Answered step by step

Verified Expert Solution

Question

1 Approved Answer

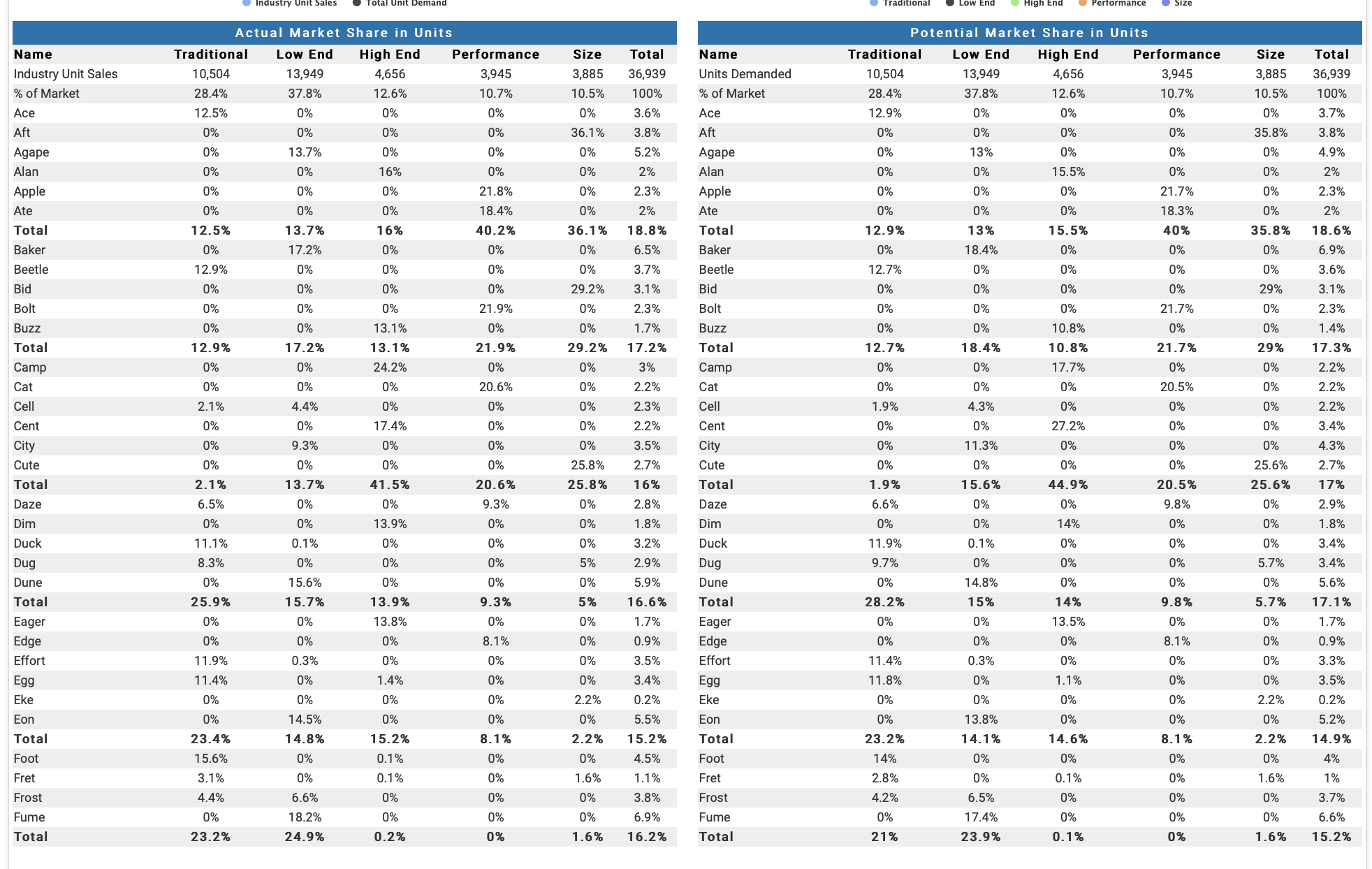

one way to strategically examine a company's portfolio is to categorize them into four distinctive groups in what is commonly called a growth share matrix

one way to strategically examine a company's portfolio is to categorize them into four distinctive groups in what is commonly called a "growth share matrix" These four groups are:

one way to strategically examine a company's portfolio is to categorize them into four distinctive groups in what is commonly called a "growth share matrix" These four groups are:

- Cash cows which are products with high share in markets with low predicted growth where companies leverage them for cash to reinvest

- Stars which are products with high share in markets with high prediccted growth where companies should significantly invest in them due to high future potential

- Question marks which are products with low share in markets with high predicted growth where companies should invest in or disgard them based on likelihood of becoming stars

- Pets which are products with low share in markets with low predicted growth where companies should liquidate divest or reposition them.

I want to apply this framework to better understand Chester's product portfolio because they are one of our key competitors. Of Chester's products, which one is a cash cow and which one is a cow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started