Answered step by step

Verified Expert Solution

Question

1 Approved Answer

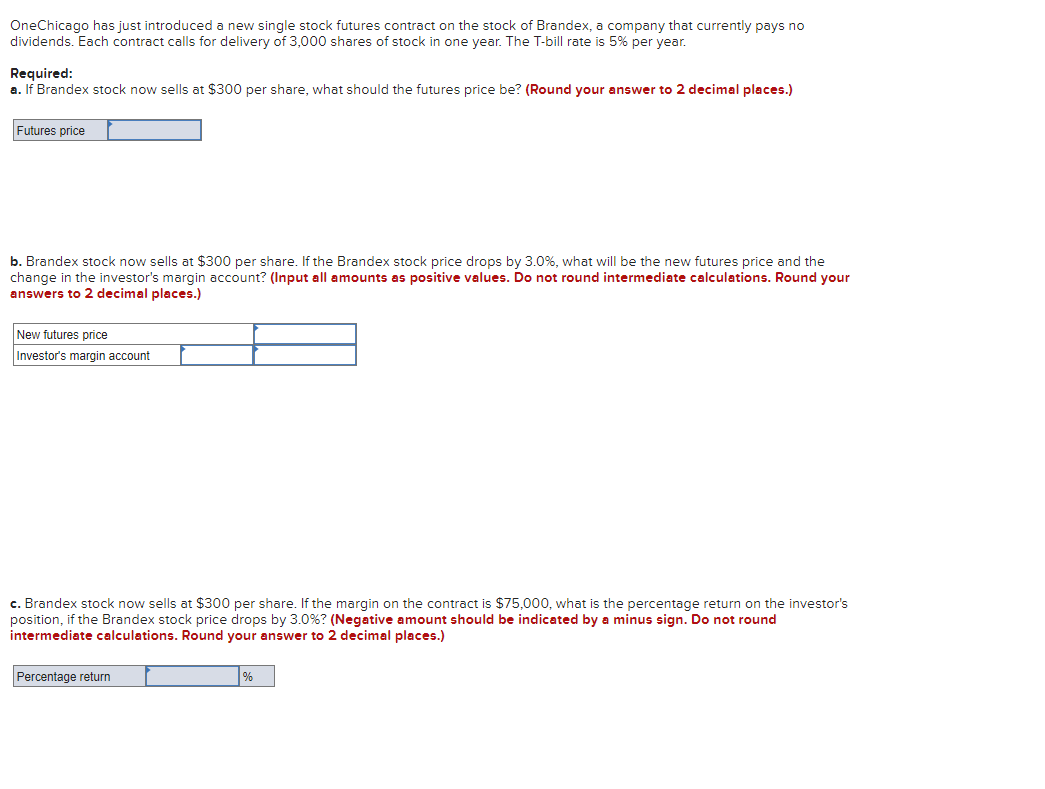

OneChicago has just introduced a new single stock futures contract on the stock of Brandex, a company that currently pays no dividends. Each contract calls

OneChicago has just introduced a new single stock futures contract on the stock of Brandex, a company that currently pays no dividends. Each contract calls for delivery of shares of stock in one year. The Tbill rate is per year.

Required:

a If Brandex stock now sells at $ per share, what should the futures price beRound your answer to decimal places.

Futures price

b Brandex stock now sells at $ per share. If the Brandex stock price drops by what will be the new futures price and the change in the investor's margin account? Input all amounts as positive values. Do not round intermediate calculations. Round your answers to decimal places.

New futures price

Investor's margin account

c Brandex stock now sells at $ per share. If the margin on the contract is $ what is the percentage return on the investor's position, if the Brandex stock price drops by Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to decimal places.

Percentage return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started