Answered step by step

Verified Expert Solution

Question

1 Approved Answer

O'Neill Inc. is a designer and manufacturer of fashionable water sports apparel and equipment. To produce some of their items, they work with TEC. Consider

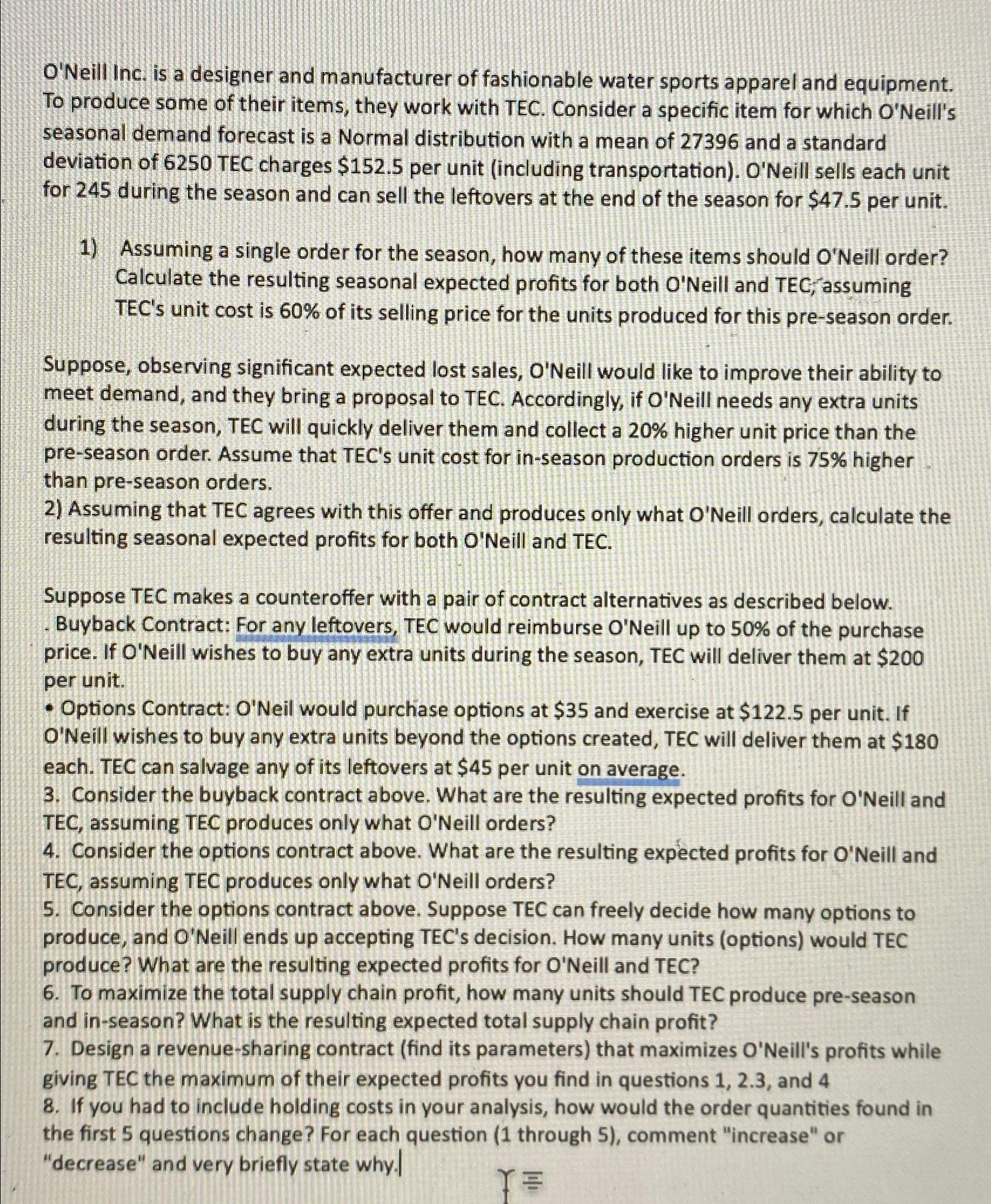

O'Neill Inc. is a designer and manufacturer of fashionable water sports apparel and equipment. To produce some of their items, they work with TEC. Consider a specific item for which O'Neill's seasonal demand forecast is a Normal distribution with a mean of and a standard deviation of TEC charges $ per unit including transportation O'Neill sells each unit for during the season and can sell the leftovers at the end of the season for $ per unit.

Assuming a single order for the season, how many of these items should O'Neill order? Calculate the resulting seasonal expected profits for both O'Neill and TEC,'assuming TEC's unit cost is of its selling price for the units produced for this preseason order.

Suppose, observing significant expected lost sales, O'Neill would like to improve their ability to meet demand, and they bring a proposal to TEC. Accordingly, if O'Neill needs any extra units during the season, TEC will quickly deliver them and collect a higher unit price than the preseason order. Assume that TEC's unit cost for inseason production orders is higher than preseason orders.

Assuming that TEC agrees with this offer and produces only what Neill orders, calculate the resulting seasonal expected profits for both O'Neill and TEC.

Suppose TEC makes a counteroffer with a pair of contract alternatives as described below.

Buyback Contract: For any leftovers, TEC would reimburse O'Neill up to of the purchase price. If O'Neill wishes to buy any extra units during the season, TEC will deliver them at $ per unit.

Options Contract: O'Neil would purchase options at $ and exercise at $ per unit. If O'Neill wishes to buy any extra units beyond the options created, TEC will deliver them at $ each. TEC can salvage any of its leftovers at $ per unit on average.

Consider the buyback contract above. What are the resulting expected profits for O'Neill and TEC, assuming TEC produces only what O'Neill orders?

Consider the options contract above. What are the resulting expected profits for O'Neill and TEC, assuming TEC produces only what O'Neill orders?

Consider the options contract above. Suppose TEC can freely decide how many options to produce, and O'Neill ends up accepting TEC's decision. How many units options would TEC produce? What are the resulting expected profits for O'Neill and TEC?

To maximize the total supply chain profit, how many units should TEC produce preseason and inseason? What is the resulting expected total supply chain profit?

Design a revenuesharing contract find its parameters that maximizes O'Neill's profits while giving TEC the maximum of their expected profits you find in questions and

If you had to include holding costs in your analysis, how would the order quantities found in the first questions change? For each question through comment "increase" or "decrease" and very briefly state why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started