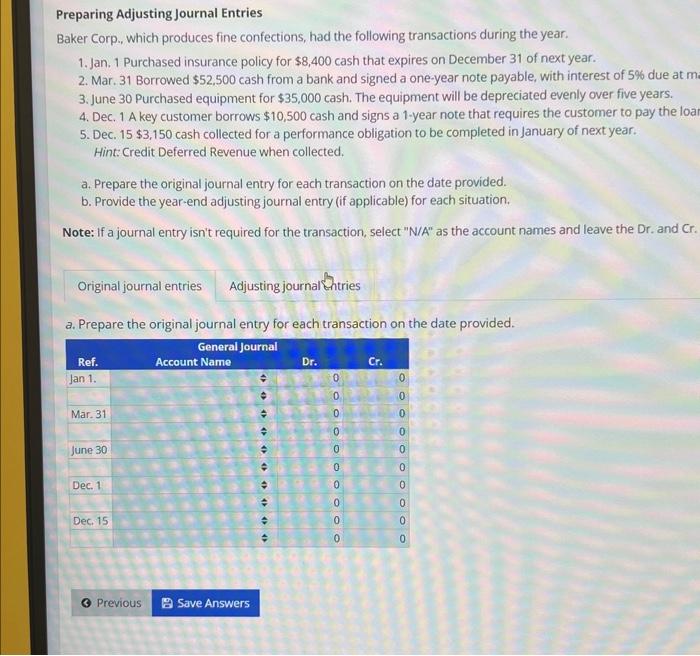

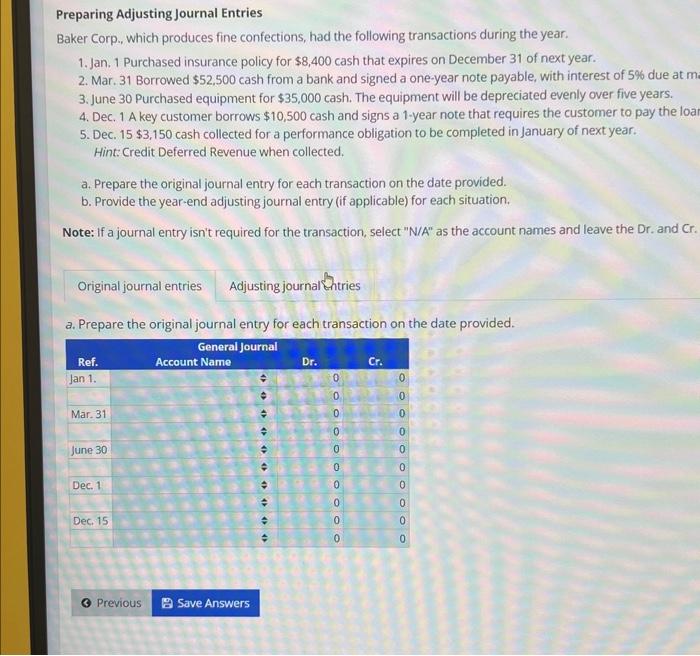

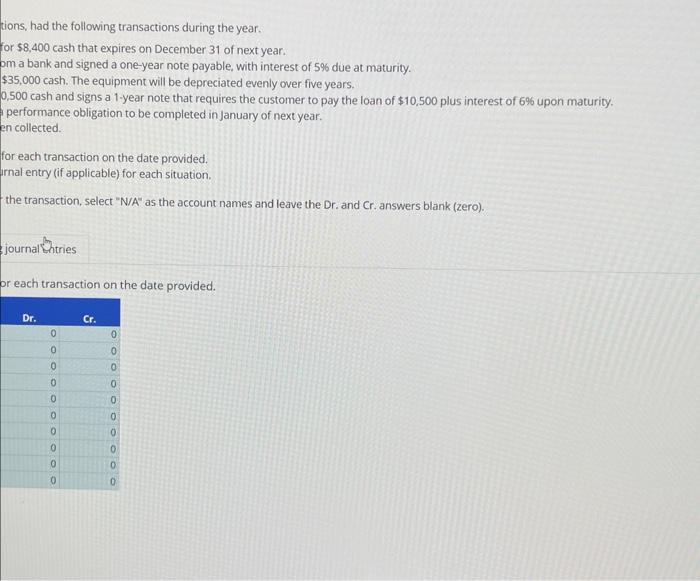

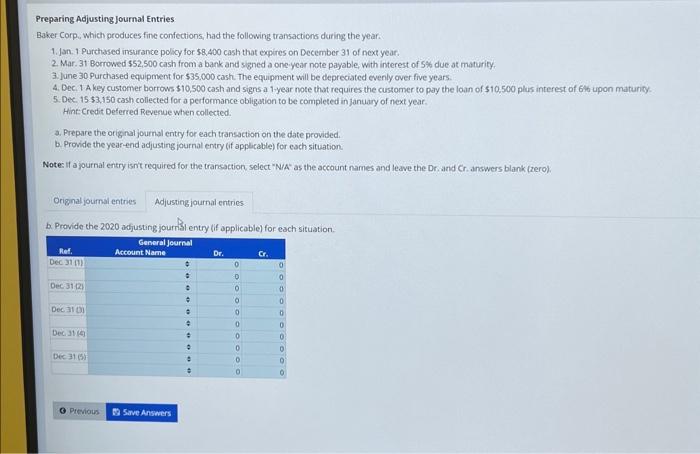

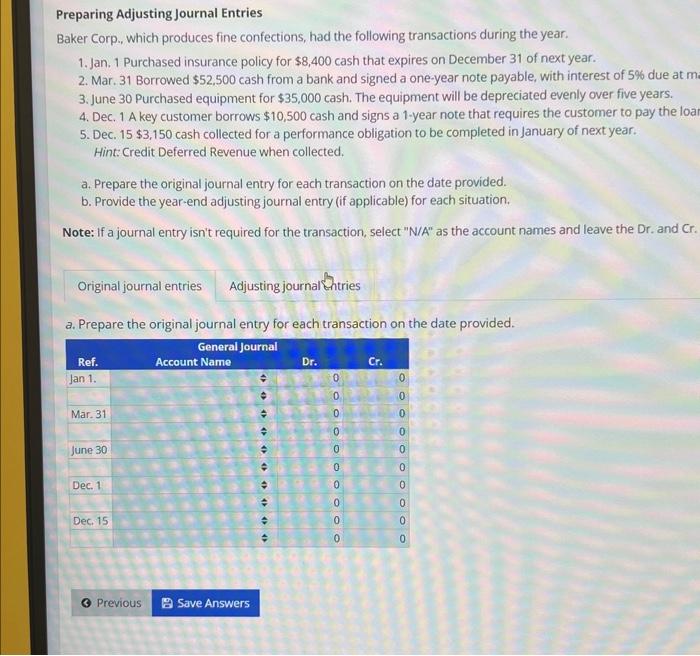

Preparing Adjusting Journal Entries Baker Corp., which produces fine confections, had the following transactions during the year. 1. Jan. 1 Purchased insurance policy for $8,400 cash that expires on December 31 of next year. 2. Mar. 31 Borrowed $52,500 cash from a bank and signed a one-year note payable, with interest of 5% due at m 3. June 30 Purchased equipment for $35,000 cash. The equipment will be depreciated evenly over five years. 4. Dec. 1 A key customer borrows $10,500 cash and signs a 1-year note that requires the customer to pay the loar 5. Dec. 15$3,150 cash collected for a performance obligation to be completed in January of next year. Hint: Credit Deferred Revenue when collected. a. Prepare the original journal entry for each transaction on the date provided. b. Provide the year-end adjusting journal entry (if applicable) for each situation. Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. a. Prepare the original journal entry for each transaction on the date provided. tions, had the following transactions during the year. for $8,400 cash that expires on December 31 of next year. om a bank and signed a one-year note payable, with interest of 5% due at maturity. $35,000 cash. The equipment will be depreciated evenly over five years. 0,500 cash and signs a 1-year note that requires the customer to pay the loan of $10,500 plus interest of 6% upon maturity. performance obligation to be completed in January of next year. en collected. for each transaction on the date provided. irnal entry (if applicable) for each situation. the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). pr each transaction on the date provided. Preparing Adjusting Journal Entries Baker Corp, Which produces fine confections, had the following transactions during the year: 1. Jan. 1 Purchased insurance policy for $8,400 cash that expires on December 31 of next year. 2. Mar. 31 Borrowed $52,500 cash from a bank and signed a one year note payable, with interest of 5% due at maturity. 3. fune 30 purchased equipment for $35,000 cash. The equipment will be depreciated evenly over five years. 4. Dec. 1 A key customer borrows $10,500 cash and signs a 1.year note that requires the customer to pay the loan of $10,500 plus interest of 6.6 upon maturity. 5. Dec, 15,\$3,150 cash collected for a performance obligation to be completed in january of next year. Hint: Credit Deferred Revenue when collected. a. Prepare the original journal entry for each transaction on the date provided. b. Provide the year-end adjusting journal entry (if applicable) for each situation. Note: if a journal entry isn't required for the trancaction select "N/A' as the account names and leave the Dr. and Cr. answers blank (zero). b. Provide the 2020 adjusting journkl entry (if applicable) for each situation