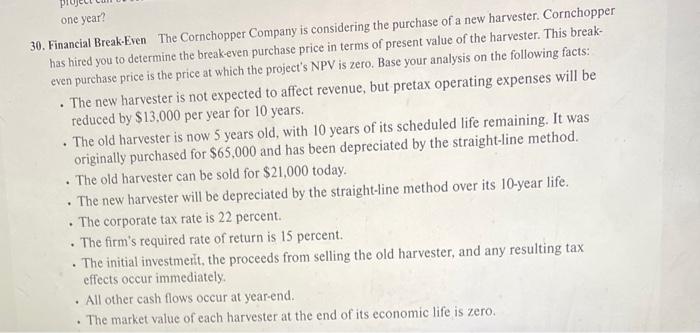

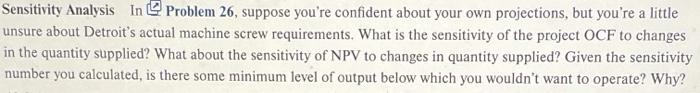

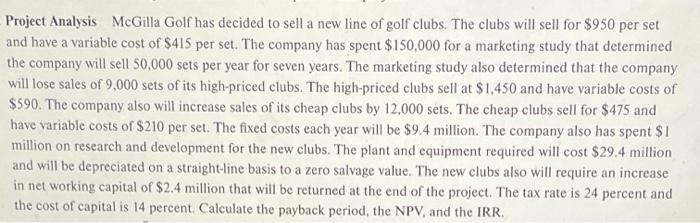

one year? 30. Financial Break-Even The Cornchopper Company is considering the purchase of a new harvester. Cornchopper has hired you to determine the break-even purchase price in terms of present value of the harvester. This break- even purchase price is the price at which the project's NPV is zero. Base your analysis on the following facts: The new harvester is not expected to affect revenue, but pretax operating expenses will be reduced by $13,000 per year for 10 years. The old harvester is now 5 years old, with 10 years of its scheduled life remaining. It was originally purchased for $65,000 and has been depreciated by the straight-line method. The old harvester can be sold for $21,000 today. The new harvester will be depreciated by the straight-line method over its 10-year life. . The corporate tax rate is 22 percent. The firm's required rate of return is 15 percent. The initial investmerit, the proceeds from selling the old harvester, and any resulting tax effects occur immediately. . All other cash flows occur at year-end. The market value of each harvester at the end of its economic life is zero. . . . Abandonment Decisions Consider the following project for Hand Clapper, Inc. The company is Page 231 considering a 4-year project to manufacture clap-command garage door openers. This project requires an initial investment of $18 million that will be depreciated straight-line to zero over the project's life. An initial investment in net working capital of $950,000 is required to support spare parts inventory: this cost is fully recoverable whenever the project ends. The company believes it can generate $12.4 million in revenue with $4.5 million in operating costs. The tax rate is 21 percent and the discount rate is 13 percent. The market value of the equipment over the life of the project is as follows: Year Market Value (in $ millions) 1 $15.0 2 11.0 3 8.5 4 0.0 a. Assuming Hand Clapper operates this project for four years, what is the NPV? b. Now compute the project NPVs assuming the project is abandoned after only one year after two years, and after three years. What economic life for this project maximizes its value to the firm? What does this problem tell you about not considering abandonment possibilities when evaluating proiects? Sensitivity Analysis In Problem 26, suppose you're confident about your own projections, but you're a little unsure about Detroit's actual machine screw requirements. What is the sensitivity of the project OCF to changes in the quantity supplied? What about the sensitivity of NPV to changes in quantity supplied? Given the sensitivity number you calculated, is there some minimum level of output below which you wouldn't want to operate? Why? Project Analysis McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $950 per set and have a variable cost of $415 per set. The company has spent $ 150,000 for a marketing study that determined the company will sell 50,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 9,000 sets of its high-priced clubs. The high-priced clubs sell at $1,450 and have variable costs of $590. The company also will increase sales of its cheap clubs by 12,000 sets. The cheap clubs sell for $475 and have variable costs of $210 per set. The fixed costs each year will be $9.4 million. The company also has spent $1 million on research and development for the new clubs. The plant and equipment required will cost $29.4 million and will be depreciated on a straight-line basis to a zero salvage value. The new clubs also will require an increase in net working capital of $2.4 million that will be returned at the end of the project. The tax rate is 24 percent and the cost of capital is 14 percent. Calculate the payback period, the NPV, and the IRR