Question

One year ago you bought a 5-year 5% coupon bond that will pay $1,000 at maturity (its par value). The bond was priced at

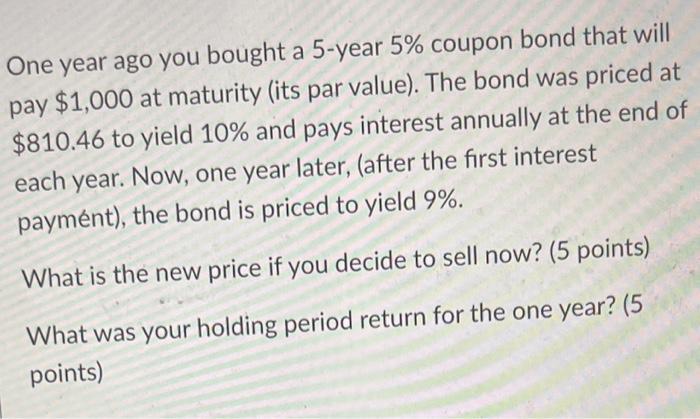

One year ago you bought a 5-year 5% coupon bond that will pay $1,000 at maturity (its par value). The bond was priced at $810.46 to yield 10% and pays interest annually at the end of each year. Now, one year later, (after the first interest payment), the bond is priced to yield 9%. What is the new price if you decide to sell now? (5 points) What was your holding period return for the one year? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to find the new price and your holding period return for the bond New Price We can use a b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

3rd Edition

0077173635, 9780077173630

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App