Answered step by step

Verified Expert Solution

Question

1 Approved Answer

OneDot is an internet company that announces plans to acquire one of its competitors, iTech. OneDot stock is trading for $40 per share. iTech

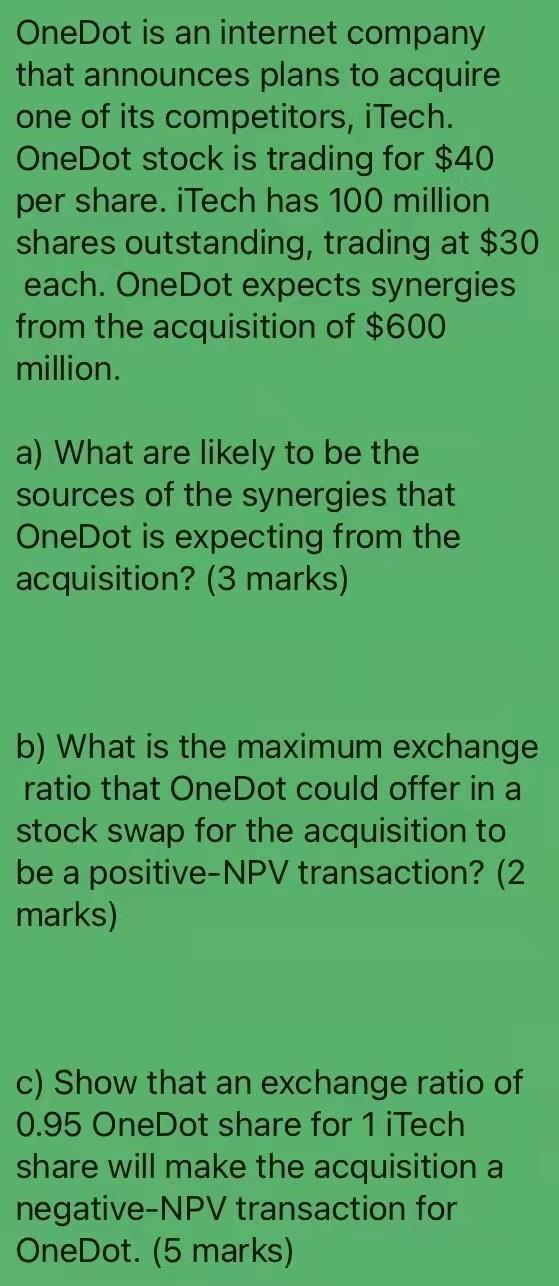

OneDot is an internet company that announces plans to acquire one of its competitors, iTech. OneDot stock is trading for $40 per share. iTech has 100 million shares outstanding, trading at $30 each. OneDot expects synergies from the acquisition of $600 million. a) What are likely to be the sources of the synergies that OneDot is expecting from the acquisition? (3 marks) b) What is the maximum exchange ratio that OneDot could offer in a stock swap for the acquisition to be a positive-NPV transaction? (2 marks) c) Show that an exchange ratio of 0.95 OneDot share for 1 iTech share will make the acquisition a negative-NPV transaction for OneDot. (5 marks)

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Synergies most likely sources 1 Revenue synergy The combined firm One dot after the acquisition of Itech will now be able to approach clients custom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started