Question

One proposal for reforming the welfare system is to create a negative income tax. Under the negative income tax, each person is entitled to

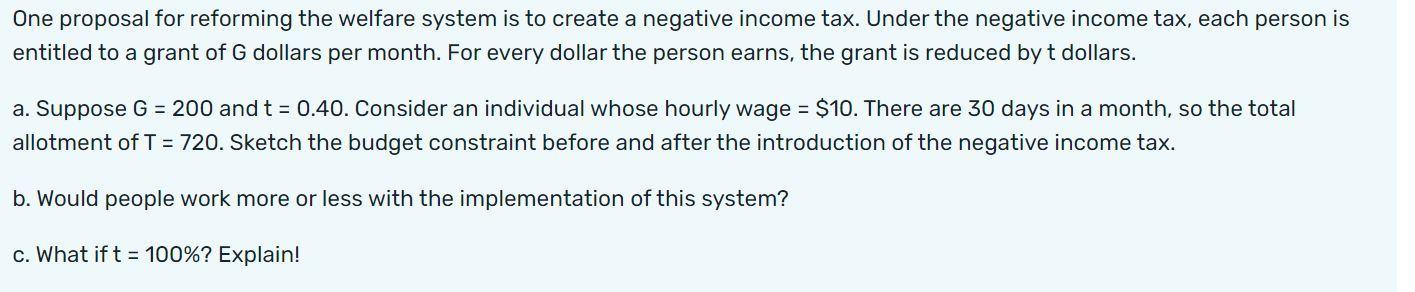

One proposal for reforming the welfare system is to create a negative income tax. Under the negative income tax, each person is entitled to a grant of G dollars per month. For every dollar the person earns, the grant is reduced by t dollars. a. Suppose G = 200 and t = 0.40. Consider an individual whose hourly wage = $10. There are 30 days in a month, so the total allotment of T = 720. Sketch the budget constraint before and after the introduction of the negative income tax. b. Would people work more or less with the implementation of this system? c. What if t = 100%? Explain!

Step by Step Solution

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Budget constraint means the maximum amount of money that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Public Finance A Contemporary Application of Theory to Policy

Authors: David N Hyman

11th edition

9781305474253, 1285173953, 1305474252, 978-1285173955

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App