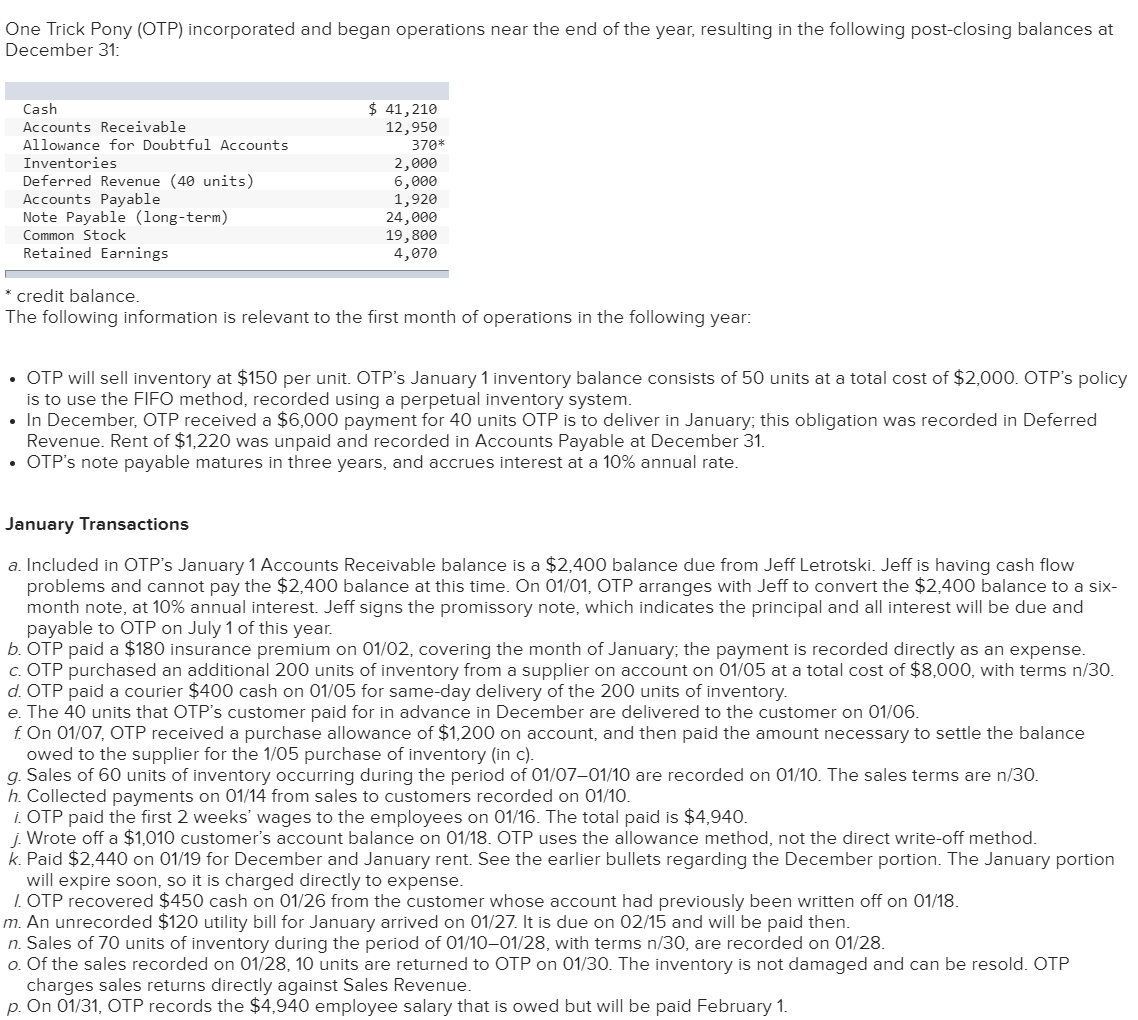

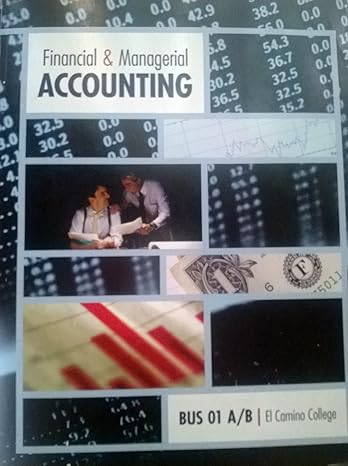

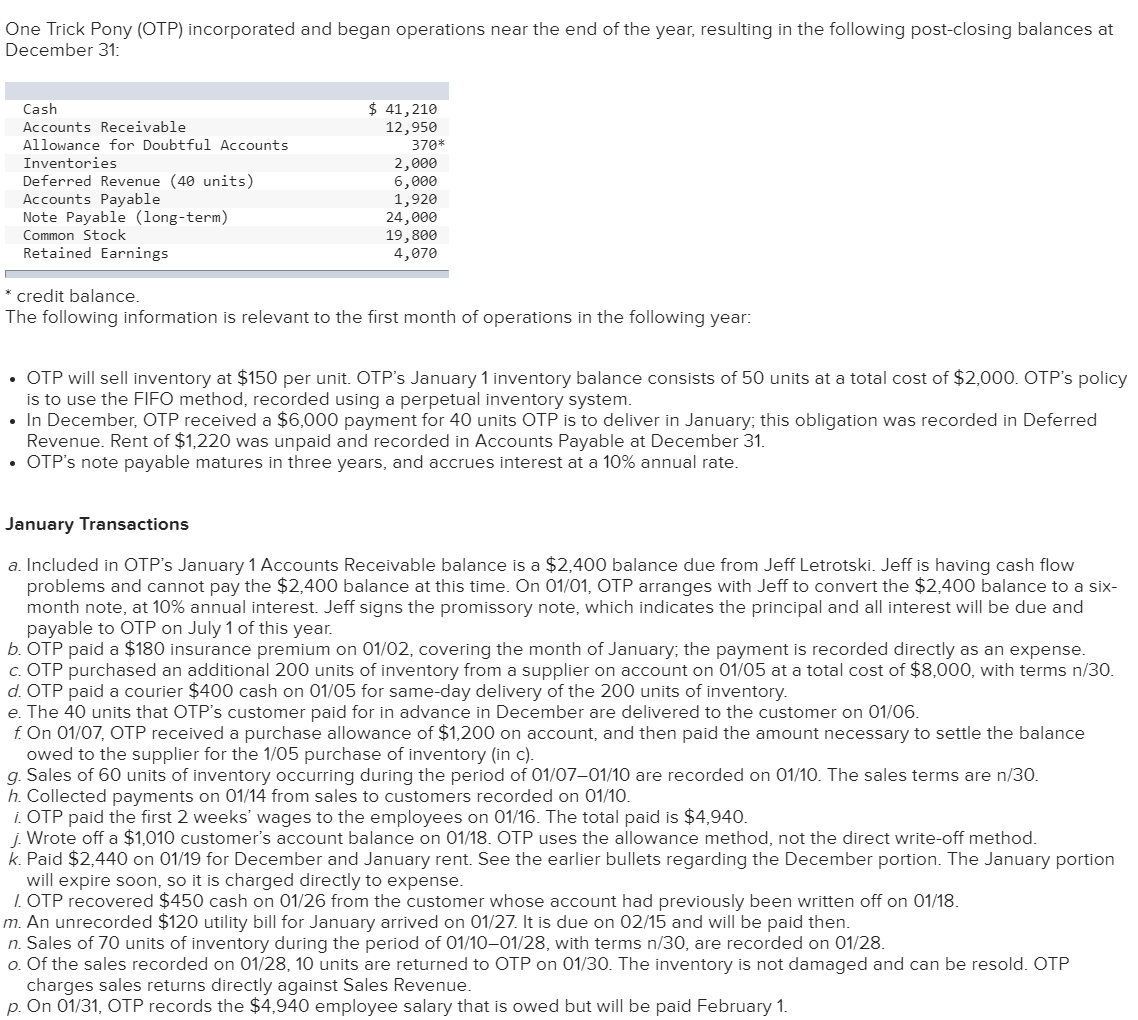

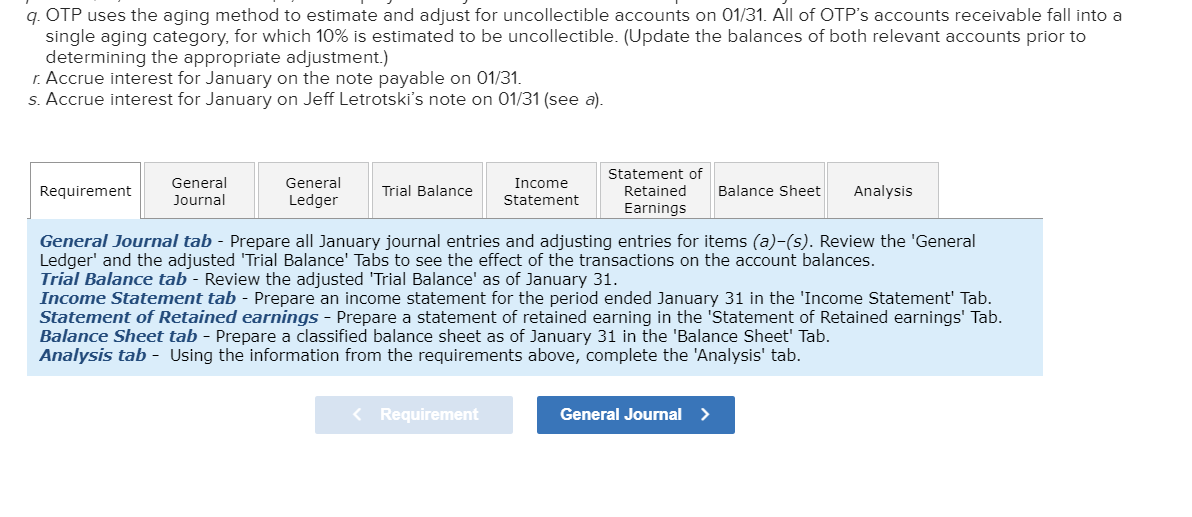

One Trick Pony (OTP) incorporated and began operations near the end of the year, resulting in the following post-closing balances at December 31: Cash Accounts Receivable Allowance for Doubtful Accounts Inventories Deferred Revenue (40 units) Accounts Payable Note Payable (long-term) Common Stock Retained Earnings $ 41,210 12,950 370* 2,000 6,000 1,920 24,000 19,800 4,070 * credit balance. The following information is relevant to the first month of operations in the following year: OTP will sell inventory at $150 per unit. OTP's January 1 inventory balance consists of 50 units at a total cost of $2,000. OTP's policy is to use the FIFO method, recorded using a perpetual inventory system. In December, OTP received a $6,000 payment for 40 units OTP is to deliver in January, this obligation was recorded in Deferred Revenue. Rent of $1,220 was unpaid and recorded Accounts Payable at December 31. OTP's note payable ma ires in three years, and accrues interest at a 10% annual rate. January Transactions a. Included in OTP's January 1 Accounts Receivable balance is a $2,400 balance due from Jeff Letrotski. Jeff is having cash flow problems and cannot pay the $2,400 balance at this time. On 01/01, OTP arranges with Jeff to convert the $2,400 balance to a six- month note, at 10% annual interest. Jeff signs the promissory note, which indicates the principal and all interest will be due and payable to OTP on July 1 of this year. b. OTP paid a $180 insurance premium on 01/02, covering the month of January, the payment is recorded directly as an expense. C. OTP purchased an additional 200 units of inventory from a supplier on account on 01/05 at a total cost of $8,000, with terms n/30. d. OTP paid a courier $400 cash on 01/05 for same-day delivery of the 200 units of inventory. e. The 40 units that OTP's customer paid for in advance in December are delivered to the customer on 01/06. f. On 01/07, OTP received a purchase allowance of $1,200 on account, and then paid the amount necessary to settle the balance owed to the supplier for the 1/05 purchase of inventory (in c). g. Sales of 60 units of inventory occurring during the period of 01/0701/10 are recorded on 01/10. The sales terms are n/30. h. Collected payments on 01/14 from sales to customers recorded on 01/10. i. OTP paid the first 2 weeks' wages to the employees on 01/16. The total paid is $4,940. j. Wrote off a $1,010 customer's account balance on 01/18. OTP uses the allowance method, not the direct write-off method. k. Paid $2,440 on 01/19 for December and January rent. See the earlier bullets regarding the December portion. The January portion will expire soon, so it is charged directly to expense. 1. OTP recovered $450 cash on 01/26 from the customer whose account had previously been written off on 01/18. m. An unrecorded $120 utility bill for January arrived on 01/27. It is due on 02/15 and will be paid then. n. Sales of 70 units of inventory during the period of 01/10-01/28, with terms n/30, are recorded on 01/28. o. Of the sales recorded on 01/28, 10 units are returned to OTP on 01/30. The inventory is not damaged and can be resold. OTP charges sales returns directly against Sales Revenue. p. On 01/31, OTP records the $4,940 employee salary that is owed but will be paid February 1. 9. OTP uses the aging method to estimate and adjust for uncollectible accounts on 01/31. All of OTP's accounts receivable fall into a single aging category, for which 10% is estimated to be uncollectible. (Update the balances of both relevant accounts prior to determining the appropriate adjustment.) r. Accrue interest for January on the note payable on 01/31. s. Accrue interest for January on Jeff Letrotski's note on 01/31 (see a). Requirement General Journal General Ledger Trial Balance Income Statement Statement of Retained Earnings Balance Sheet Analysis General Journal tab - Prepare all January journal entries and adjusting entries for items (a)-(s). Review the 'General Ledger' and the adjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. Trial Balance tab - Review the adjusted 'Trial Balance' as of January 31. Income Statement tab - Prepare an income statement for the period ended January 31 in the 'Income Statement' Tab. Statement of Retained earnings - Prepare a statement of retained earning in the Statement of Retained earnings' Tab. Balance Sheet tab - Prepare a classified balance sheet as of January 31 in the 'Balance Sheet' Tab. Analysis tab - Using the information from the requirements above, complete the 'Analysis' tab.