Answered step by step

Verified Expert Solution

Question

1 Approved Answer

one Question please check the answer right before you submit . thank you so much om X 62100/quizze381953 Lake Vytichiamo son VUE Cart Intering DooOOM

one Question please check the answer right before you submit . thank you so much

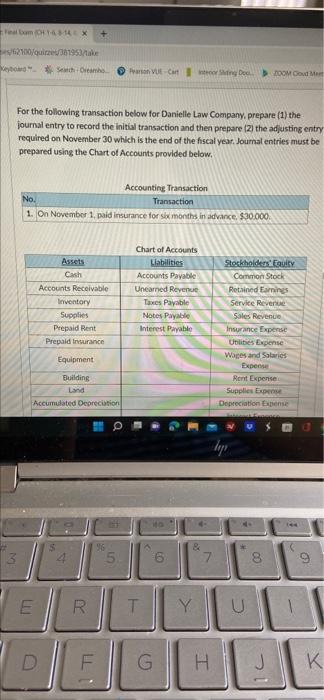

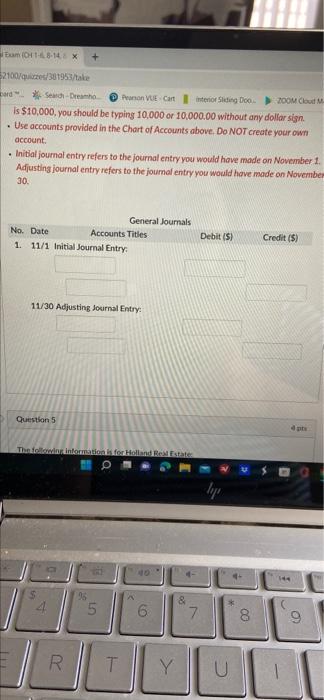

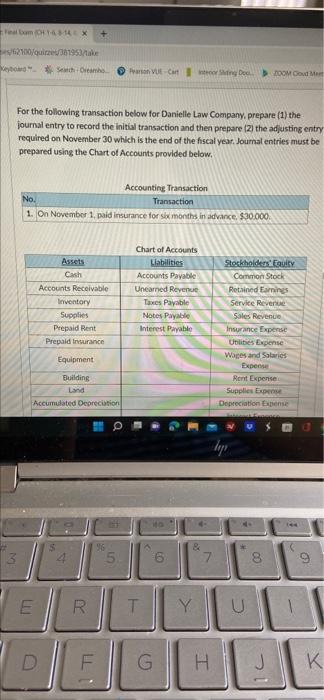

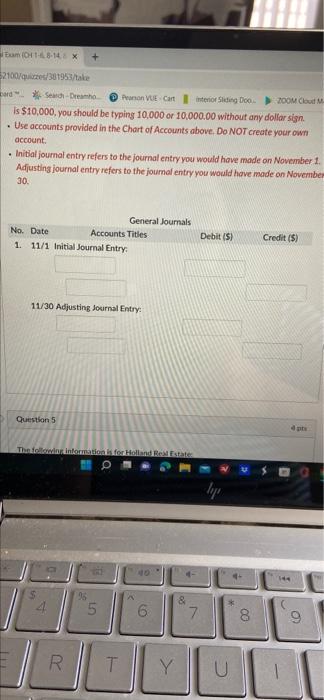

om X 62100/quizze381953 Lake Vytichiamo son VUE Cart Intering DooOOM Goud For the following transaction below for Danielle Law Company, prepare (1) the journal entry to record the initial transaction and then prepare (2) the adjusting entry required on November 30 which is the end of the fiscal year, Journal entries must be prepared using the Chart of Accounts provided below. Accounting Transaction No Transaction 1. On November 1, paid insurance for ske months in advance $30.000 Assets Cash Accounts Receivable Inventory Supplies Prepaid Rent Prepaid Insurance Chart of Accounts Liabilities Accounts Payable Uneamed Revenge Taxes Payable Notes Payable Interest Payable Stockholders'. Caulty Common Stock Retained Earnings Service Revenue Sales Revenue Insurance Expense Utilities Expense Wapes and Salaries Expense Rent Experise Supplies Expose Depreciation Expense Equipment Building Lud Accumulated Depreciation S & 96 5 8 9 E R T Y U D F G H K K um 8-14X + 52100/q/381953/take Dard Sech-Draho Proton VUE con interior Sliding Doo 200M Cloud is $10,000, you should be typing 10,000 or 10,000.00 without any dollar sign. Use accounts provided in the Chart of Accounts above. Do NOT create your own account . Initial journal entry refers to the journal entry you would have made on November 1 Adjusting journal entry refers to the joumal entry you would have made on November 30 General Journals No. Date Accounts Titles 1 11/1 Initial Journal Entry Debit (S) Credit ($) 11/30 Adjusting Journal Entry: Question 5 The wiarintomation Holland Estate 4 5 6 & 7 8 00 9 R 2 T Y U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started