Answered step by step

Verified Expert Solution

Question

1 Approved Answer

OnePotato TwoPotato Limited reports the following shareholders' equity as of December 31, 2023: Preferred shares, $5.00, authorized 100,000 shares, issued 80,000 shares Common shares,

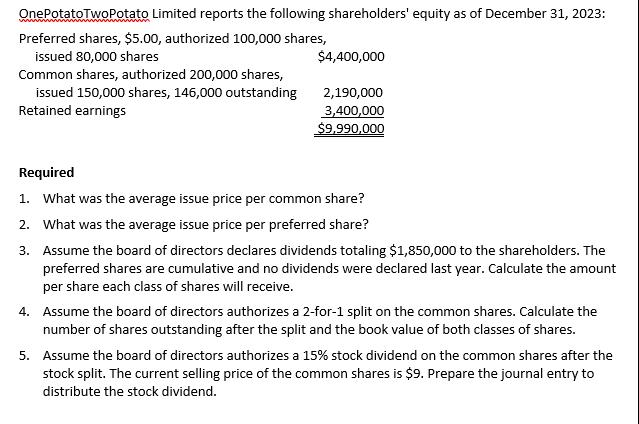

OnePotato TwoPotato Limited reports the following shareholders' equity as of December 31, 2023: Preferred shares, $5.00, authorized 100,000 shares, issued 80,000 shares Common shares, authorized 200,000 shares, issued 150,000 shares, 146,000 outstanding Retained earnings $4,400,000 2,190,000 3,400,000 $9,990,000 Required 1. What was the average issue price per common share? 2. What was the average issue price per preferred share? 3. Assume the board of directors declares dividends totaling $1,850,000 to the shareholders. The preferred shares are cumulative and no dividends were declared last year. Calculate the amount per share each class of shares will receive. 4. Assume the board of directors authorizes a 2-for-1 split on the common shares. Calculate the number of shares outstanding after the split and the book value of both classes of shares. 5. Assume the board of directors authorizes a 15% stock dividend on the common shares after the stock split. The current selling price of the common shares is $9. Prepare the journal entry to distribute the stock dividend.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the average issue price per common share we need to divide the total amount raised from issuing common shares by the number of common shares issued Total amount raised from issuing comm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started