Answered step by step

Verified Expert Solution

Question

1 Approved Answer

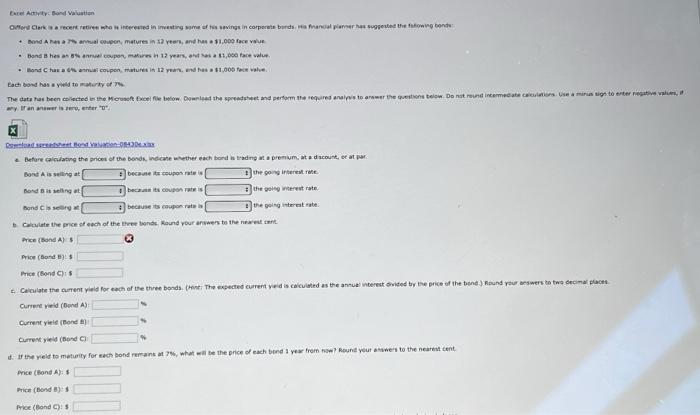

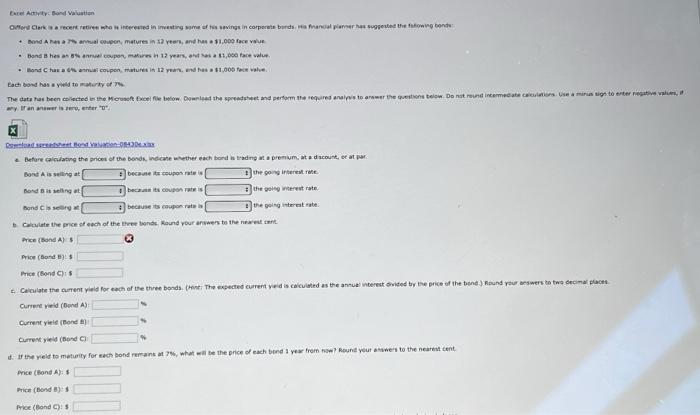

One whole continued question Each bond has e yeld te maherier of 4. Before calcalating the prices of the bondk, wicane wether each bond in

One whole continued question

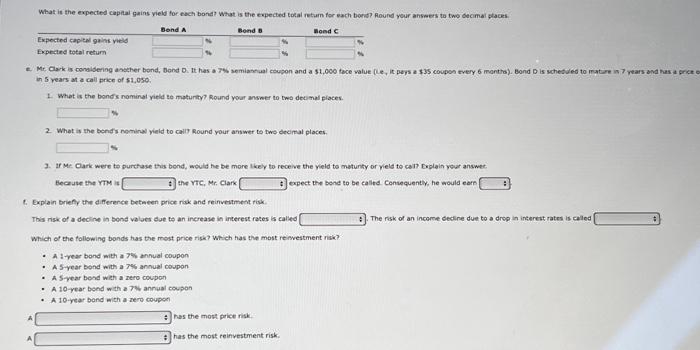

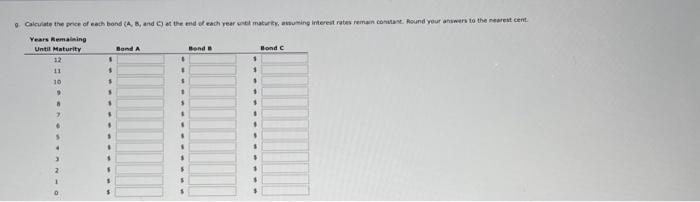

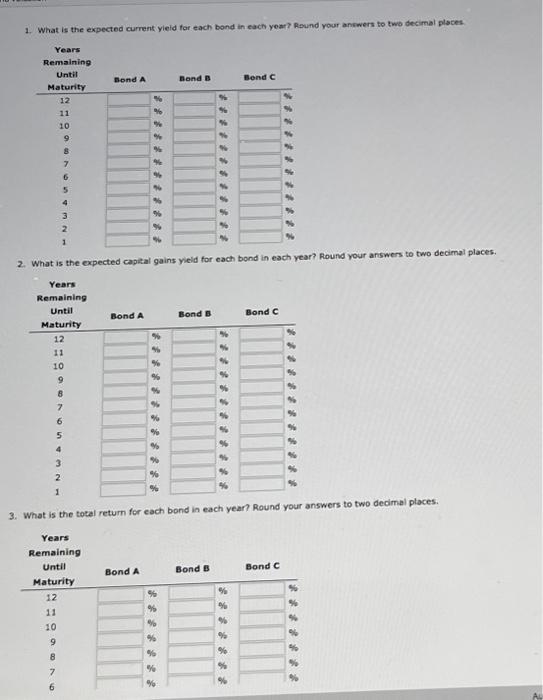

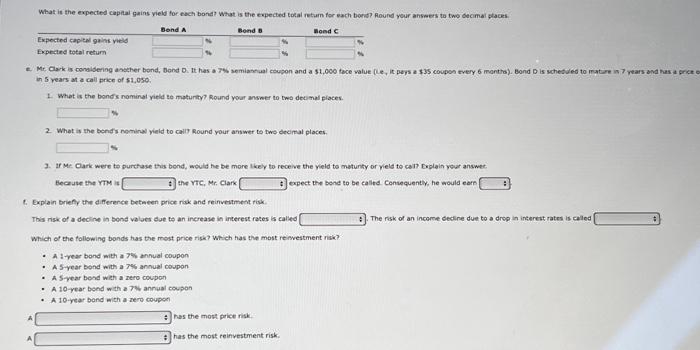

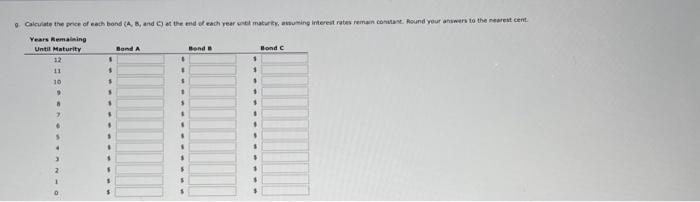

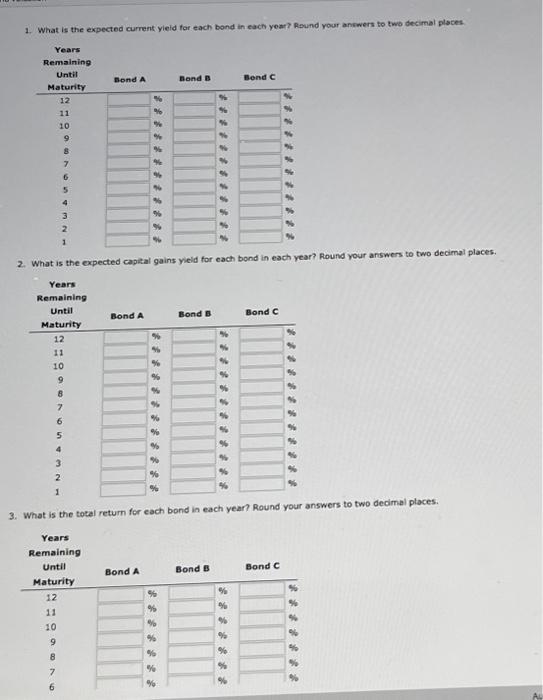

Each bond has e yeld te maherier of 4. Before calcalating the prices of the bondk, wicane wether each bond in Eadng an a prenium, at a d acoune, of at par. \begin{tabular}{|c|c|c|} \hline bood A is selling at & becaune te ceupos rate is & the soing interest tose \\ \hline Dond o it selling & bectant its eoupos rate is & the goive interent rate \\ \hline Bon & becavse its eoupon rats in & the geing interat in \\ \hline \end{tabular} Aree (bond A) 's Arice (bond Bu) 5 Frice (Bond C) is Currere vield (Dond A): Curnet yiele (Bond A) currex yield (bond C) Price (Fond A ) : 5 Drice (Bend b): 1 Fice (eond C): s in 5 vears at a call price of $1,050. 1. What is the bonds nominal yeld te maturity? Round your answer to twa decinal places. 2. Whet is the bends nominal vield to cally Round your answer to two decimal places. 3. If Mc Cark were te purchase thas bond, would he be more lkev to receive the vield to matunty or vield to can caplain your answec: Becaute the YTM is the vic, Mr, Clark expect the bond to be called Consequentiv, he would ears 1. Explain brieffy the difference between price nak and reinveutment risk. This risk of a decline in bend values due to an increase in interest rates is calkd The rosk of an income decline due to a drep in incerest rates is caled Which of the following bonds has the most price risk? Which has the most reimestment riak? - A t rear bond with a 7% annual coupon - A S-year bond with a Jes annual coupon - A S vear bond wich a nero coupon - A 10 -year bond w th a Th annual coupon - A 10 -year bond wich a zero coupon A has the most price risk. A has the most reinvestment risk. \begin{tabular}{|c|c|c|c|} \hline Until Maturity & Band A & Eend E & Elond C \\ \hline 12 & t & 1 & 1 \\ \hline 11 & 4 & 1 & 1 \\ \hline 10 & 8 & 5 & i \\ \hline 7 & s & 1 & 1 \\ \hline a & 1 & 5 & 4 \\ \hline & 6 & 1 & t \\ \hline & 4 & 1 & 1 \\ \hline s. & 4 & 8 & 4 \\ \hline 4 & 1 & 1 & 1 \\ \hline 3 & 4 & 1 & 7 \\ \hline 2 & 5 & s & 1 \\ \hline 1 & 1 & s & 4 \\ \hline 0 & 5 & 8 & 3 \\ \hline \end{tabular} 1. What is the expected current yield for each bond in each year? Reund your aniwers to two decimal places 2. What is the expected capical gains yield for each bond in each year? Round your answers to two decimal places. 3. What is the total return for each bond in each year? Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started