One question multiple parts

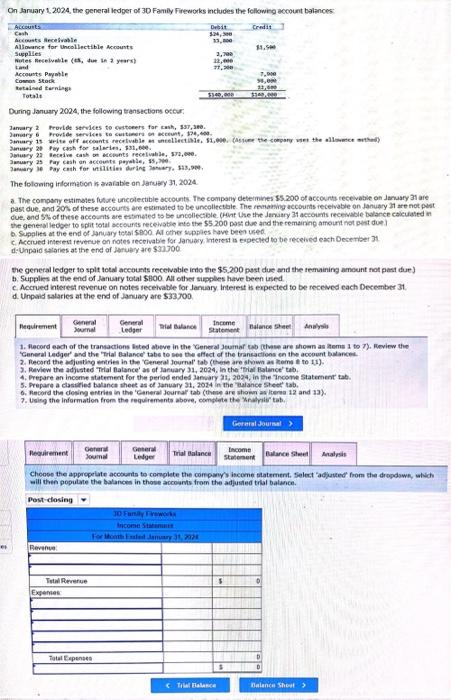

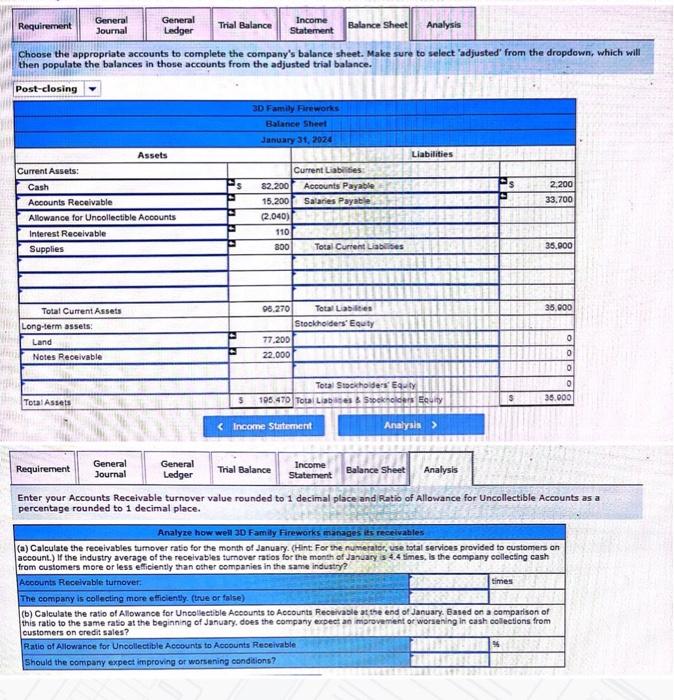

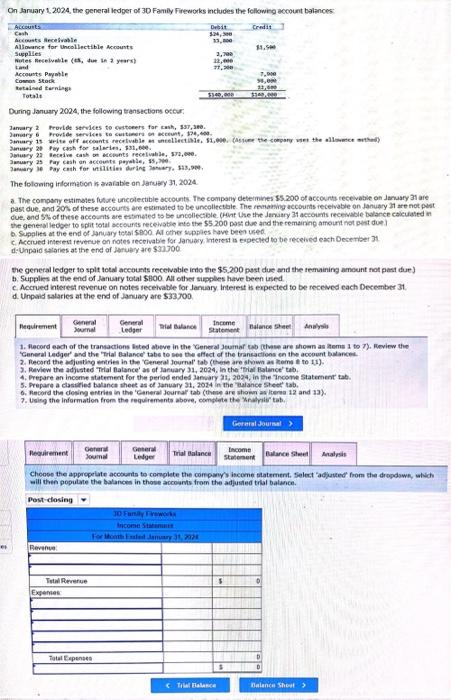

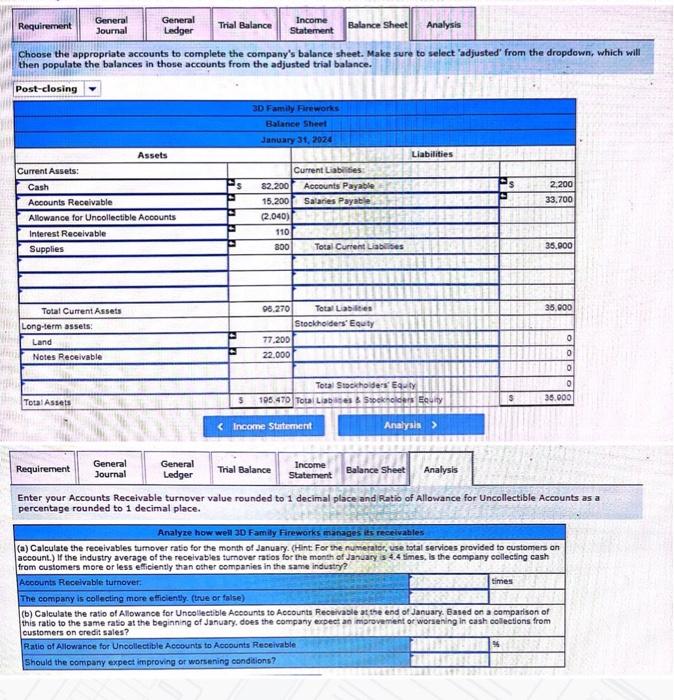

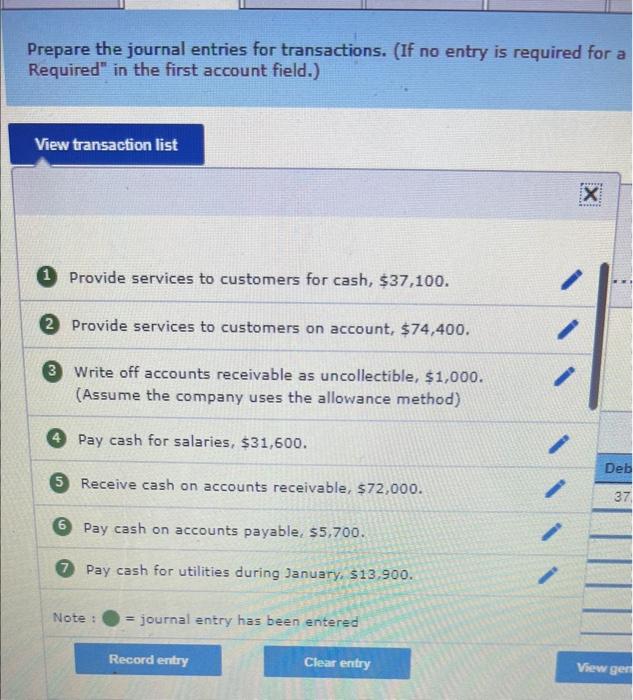

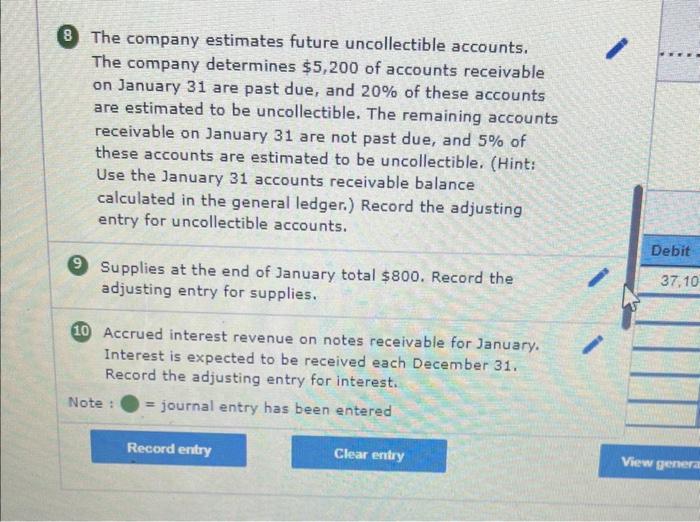

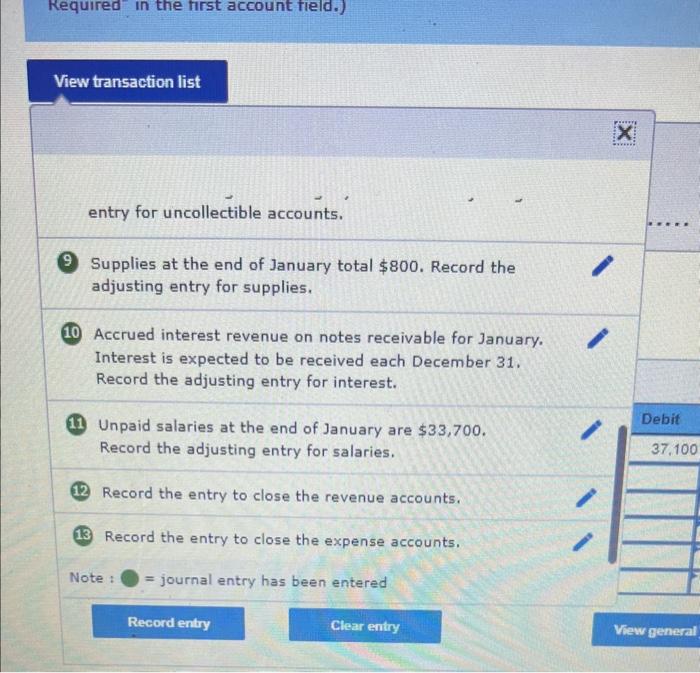

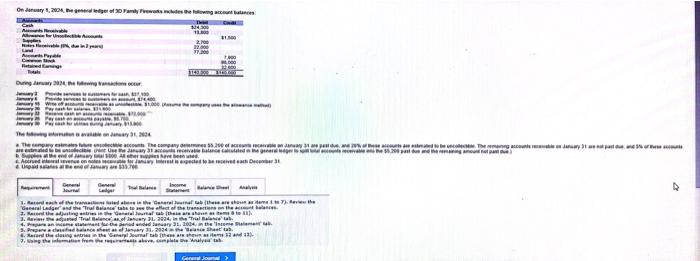

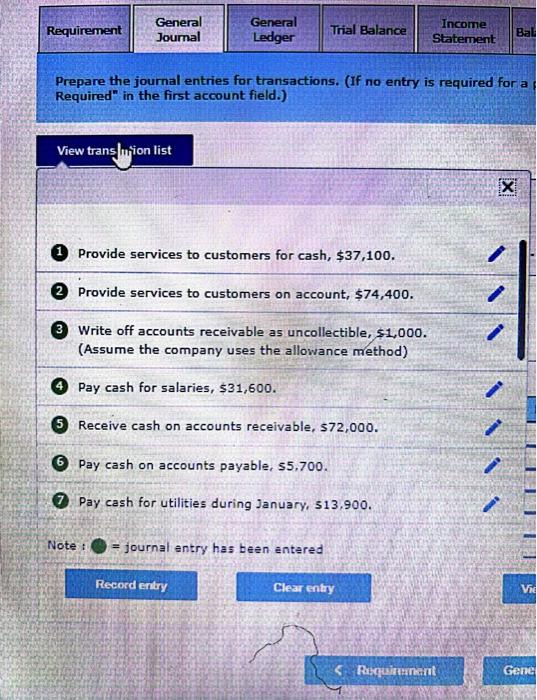

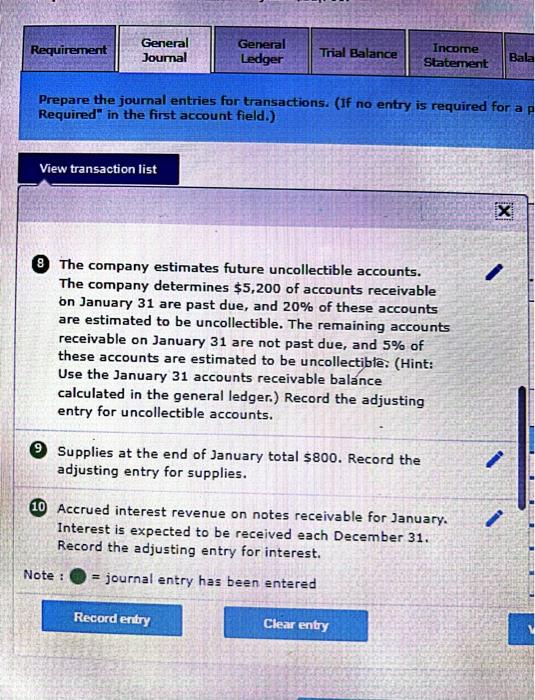

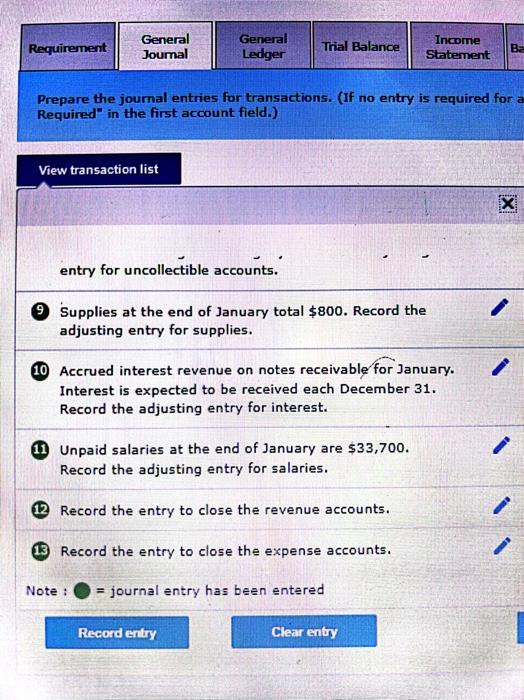

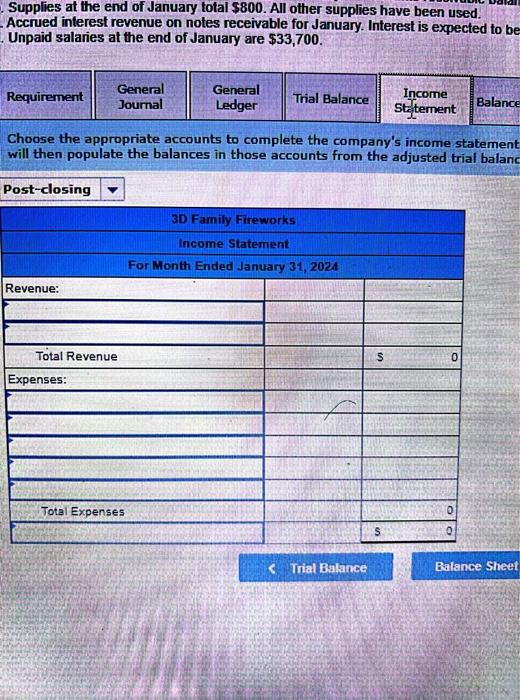

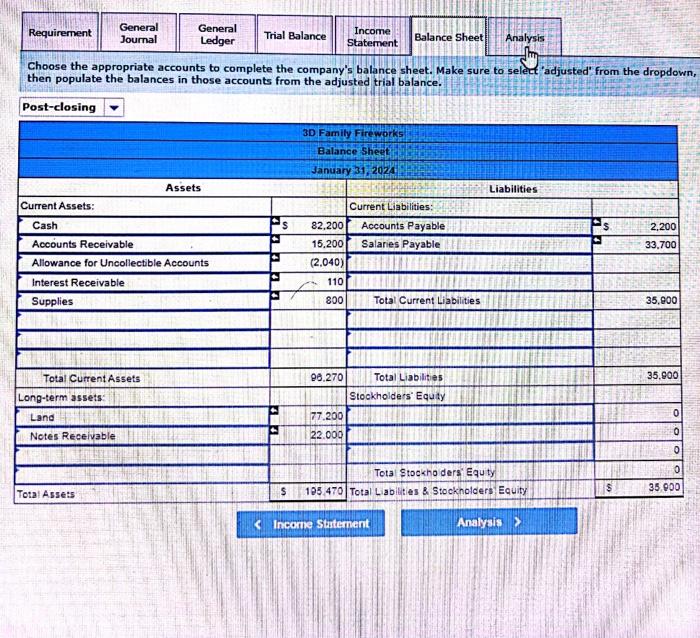

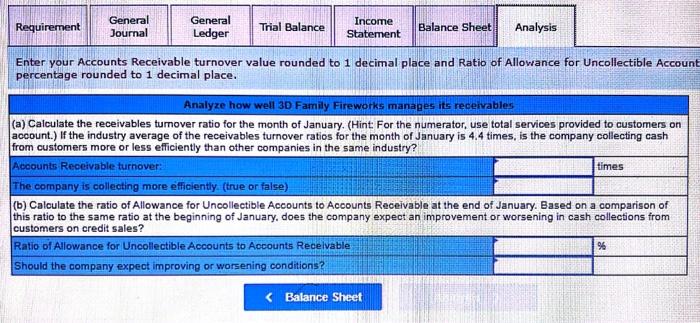

On Janary 1.2024, the general iedper of 30 Fanily Fireworks includes the follcwing account balences: During January 2024 , the followitg transectians occur. Jamary 2 frorlde strvices to westeeers far cash, 331, 2eb. Jumedry 6 Froptde sterides to celtianera in eccevet, 174,40. Junuey at Pay cash foe talarias, 331, 6ied. The folowing if formation if avalabie on darsacy 31, 2024. a. The company estimates future uncotectable accounts. The company deteimines 5.5.200 of accourts receivabie on daruafy 3t are past due, and 20 fo of these accourts are exmated to be uncoliectale. The manaivig accounts receivable on January 21 are not past b. Supalies at the end of Januay teraisped Al other supples have been uret. c. Accrued ifterest feveete on notes recoivabie for Januacy interest is eapecled fo be receited each Decertaet Jt. di. Uhpaid sataries at the end of Latuey are $37700 c. Mccrued interest reverue on nates tecevable for Jamuary interest is expected to be received each Deceentser 31. d. Unpaid tataries at the end of Januacy are 333700 . 'Ceneral Ledger' and the 'Trial falance' tabe to ses the affect of the transactions en the acoeunt bulanced. 3. Review the adjisted 'Trial fatance' as of faniary 31, 2024, In the 'Frial Palance' tab. 4. Prepare an income statement for the period ended zamary 71,2024 , in the Income 5 tatement tab. 5. Prepare a ctastilied balance theet as of January 21,2024 in the 7aalance sheet tab. 6. Record tha desing entrits in the 'Ceneral Josinal' tab (theme are shomi as lterea 12 and 37). 7. Usieg the infermation frem the cequirements abore, compteta the Xralrile" tab, vill then poputate the balarees in those accoismts from the adjusted trial balance. Choose the appropriate accounts to complete the company's balance sheet. Make sure to select 'adjusted' from the dropdown, which will then populate the balances in those accounts from the adjusted trial balance. Enter your Accounts Receivable turnover value rounded to 1 decimal place and Ratio of Allowance for Uncollectible Accounts as a percentage rounded to 1 decimal place. Prepare the journal entries for transactions. (If no entry is required for a Required" in the first account field.) Provide services to customers for cash, $37,100. Provide services to customers on account, $74,400. Write off accounts receivable as uncollectible, \$1,000. (Assume the company uses the allowance method) Pay cash for salaries, $31,600. Receive cash on accounts receivable, $72,000. Pay cash on accounts payable, 55,700 . Pay cash for utilities during January, \$13,900. Note : = journal entry has been entered 8 The company estimates future uncollectible accounts. The company determines $5,200 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record the adjusting entry for uncollectible accounts. (9) Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. Note : = journal entry has been entered entry for uncollectible accounts. Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. (11) Unpaid salaries at the end of January are $33,700. Record the adjusting entry for salaries. Record the entry to close the revenue accounts. Record the entry to close the expense accounts. Note : = journal entry has been entered Prepare the journal entries for transactions. (If no entry is required for a Required n in the first account field.) Provide services to customers for cash, $37,100. Provide services to customers on account, $74,400. Write off accounts receivable as uncollectible, $1,000. (Assume the company uses the allowance method) Pay cash for salaries, $31,600. Receive cash on accounts receivable, $72,000. Pay cash on accounts payable, $5,700. Pay cash for utilities during January, 513,900 . Note: = journal entry has been entered Prepare the journal entries for transactions. (If no entry is required for a f Required" in the first account field.) 8 The company estimates future uncollectible accounts. The company determines $5,200 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible: (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record the adjusting entry for uncollectible accounts. (9) Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. Prepare the journal entries for transactions. (If no entry is required for a Required" in the first account field.) entry for uncollectible accounts. Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. (11) Unpaid salaries at the end of January are $33,700. Record the adjusting entry for salaries. Record the entry to close the revenue accounts. (13) Record the entry to close the expense accounts. Note : = journal entry has been entered Supplies at the end of January total $800. All other supplies have been used. Accrued interest revenue on notes receivable for January. Interest is expected to be Unpaid salaries at the end of January are $33,700. Choose the appropriate accounts to complete the company's income statement will then populate the balances in those accounts from the adjusted trial balanc Choose the appropriate accounts to complete the company's balance sheet. Make sure to select'adjusted' from the dropdown, then populate the balances in those accounts from the adjusted trial balance. Enter your Accounts Receivable turnover value rounded to 1 decimal place and Ratio of Allowance for Uncollectible Accol percentage rounded to 1 decimal place. Analyze how well 30 Family Fireworks manages its receivables a) Calculate the receivables tumover ratio for the month of January. (Hint. For the numerator, use total services provided to customers on ocount.) If the industry average of the receivables turnover ratios for the month of January is 4.4 times, is the company collecting cash rom customers more or less efficiently than other companies in the same industry? On Janary 1.2024, the general iedper of 30 Fanily Fireworks includes the follcwing account balences: During January 2024 , the followitg transectians occur. Jamary 2 frorlde strvices to westeeers far cash, 331, 2eb. Jumedry 6 Froptde sterides to celtianera in eccevet, 174,40. Junuey at Pay cash foe talarias, 331, 6ied. The folowing if formation if avalabie on darsacy 31, 2024. a. The company estimates future uncotectable accounts. The company deteimines 5.5.200 of accourts receivabie on daruafy 3t are past due, and 20 fo of these accourts are exmated to be uncoliectale. The manaivig accounts receivable on January 21 are not past b. Supalies at the end of Januay teraisped Al other supples have been uret. c. Accrued ifterest feveete on notes recoivabie for Januacy interest is eapecled fo be receited each Decertaet Jt. di. Uhpaid sataries at the end of Latuey are $37700 c. Mccrued interest reverue on nates tecevable for Jamuary interest is expected to be received each Deceentser 31. d. Unpaid tataries at the end of Januacy are 333700 . 'Ceneral Ledger' and the 'Trial falance' tabe to ses the affect of the transactions en the acoeunt bulanced. 3. Review the adjisted 'Trial fatance' as of faniary 31, 2024, In the 'Frial Palance' tab. 4. Prepare an income statement for the period ended zamary 71,2024 , in the Income 5 tatement tab. 5. Prepare a ctastilied balance theet as of January 21,2024 in the 7aalance sheet tab. 6. Record tha desing entrits in the 'Ceneral Josinal' tab (theme are shomi as lterea 12 and 37). 7. Usieg the infermation frem the cequirements abore, compteta the Xralrile" tab, vill then poputate the balarees in those accoismts from the adjusted trial balance. Choose the appropriate accounts to complete the company's balance sheet. Make sure to select 'adjusted' from the dropdown, which will then populate the balances in those accounts from the adjusted trial balance. Enter your Accounts Receivable turnover value rounded to 1 decimal place and Ratio of Allowance for Uncollectible Accounts as a percentage rounded to 1 decimal place. Prepare the journal entries for transactions. (If no entry is required for a Required" in the first account field.) Provide services to customers for cash, $37,100. Provide services to customers on account, $74,400. Write off accounts receivable as uncollectible, \$1,000. (Assume the company uses the allowance method) Pay cash for salaries, $31,600. Receive cash on accounts receivable, $72,000. Pay cash on accounts payable, 55,700 . Pay cash for utilities during January, \$13,900. Note : = journal entry has been entered 8 The company estimates future uncollectible accounts. The company determines $5,200 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record the adjusting entry for uncollectible accounts. (9) Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. Note : = journal entry has been entered entry for uncollectible accounts. Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. (11) Unpaid salaries at the end of January are $33,700. Record the adjusting entry for salaries. Record the entry to close the revenue accounts. Record the entry to close the expense accounts. Note : = journal entry has been entered Prepare the journal entries for transactions. (If no entry is required for a Required n in the first account field.) Provide services to customers for cash, $37,100. Provide services to customers on account, $74,400. Write off accounts receivable as uncollectible, $1,000. (Assume the company uses the allowance method) Pay cash for salaries, $31,600. Receive cash on accounts receivable, $72,000. Pay cash on accounts payable, $5,700. Pay cash for utilities during January, 513,900 . Note: = journal entry has been entered Prepare the journal entries for transactions. (If no entry is required for a f Required" in the first account field.) 8 The company estimates future uncollectible accounts. The company determines $5,200 of accounts receivable on January 31 are past due, and 20% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 5% of these accounts are estimated to be uncollectible: (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.) Record the adjusting entry for uncollectible accounts. (9) Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. Prepare the journal entries for transactions. (If no entry is required for a Required" in the first account field.) entry for uncollectible accounts. Supplies at the end of January total $800. Record the adjusting entry for supplies. 10 Accrued interest revenue on notes receivable for January. Interest is expected to be received each December 31 . Record the adjusting entry for interest. (11) Unpaid salaries at the end of January are $33,700. Record the adjusting entry for salaries. Record the entry to close the revenue accounts. (13) Record the entry to close the expense accounts. Note : = journal entry has been entered Supplies at the end of January total $800. All other supplies have been used. Accrued interest revenue on notes receivable for January. Interest is expected to be Unpaid salaries at the end of January are $33,700. Choose the appropriate accounts to complete the company's income statement will then populate the balances in those accounts from the adjusted trial balanc Choose the appropriate accounts to complete the company's balance sheet. Make sure to select'adjusted' from the dropdown, then populate the balances in those accounts from the adjusted trial balance. Enter your Accounts Receivable turnover value rounded to 1 decimal place and Ratio of Allowance for Uncollectible Accol percentage rounded to 1 decimal place. Analyze how well 30 Family Fireworks manages its receivables a) Calculate the receivables tumover ratio for the month of January. (Hint. For the numerator, use total services provided to customers on ocount.) If the industry average of the receivables turnover ratios for the month of January is 4.4 times, is the company collecting cash rom customers more or less efficiently than other companies in the same industry