Answered step by step

Verified Expert Solution

Question

1 Approved Answer

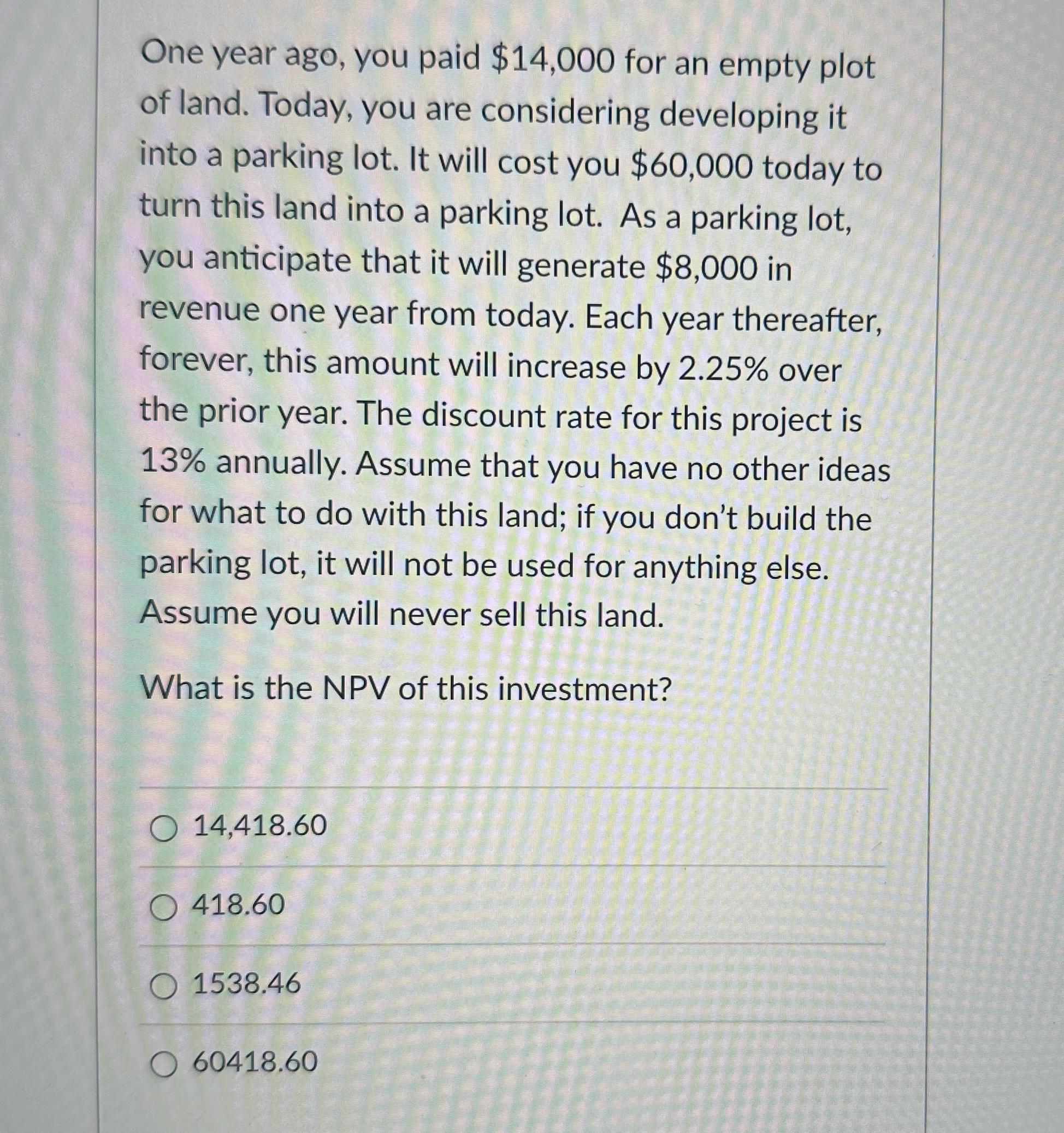

One year ago, you paid $ 1 4 , 0 0 0 for an empty plot of land. Today, you are considering developing it into

One year ago, you paid $ for an empty plot of land. Today, you are considering developing it into a parking lot. It will cost you $ today to turn this land into a parking lot. As a parking lot, you anticipate that it will generate $ in revenue one year from today. Each year thereafter, forever, this amount will increase by over the prior year. The discount rate for this project is annually. Assume that you have no other ideas for what to do with this land; if you don't build the parking lot, it will not be used for anything else. Assume you will never sell this land.

What is the NPV of this investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started